This article is a local version of our Energy Sources newsletter. Premium subscribers can sign up here to receive the newsletter every Tuesday and Thursday. Standard subscribers can upgrade to Premium here or explore all FT newsletters

Good morning and welcome back to The Power Source coming to you from New York.

Today, we focus on an epic legal battle involving ExxonMobil and two climate-focused shareholder groups that has important implications for shareholder rights and corporate responsibility.

Bottom line: In January, Exxon sued Follow This, a Dutch climate activist group, and investor Arjuna Capital to block a climate resolution the groups submitted ahead of the company’s annual meeting scheduled for tomorrow. The resolution would allow shareholders to vote on whether to accelerate Exxon’s reductions in greenhouse gas emissions.

Both climate groups withdrew their proposals after Exxon’s lawsuit, but the oil supermajor is pushing forward in hopes of winning a ruling that would set a precedent for such cases.

Last week, a judge dismissed the case against Follow This due to jurisdictional issues because it is based in the Netherlands – but the case against Arjuna will continue.

Exxon says it must resist efforts to manipulate shareholder activism. But shareholder groups say the company is “bullying” investors and say shareholders’ rights will be suppressed if Exxon’s action succeeds.

Exxon’s lawsuit sparked an outcry from some shareholders. Calpers, the largest public pension fund in the US, said it would vote against the re-election of Exxon board members, including CEO Darren Woods. Norway’s oil fund said last week it would vote against independent director Jay Hooley, who heads Exxon’s management strategy.

Ahead of tomorrow’s vote, Energy Source asked the CEOs of Exxon and Calpers to outline why legal action is such an important issue. Here they are in their own words. Let us know what you think at energy.source@ft.com.

Thanks for reading – Jamie

Join us tomorrow, May 29, in Washington DC or online for our inaugural US Decarbonization and Industrial Transformation Summit. Register today and as a newsletter subscriber, save up to 15 percent with the code NEWS15.

Marcie Frost: ExxonMobil lawsuit threatens shareholder democracy, Calpers CEO writes

The writer is CEO of the California Public Employees Retirement System.

ExxonMobil’s decision to sue a group of shareholders goes to the very heart of our mission as a public pension fund.

Calpers has a sacred, fiduciary duty to provide retirement benefits for more than 2 million public sector workers and their families. Our members expect us to invest prudently and to do everything we can to improve the long-term success of those investments.

This includes responsible corporate governance. When we exercise our rights as shareholders in America’s approximately 6,000 companies, we engage in what is often called “shareholder democracy,” a way of speaking truth to power. This process is overseen by the US Securities and Exchange Commission.

Calpers plays by the rules of shareholder democracy regardless of who is in Washington, DC. Why can’t ExxonMobil?

For months, the company’s directors and senior management have acted as if they were under siege by two small shareholder groups that have dared to put forward proposals related to climate change in recent years. Rather than ask the SEC to be exempt from voting on the measures, ExxonMobil asked a U.S. district judge to rewrite the rules.

Don’t be distracted by outlandish claims that this is a fight over politics or a valiant effort to fend off radical climate activism. This fight is purely about whether shareholders will retain their existing rights to speak on issues they believe are material to the company’s long-term profitability.

A newspaper opinion page recently likened Calpers and other critics of the ExxonMobil lawsuit to unruly “agitators” as a reason to justify silencing shareholders who raise issues the company’s executives do not want to address.

The company sought to further mask its anti-speech efforts by insisting it was only seeking court-ordered “clarity” about the SEC’s rules on shareholder proposals. We believe the real intention is to tip the balance of power towards corporate C-suites and boardrooms.

Workers’ rights, fair and transparent executive compensation, and independent directors — all of these issues and more could be sidestepped for years to come if shareholders ignore this legal battle and ExxonMobil wins. Fortunately, a growing number of investors are now paying attention.

Since we first spoke out against the lawsuit two months ago, we’ve been asking the question ExxonMobil can’t — or won’t — answer: When faced with shareholder proposals it didn’t like earlier this year, why not? is the company following established procedures and asking the SEC for so-called “no action” relief from filing these proposals? After all, a recent independent review found that more than two-thirds of such requests have been granted by regulators this year.

ExxonMobil’s decision to bypass the SEC and go straight to Texas federal court, not to mention continuing to sue even after shareholder groups dropped their proposals in February, strikes us as a clear signal that something bigger is at play.

Without full and fair rights governing corporate engagement, Calpers and other similar investors will struggle to meet their fiduciary duty.

ExxonMobil’s lawsuit is a shocking overreaction to a pair of non-binding shareholder proposals — advisory measures that seek to foster dialogue, not impose directives. Meanwhile, the company, which reported net profits of more than $36 billion last year, complains about the cost of preparing shareholder proposals for a formal vote, which the SEC generally estimates at $150,000.

