The popular view of generative AI is that it is unjustifiably expensive, chronically wasteful, rarely useful, and forced on the general public for ideological reasons, even as it degrades the services they rely on. Governments will certainly be behind it.

So says Barclays:

The initial wave of artificial intelligence is in full swing, fueled in large part by billions of dollars in hyperscale. Concerns with Nvidia and ultimately the second wave of the AI ecosystem is why the next pocket of dollars comes from a time when hyperscale capex won’t be able to move further into AI or grow meaningfully year-over-year.

In recent months, we have seen a growing initiative by nations around the world to quickly educate themselves and stay at the forefront of AI’s powerful potential. In practical terms, this represented public announcements of multi-hundred-million and even billion-dollar spending plans from several countries (Saudi Arabia, Singapore, Germany, UK, India) that will go towards supporting the AI hardware ecosystem.

AI’s private sector cash burn is already sovereign-sized. The joint capital of Amazon, Meta, Google and Microsoft will be around $200 billion this year according to Bernstein Research.

These sunk costs must yield some kind of return by the time depreciation hits their income statement. Continued acceleration in investment growth depends on companies finding something the public wants to buy. Their need for income may soon become urgent, and current concepts are not encouraging.

But because political leaders care more about one-time improvements than ROIC, taxpayer-subsidized AI may continue to boom even after the corporate bubble bursts.

Barclays estimated in a recent report that if the countries of the former China matched the US’s $4 billion in AI spending, on a GDP basis, it would add another $3.5 billion:

For Nvidia, this represents barely a month’s revenue. More important is the replacement cycle.

Barclays estimates that hardware purchases will become obsolete within two years. As AI hardware gets bigger and more expensive, aggregate annual government spending could easily exceed $25 billion very quickly:

Overall, we see AI as the most powerful enabler of technological progress as well as a major security risk as hostile countries increase capabilities, which ultimately justifies our estimated spending and gives us confidence that the numbers should increase substantially.

The US soon took the lead as their government was relatively enthusiastic about AI. The Federal Use Case Inventory was released in September, identifying more than 700 possible applications, and the Senate AI Policy Plan earlier this month proposed a $32 billion research and development budget.

Although such numbers may appear fanciful, the larger costs are far less scrutinized. The Senate plan does not include defense, which appears to account for almost all current US federal spending on AI.

A study of government procurement published by the Brookings Institution in March found that the US Department of Defense was aggressively increasing investment in artificial intelligence in 2022. The maximum potential value of the contract was just over $4 billion of last year’s $4.56 billion in AI acquisition spending. defense agency, Brookings calculates.

Senate Majority Leader Chuck Schumer said the U.S. defense budget against AI needs to increase about eightfold. The exact purpose of all these investments will remain classified information.

Countries following America’s lead will want something built in-house that is at least equivalent to OpenAI GPT-4, Barclays says. Last year’s top technology represents a “minimum starting point for nations striving to remain at the forefront of AI for both economic and security purposes.”

The processor blades for such a device will cost $600 million at current prices, plus the same to cover the costs of connectivity, storage, power, etc. What such a setup will not do is scare the enemy. This requires staying on the edge of AI, which will be a lots of more expensive.

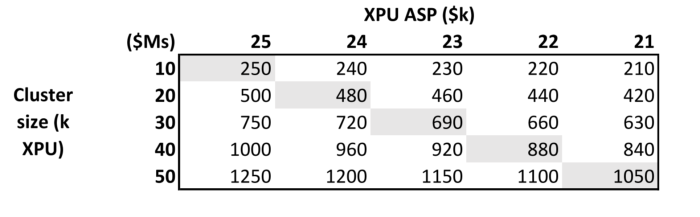

The training GPT-4 reportedly used 25,000 accelerator cards, while the GPT-3 – released less than three years ago – needed just 1,000. The grid below gives a rough idea of the current cost of building all-in in increments of ten thousand accelerators, or XPU.

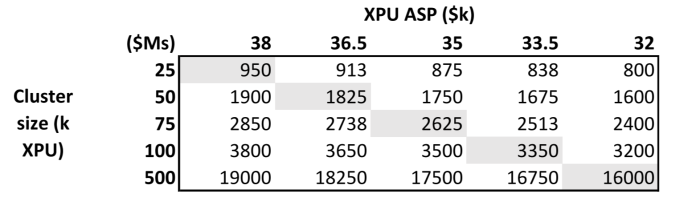

If hardware cost inflation continues at its current rate, the cost of a single best-in-class AI computing cluster could easily exceed $5 billion, Barclays says:

The Infowars arms race will escalate so quickly only about 15 nations can afford to participate, Barclays says. And for those who are able to pay, there is no way to back down, it says, because “AI capabilities have become one of the most important, if not the most important, national initiatives in the entire world”:

In our view, the global development of AI applications will undoubtedly become a national security issue no different than how the government views the domestic production of high-end chips, and under the lens of the ~$39 billion CHIPS Act that was passed a few years ago, we see corresponding space. in the government budget for increased spending on new clusters and more advanced hardware as it becomes readily available.

Additionally, we believe that new AI/computing investment plans presented by Saudi Arabia ($40 billion AI investment fund according to the New York Times), Singapore, Germany, and even India could prompt policymakers to act sooner rather than later to create more robust AI . investment plans into politics

So buy Nvidia, Barclays tells clients. The stock may look expensive, with a bunch of sanctions and antitrust risks attached, but government officials won’t know any better than to buy servers off the shelf:

We see NVDA as the biggest beneficiary of Sovereign AI given its already dominant share of the merchant AI accelerator installed base, performance leadership and developer community preference. We also see the Sovereign AI market as a strong potential adopter of the company’s complete rack solution [ . . . ] given that government agencies lack the engineering know-how and resources needed to build custom solutions around commercial hardware. Overall, we believe that the projected spend from Sovereign AI is additive to the entire AI ecosystem, and therefore we believe that it will permeate the broader AI ecosystem as well.

And sure. Why not. Once the trailing PE gets above 300x, anything goes.

Being an ESG darling was a big part of Nvidia’s purchase case last year. A year earlier it was adjacent to the shitcoin bubble and before that it was mostly o Cyberpunk 2077 frame rate. It is now a buy as it is the de facto weapons supplier to the World War GPT.

One common thread that connects Nvidia customers and shareholders is that they don’t know what they’re buying or why they need it, but they’re sure they have to have it. International arms races for billion-dollar boondoggles and tiger-repellant rocks would fit that description perfectly.

Further reading:

— “Sell Nvidia” (FTAV)