- Mt. Gox transferred 42,830 BTC worth around $2.9 billion to new addresses on May 28.

- Rising Bitcoin Supply and Potential Large-Scale Sell-Offs by Lenders Mt. Gox could push prices.

Tokyo’s Mount Gox, once a bitcoin behemoth [BTC] exchanges, processing 70% of all transactions by 2013, have re-entered the cryptocurrency story after a considerable period of inactivity.

The platform, which went out of business and entered bankruptcy after a massive security breach in 2014 that resulted in the loss of 800,000 bitcoins, is now making headlines again.

Recent activity indicates a significant movement of funds that has piqued the interest of investors and analysts around the world.

Mt. Gox re-emerges, making historic Bitcoin transfers

As part of the ongoing bankruptcy resolution, the trustees of Mt. Gox to transfer significant shares of Bitcoin.

Data of Arkham Intelligence reported that 42,830 BTC worth around $2.9 billion were moved to new addresses in the early hours of May 28.

This is the first such activity in the last five years and heralds a possible distribution of these assets to creditors by the end of October 2024.

The looming question is the impact of these moves on the Bitcoin market, particularly whether it will lead to a selling frenzy among takers.

After the transfer, Bitcoin saw a slight drop of around 2%, which brought its trading price down to around $67,830.

This move occurred in the larger context of Bitcoin’s recent 24 high above $70,000.

Observers are keenly watching the potential knock-on effects of the large-scale asset movements of Mt. Gox given the historical precedents set by similar large payouts in the cryptocurrency space.

AMBCrypto’s in-depth analysis explored various metrics that could affect Bitcoin’s resilience to potential market shocks coming from these releases.

