Image © Adobe Stock

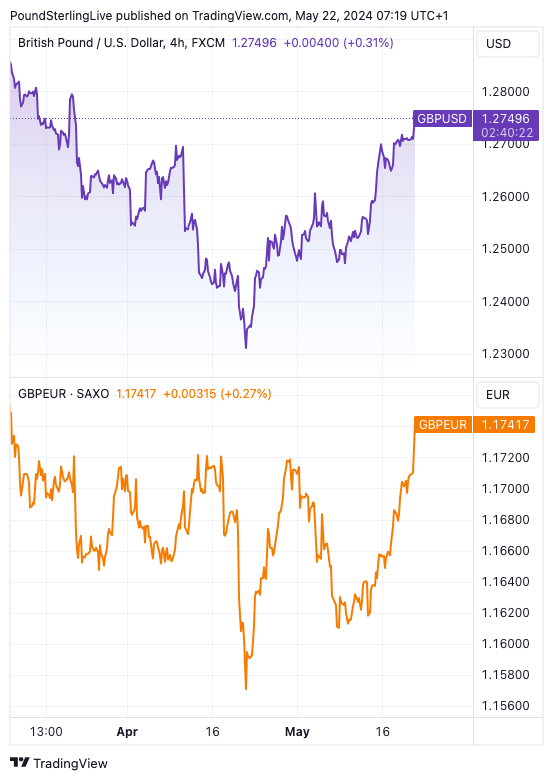

The pound-to-euro exchange rate hit its highest level since March at 1.1736 after UK inflation fell to 2.3% year-on-year in April, a figure that was higher than the market and the Bank of England had expected (2.1 %).

The most important and closely watched component of services inflation was significantly higher than expected at 5.9%, while the market and the Bank of England were expecting 5.5%.

The probability of a rate cut by the Bank of England in June is now well below 50%, having been close to 60% just a few days ago. The rise in the value of the pound reflects this adjustment in expectations about Bank of England policy.

The pound rose against all its G10 peers after the release, with the pound-to-dollar exchange rate hitting 1.2745, its highest level since March 21. $1.2759, from $1.2707, before moving back to $1.2735 Markets are now not fully pricing in until November, compared to last August,” said Gabriella Dickens, G7 economist at AXA Investment Managers.

Those who read the recent Pound Sterling Live article on the views of Andrew Sentance, who warned of an upside shock, will be prepared for the eventuality of a positive surprise. “My forecast for core inflation and services inflation was broadly correct. I forecast core inflation at 3.8% – actual was 3.9%. My forecast for services was 6% versus 5.9% actual. Core inflation figures they showed much higher than the market consensus,” says Sentance after the release.

Meanwhile, the result reduces the tail risk to the pound in the form of an outright rate cut in the summer. “Will the central bank say in June or will they take advantage of the fact that inflation has been slightly higher than expected and hold off until the August meeting? Movements in currency markets this morning suggest that an August cut is slightly more likely,” says Nicholas Hyett , investment manager at Wealth Club.

“UK inflation at 2.3% is now undershooting the G20 average – and will be for the rest of the summer – but the symbolism of going above 2% will delay some of the more incisive policy calls to cut by a month or two,” says Simon. French, economist at Panmure Gordon.

Above: GBP hits new multi-week highs against the dollar and euro. Track GBP/AUD with custom rate alerts. Set here

He explains that services inflation of 5.9% is the most important aspect of the report as it proves that non-tradable components are proving stickier than hoped. “We will stick to August for the first rate cut – although the next round of data on wages and prices will come before the June MPC,” says French.

“Today’s news was a bit of a blow to the BoE and the Prime Minister,” said Paul Dales, chief UK economist at Capital Economics. “Although wages and CPI are still to be released before the BoE meeting on 20 June, a cut now looks very unlikely. Even a cut in August looks somewhat more doubtful.”

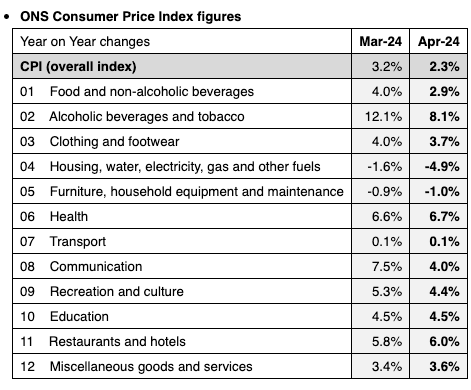

Looking at the details, it was the drop in household utility bills in April that provided the most significant impetus for the reduction in inflation. Falling food prices also weighed. There was also a significant decline in inflation for clothing and footwear and alcoholic beverages.

Image courtesy of BRC.

As the chart above shows, service-oriented industries such as restaurants and hotels continue to push prices up. This will reflect the high labor costs faced by these industries and highlights that inflation will only return to the 2.0% target on a sustainable basis if wages cool.