The pound-to-euro exchange rate rose to a new 21-month high of 1.1784 after German state-level inflation pointed to a slowdown in May, but analysts warned that levels above 1.1765 would not be sustained.

Euro exchange rates came under pressure after German state-level inflation showed a sharp slowdown, raising the prospect of subdued euro zone inflation on Friday, opening the door to gradual rate cuts by the European Central Bank in June and July.

Germany’s most populous state, North Rhine-Westphalia, saw inflation slow to 0.2% month-on-month in May from 0.3% in April. In Saxony, inflation slowed from 0.6% to 0.1%; in Hesse, inflation stagnated at 0% from 0.6%. Bavaria saw inflation fall from 0.6% to 0.1%.

Headline German inflation came in at 0.1%, down from 0.5% and below expectations of 0.2%. German data can sometimes overshadow the euro zone inflation figure, which is due two days later, meaning that the euro’s weekly inflation-related move is already underway.

By late morning, the euro was lower against all of its G10 counterparts, meaning this is a euro-specific move that is pushing GBP/EUR to new highs.

The European Central Bank will cut interest rates in June, but Friday’s mild inflation in the eurozone could increase the chances of a second cut in July. This would put the ECB at the forefront of the rate-cutting cycle and penalize the euro against currencies belonging to central banks that will be more reluctant to cut rates.

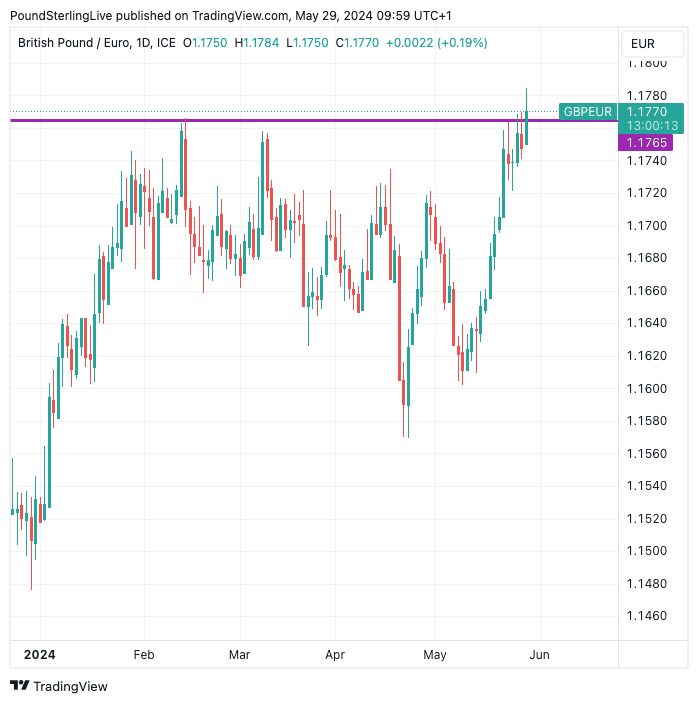

A mid-week rally will take sterling above the upper end of the 2024 range against the euro and the exchange rate is starting to look expensive for some analysts.

ING’s global head of markets for UK and Central and Eastern Europe, Chris Turner, says he favors resistance near €1.1765 to hold as the pound looks set to ignore domestic politics and instead bounce back Bank of England interest rate expectations.

“We think the market is pricing in just 33 basis points for a Bank of England rate cut this year to be too modest. And we think EUR/GBP will largely hold support near 0.8500,” says Turner. EUR/GBP at 0.85 corresponds to a conversion of GBP/EUR at 1.1765, which is the location of the upper resistance band:

Above: GBP/EUR on daily intervals showing potential resistance. Track GBP/EUR with custom rate alerts. Set here

As can be seen from the above, although GBP/EUR has rallied in recent days, it is still convincingly defying the severity of the 2024 range.

The rally comes as investors assess the potential impact on July 4, when a Labor government takes the reins. So far, markets seem relatively bullish on such a prospect; some analysts say a strong Labor majority could actually support the GBP.

“EUR/GBP continues to trade at lows. Labour’s shadow chancellor Rachel Reeves is making all the right fiscal noises – although Labor may find itself politically boxed in if it wins the July general election. FYI, UK sovereign five-year credit swap default (CDS) falls to 25 basis points.

File picture of Labor leader Keir Starmer and Shadow Chancellor of the Exchequer Rachel Reeves. Image © Keir Starmer

“While the drop in UK CDS is welcome – and a far cry from the over 50bp increase seen during Liz Truss’s brief 2022 government – we think the pound will still largely trade on the interest rate story “, he adds.

The likelihood of a June rate cut by the Bank of England narrowed following last week’s above-consensus UK inflation. All but evaporated after Prime Minister Sunak announced that the country would go to the polls on July 4 as all civil servants – including those at the Bank of England MPC – would enter a period of purdah.

This enforced radio silence means the bank can’t steer market expectations towards a rate cut in June, meaning such a move would come as a big surprise to a market that doesn’t expect it.

Most economists we follow think an August cut is likely. “We think the market price of just 33 basis points for a Bank of England rate cut this year is too modest,” says Turner.

33bp suggests that the market is only set for one drop. Pricing in a second or even third cut (assuming an August kick-off) suggests room for a recalibration of market expectations and potential weighting to the pound.