A flurry of speculation by futures traders pushed the prices of metals such as copper and gold to record highs as funds bet on impending supply shortages and sought to hedge against inflation.

Copper has rallied 30 percent since early March to breach $11,000 a tonne this week, an all-time high. That helped lift prices of other industrial metals from aluminum to zinc.

A flurry of investor buying also pushed gold past its previous records to $2,450 a troy ounce, and silver then topped $30 an ounce for the first time in a decade.

There has been a “significant influx of investment” into metals from algorithmic traders, commodity-specific investors and macro funds, said Greg Shearer, head of base and precious metals strategy at JPMorgan.

Metal price movements have often defied traders’ expectations. Strong demand last year helped deplete inventories to historic lows, yet prices fell. Prices have risen this year, even as supplies improve.

Commodities’ share of global markets, meanwhile, has been shrinking, falling to 2 percent in the past 12 months from 8.8 percent in 2009, according to Bloomberg data, as stocks and bonds raced ahead.

“The market kind of ignored everything from a fundamental standpoint,” said Ricardo Leiman, chief investment officer at KLI Asset Management, a London-based commodities investment manager.

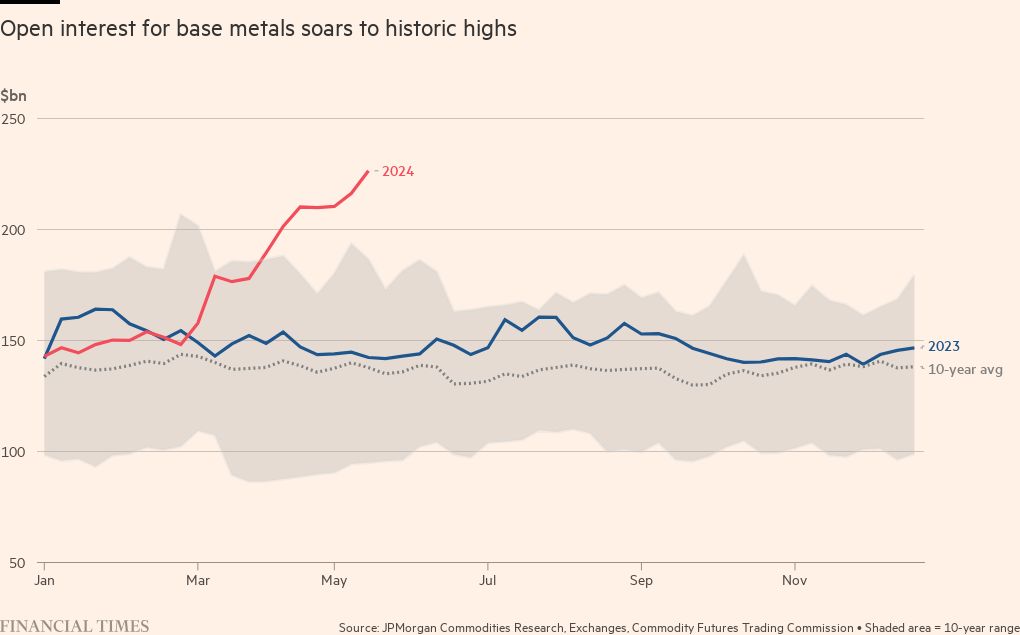

Analysts said the moves were driven by an increase in open interest – the number of open futures positions and the depth of the market.

Open interest in the base metals and precious metals markets reached a record $227 billion and $215 billion, respectively, last week, according to JPMorgan analysis.

This is largely due to funds hedging their bets on falling prices and those taking long positions to profit from price movements, rather than producers or consumers hedging against the risk of price movements when buying or selling commodities, analysts said .

Investors’ net long positions on the Comex and London Metal Exchange for base metals stood at 2.6 million tonnes in mid-May, up from 556,000 tonnes in early March, eclipsing the previous high at the end of 2020.

The wave of money pouring into metals came not only from algorithmic momentum traders, but also from macro hedge funds that are boosting their allocation to real assets and specialist commodity hedge funds, analysts said.

Copper, which is most important to the decarbonisation process, has led to a sharp rise in prices. Shearer said a “very difficult supply picture to fix” supported copper’s rally.

“With copper, the tightening supply picture multiplies the possible number [artificial intelligence] The increase in demand and greater comfort that we are at an inflection point for global demand, plus the hedge against inflation, has been a powerful lever,” he said. “That made a lot of funds say ‘now is the time for copper’.”

Other base metals such as zinc, aluminum and lead followed copper, jumping between 15% and 28% in a sharp collective swing higher since early April.

Aline Carnizelo, managing partner of Frontier Commodities, a start-up commodity investment vehicle, said investors are looking to diversify their returns away from big tech stocks by turning to metals.

The funds put money behind commodities for exposure to “decarbonisation, deglobalisation, hedging against inflation and geopolitical risks, as well as underinvestment in new supplies, particularly energy”, she said.

Inflows into broad-basket commodity funds – including grains, minerals, metals, cotton and cocoa – have increased in recent months, more than doubling to £1.9bn in April, according to data from Morningstar.

Despite weaker-than-expected demand in China and a rapid rise in metal inventories, there were signs that global production was finally turning a corner, which also helped fuel interest in silver, given its widespread use in solar panels. China’s purchasing managers’ index rose for the second month in a row in April after half a year of decline.

Australian mining group BHP’s £34bn approach to buy rival Anglo American to secure its coveted copper mines in Latin America has also sent another signal to investors to snap up the red metal, investors say.

“The takeover of BHP woke up a lot of people to the fact that it’s much cheaper to buy a company than to build a new mine,” Leiman said. “It made a lot of people vacate positions and pro [computer-driven trend-following hedge funds] and some of the macro crowd go long. There has been a massive reorganization of the streams.’

A net 13 percent of global fund managers surveyed by Bank of America were overweight commodities in May, the most since April of last year. The past three months saw the largest increase in their allocation to commodities since August 2020, according to the survey.

Some top hedge funds are beefing up their commodity trading teams to take advantage of volatility in the asset class. Family office BlueCrest Capital plans to expand the number of trading teams, including in commodities, by 10 percent by the end of the year.

Commodities typically trade based on their current supply and demand, but Carnizelo said the growing role of speculative investors in the market means they are starting to trade based on a likely future picture.

“Commodities are starting to behave a bit like stocks,” she said.