That is a small price to pay for upholding the basic principles of shareholder democracy, while the cost to shareholder rights if ExxonMobil wins the lawsuit is priceless.

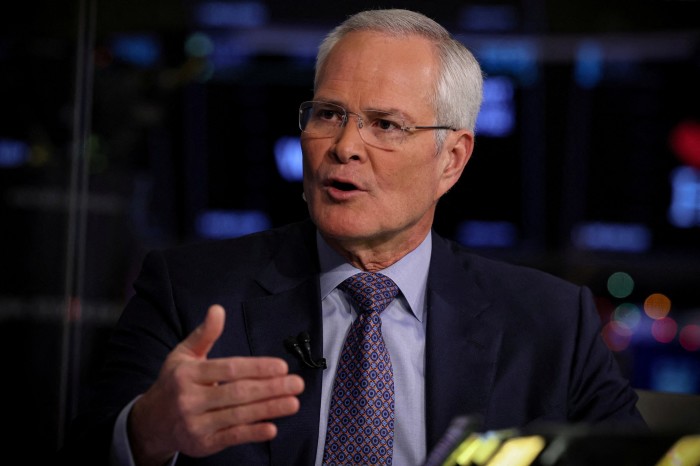

Darren Woods: Calpers should ‘leave politics to politicians,’ writes Exxon boss

The author is chairman and CEO of ExxonMobil.

It’s easy to get distracted by all the noise surrounding ExxonMobil’s legal action against activists posing as shareholders. Here are the facts:

This isn’t about David vs Goliath – just because you’re big doesn’t mean you’re wrong.

This isn’t about climate change, either — ExxonMobil has recently stood up to shareholders this year who want us to do less, not more, on climate.

Finally, this is not a challenge to shareholder democracy – in fact, we support it. One of the hallmarks of a democracy is that everyone is treated fairly and follows the same rules.

These are activists who, for the third year in a row, have proposed that we limit sales and allow others to meet the world’s energy demand. This proposal was rejected by the overwhelming majority of our shareholders two years in a row.

When we exercised our right to be heard by a federal judge on the critical question of whether the defendants were violating US securities laws, the proponents immediately withdrew their motion.

Why did they back down in the face of this simple request for clarity? What happened to the devotion to their cause? I suspect they wanted to avoid a legal defeat that would undermine their fundraising “business model”.

Their arguments make for easy headlines, but fall apart under scrutiny.

For example, they claim that they withdrew because the cost of their defense was too high. That’s bullshit. These are the same organizations that raise funds through attacks on our company.

And in fact, the judge in the case said he expected to resolve the issue through legal documents rather than in court, which would minimize the financial burden on all parties.

They also say that we are trying to silence small shareholders. Conversely, resubmitting a twice-failed proposal in violation of SEC rules ignores the votes of 90 percent of the shares voted that did not agree to it on the last attempt. Introducing greater clarity to the SEC’s rules is better for all shareholders.

They also say that because they dropped the motion and promised not to file it again, the case should be dismissed. But, as the court said, “not so fast”. Their promise is “toothless” because they could simply “ . . . add an oxford comma here, shorten a sentence there and resubmit the results”.

Finally, some critics argue that this lawsuit is unnecessary because the SEC has increased the frequency with which it grants so-called “no-action” relief, meaning that a company does not have to act on a specific shareholder proposal. That’s true, but two things seem to have happened since our lawsuit went public: more and more companies are seeking relief, and more are getting it. In recent years leading up to our lawsuit, activist proposals have increased and SEC relief has decreased.

Organizations like Calpers know these facts to be true. More importantly, they know their job is to be the best possible stewards of the pension funds entrusted to them by the employees of the state of California.

Calpers also knows that these activists are not interested in profiting from ExxonMobil stock. They want to financially damage the company and compromise the investments of millions who rely on the dividend as part of their retirement portfolio. Calpers’ fiduciary duty is not supported by their attack on our company (or any company). They should leave politics to the politicians.

All we are seeking in our lawsuit is greater clarity on the SEC’s rules and their application. I understand why activists might object, but it’s hard to imagine why an investor like Calpers would be against federal regulations being better understood and more consistently applied. It’s even harder to imagine why Calpers would organize an effort to stifle and punish the company when it seeks what anyone in business wants: fairness and predictability in the application of the law.

That is ultimately what our lawsuit is about.

The Power Source was written and edited by Jamie Smyth, Myles McCormick, Amanda Chu and Tom Wilson, with support from the FT’s global team of reporters. Contact us at energy.source@ft.com and follow us on X at @FTEenergy. Follow past issues of the newsletter here.

Recommended newsletters for you

Moral money — Our must-see newsletter on socially responsible business, sustainable finance and more. Register here

Climate Graphics: Explained — Understanding the most important climate data of the week. Register here