Leading online food delivery groups in Europe and the US have racked up more than $20 billion in combined operating losses since going public after a fierce battle for market share.

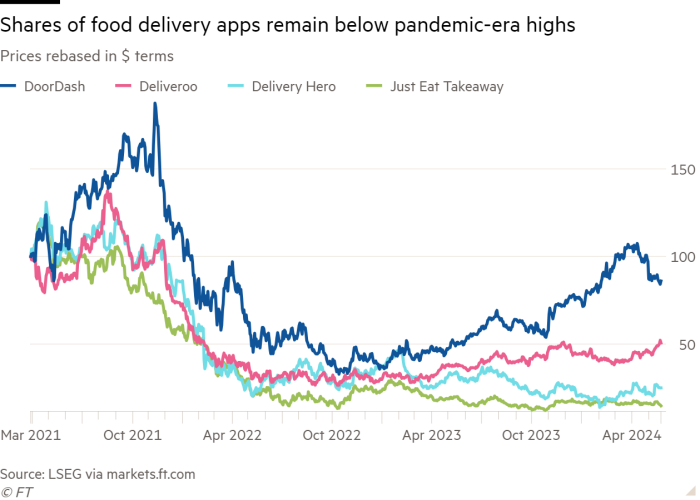

Shares in Deliveroo, Just Eat Takeaway, Delivery Hero and DoorDash — the four largest stand-alone, publicly listed food delivery businesses in the U.S. and Europe — are all trading well below their pandemic-era peaks as investors examine their business models.

After a period of pandemic-fueled growth, the four companies now face a tougher macroeconomic environment that has hit consumers.

As they press again to prove profitability to investors, their cumulative annual operating losses have now reached $20.3 billion, according to calculations by the Financial Times and industry analyst theDelivery.World.

This figure covers the seven years since Deliveroo, Delivery Hero and DoorDash went public and after Just Eat Takeaway was created following a 2020 merger. Includes significant amortization related to acquisitions and stock-based compensation.

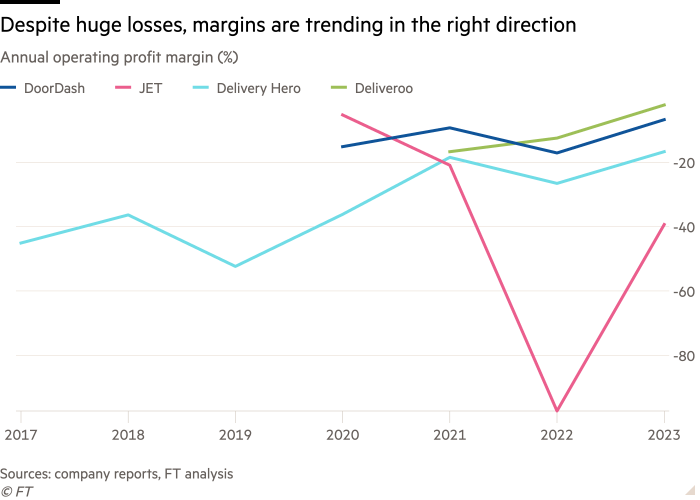

“Investors’ willingness to fund losses has changed” and they now want food delivery businesses to “demonstrate sustainable, profitable growth” after interest rate rises, UBS analyst Jo Barnet-Lamb said.

Rival Uber did not break even on the profitability of its Eats business, but it recorded its first full year of group-wide operating profitability in 2023 after a concerted push to boost margins, a moment the company hailed as an “inflection point”.

For years, venture capital groups have poured money into so-called “gig economy” companies that subsidize food deliveries to lure customers with low prices and gain market share.

But with interest rates rising, investors have focused on profitability even though the companies’ operating costs, including marketing costs, remain high.

The industry also has to contend with ongoing scrutiny of workers’ rights from regulators and labor groups. If couriers were paid higher wages, skeptics argued, consumers would never be willing to pay the true cost of food delivery.

However, stock market analysts are increasingly optimistic that companies can improve their performance. In April, the three European players said they expected to follow DoorDash this year and become free cash flow positive annually.

The focus on free cash flow follows a long-standing emphasis among companies in the industry on an alternative earnings measure — adjusted earnings before interest, taxes, depreciation and amortization — that strips out a number of costs such as legal provisions.

But many people “don’t see.” [adjusted earnings metrics] as the true level of profitability of the underlying business,” said Joseph McNamara, an analyst at Citi.

Operating losses offer “the best standardized view across all companies” that minimized adjustments and other non-cash and non-operating impacts, said Amanda Benincasa Arena, a partner at management consultancy Aon.

Whether companies could demonstrate they were generating more money than they were spending was the next big “litmus test”, McNamara added, now that the “growth at any cost” phase was over.

Giles Thorne, an analyst at Jefferies, noted that consumers had continued to use services in recent years “despite having less money and being charged more” – because of smaller discounts and higher inflation – which he said had supported the sector’s long-term outlook.

While the online grocery delivery sector was boosted by the impact of the pandemic, sales growth rates have declined in subsequent years. The groups have sought to develop new revenue streams to help spur growth, such as food delivery and higher-margin advertising companies.

Uber has credited the expanding range of services it offers for helping to increase overall sales, increase user numbers and increase economies of scale.

The teenage industry is also witnessing a period of consolidation, with some players exiting certain markets and others looking to double down in places they believe they can dominate.

US-focused DoorDash previously told the FT it was looking to push into new markets, while Delivery Hero said in May it planned to sell its Taiwan business to Uber to “focus our resources” elsewhere. In January, the German group also sold its minority stake in London-based Deliveroo.

Historic deals also hit the bottom lines of some of the four companies, however, with a sharp decline in industry valuations leading to write-downs.

The extent of JET’s losses in 2022 and 2023 was partly due to write-downs of the businesses it acquired totaling $6.5 billion, with the write-downs mostly relating to Grubhub, which JET has been struggling with since 2022, and Just Eat. Delivery Hero also announced substantial recent write-downs totaling about $1.7 billion in 2022 and 2023.

The write-down could indicate that acquisitions or mergers “didn’t happen” as hoped, Aon’s Benincasa Arena said. Consistent write-offs could mean a company “entered the wrong markets through an acquisition or once in those markets they’re not doing the operations right,” she said.

Expenses related to employee stock awards also hit operating profits, with DoorDash reporting more than $1 billion in such expenses in 2023.

Operating losses since IPO:

CURRENT: operating losses of $9.1 billion since it was created by the merger of the UK’s Just Eat and the Netherlands’ Takeaway.com in 2020.

Delivery hero: operating losses of $7.8 billion since 2017, when it was listed.

DoorDash: $2.6 billion in operating losses since 2020 when it went public.

Deliveroo: operating losses of $777 million by 2021 when it went public.

Deliveroo said: “We continue to make strong progress in delivering on our strategic priorities and remain confident in our ability to deliver profitable growth.”

DoorDash said it has “invested billions” to help merchants “build successful businesses,” adding that the company expects to deliver “[generally accepted accounting principles] profitability over time”.

Emmanuel Thomassin, Delivery Hero’s chief financial officer, said the operating losses include “items not considered operationally relevant to the measurement of the company’s economic development”. The company is more focused on other metrics including free cash flow, he added.

JET declined to comment.