Supply dynamics and investor sentiment

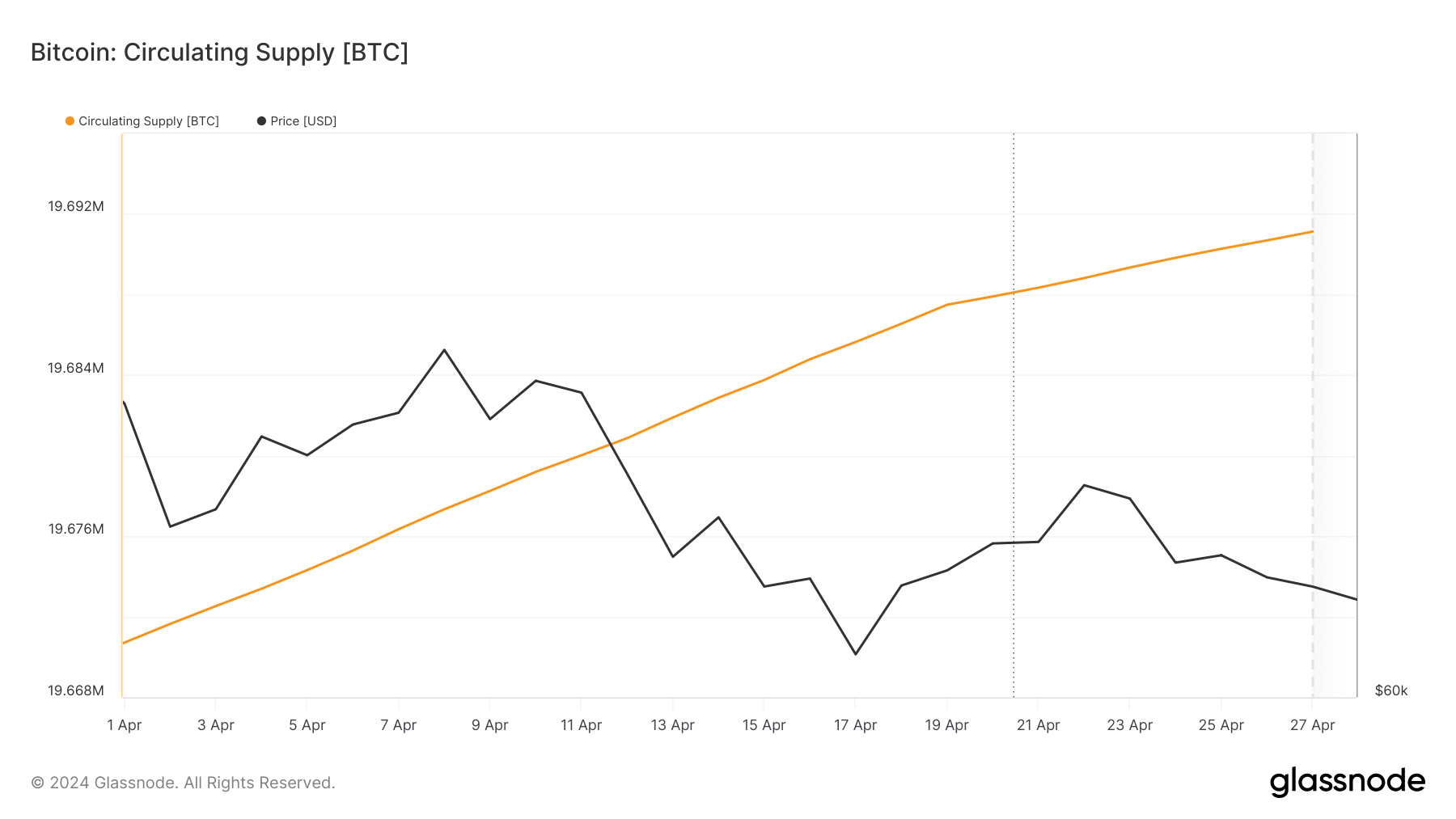

Complicating the market outlook is the behavior of Bitcoin’s circulating supply and investor demand.

Data from Glassnode suggests an increase in circulating supply, which, if not matched by demand, could put downward pressure on bitcoin prices.

This is a classic economic scenario where excess supply without corresponding demand leads to price depreciation.

Source: Glassnode

This trend could be particularly significant if lenders to Mt. Gox decided to sell at a time of rising supply like this.

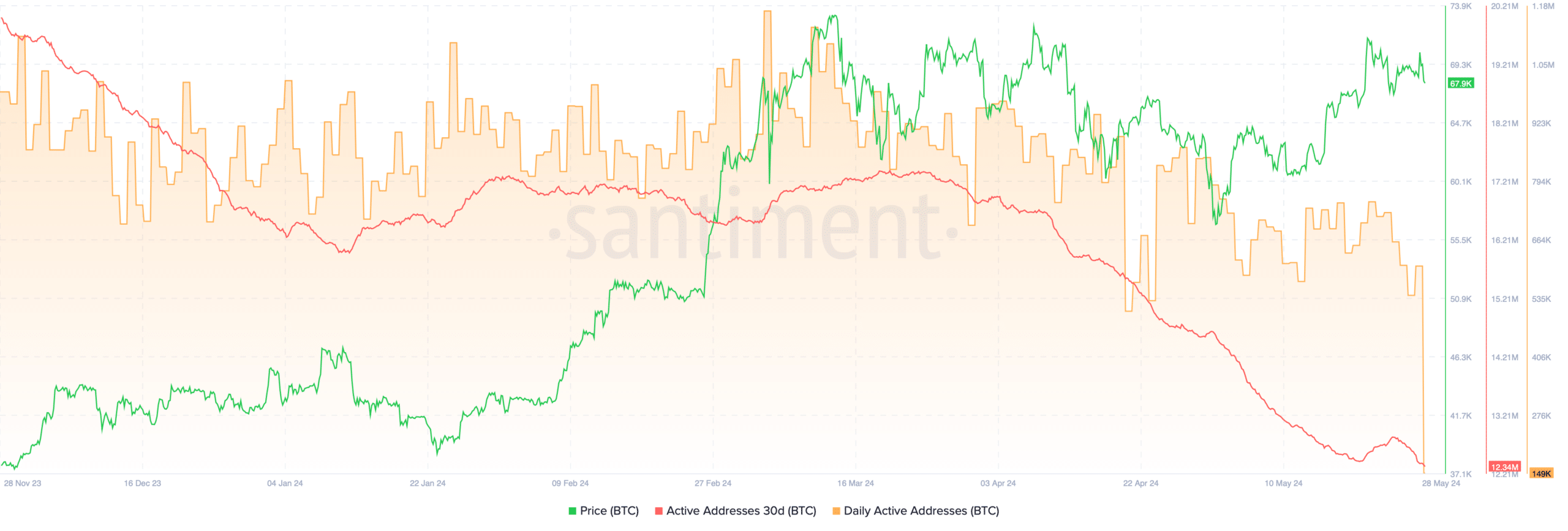

On the contrary, according to Santimento dataBitcoin’s daily active addresses and 30-day active addresses are also falling, indicating a reduction in demand.

Under such market conditions, a sell-off by Mt.Gox creditors could also lead to a sharp price correction in BTC.

Source: Santiment

However, there are balancing forces at play.

The approval and operation of bitcoin ETFs that consistently buy significant amounts of bitcoins per day – now holding 855,619 bitcoins and buying an average of 6,200 BTC per day – could mitigate potential market shocks.

These ETFs could absorb some of the increased supply if Mt.Gox creditors start selling, which could lead to price stabilization.

Another bullish investor sentiment, recently AMBCrypto announced that the Bitcoin Rainbow Chart—an indicator used to measure long-term value trends—shows bitcoins currently placed in the “Buy” zone.

Is your portfolio green? Check out the BTC profit calculator

Historically, entering this zone preceded a substantial price increase.

The current positioning suggests that this could be a good time for investors to grab Bitcoin at a lower price before it enters the “Accumulate” and “HODL” zones.