Harland and Wolff has the potential to become increasingly important to the future of the Royal Navy with its extensive facilities and its key role in the construction of Fleet Solid Support Ships. Here we look at how the company is reviving shipbuilding against the odds.

Background

In August 2019, Harland and Wolff, Belfast entered administration and it was widely assumed that the yard with its long and distinguished shipbuilding history was finished. Although the yard has a large capacity, lack of investment and the inability to get new work has seen the workforce dwindle to just 79. RFA Fort Victoria was launched in 1990 and is the latest ship built by H&W for naval service and the last ship built in 1990. the MV Anvil Point was completed in 2003. In the following years, the company focused on engineering for offshore energy and ship repair.

In December 2019, the business was bought by Infrastra, whose original vision was to use the yard for production work to support their underground natural gas storage project at Islandmagee, near Larne. However, the long-term ambition was always much greater, to restore H&W as a sustainable engineering and shipbuilding industry. A memorandum of understanding was signed with Spanish shipbuilder Navantia to collaborate on projects, and H&W also began to do well in securing a mix of new small and medium-sized commercial work projects. (In September 2021, Infrastrata plc was renamed Harland & Wolff Group Holdings plc).

Finance

The regeneration of the shipyard from its greatly weakened state, as well as the acquisition of other businesses, inevitably requires a loan to finance the investment. H&W is being financed by private lenders and banks, but everyone involved is aware that this is a long-term project that would initially lose money and not show profits for some time. Much higher interest rates and inflation since 2019 haven’t helped, but the company has made great strides and is on track to reach £200m in revenue this year, with 90% of work already under contract.

A report in The Times in May suggesting that H&W would go out of business without government support caused alarm and hit the share price. These claims are strongly denied by CEO John Wood, who described the piece as “misleading and inaccurate”. H&W is seeking a government guarantee for a £200m UK Export Finance (UKEF) loan. This system normally underwrites 80% of the risk, but H&W requested 100%. No decision has been made yet and the company says it will be fine regardless of the conditions. H&W are not asking for any other form of taxpayer support and point out that they do not have a Terms of Business Advantage (TOBA), have not taken any government funding during the pandemic and note that the use of UKEF is standard practice for other Defense First Class.

At the end of 2023, the company hired its 1,000th employee and is still recruiting as it works to launch the FSS project. The average age of its workforce has dropped from 58 to 40 and continues to decline. More than 140 apprentices have been accepted and there are more vacancies. A small number of H&W employees are learning how to set up and operate a digital yard and automated panel lines with Navantia in Cádiz. Navantia also sent some of its staff to Belfast to help oversee the modernization of the shipyard.

Belfast

The 81-acre Belfast Yard is an impressive site with 1,800m of waterfront and 30,000m2 covered production halls. As part of the £77 million investment that followed the award of the FSS contract, 5,000 million2 an extension is added to the halls with an automated panel line capable of producing 16m2 panels. The vast dry dock that dominates the site is 335 m long, 50 m wide and 12 m deep with a capacity of 200,000 m³. An intermediate gate can be placed across the dock and divided into a flexible, semi-wet and semi-dry layout. The dry dock is served by two 140m gantry cranes (Goliath and Sampson) certified to lift up to 900t (and two 60t tower cranes), which will be important in consolidating large blocks for Fleet Solid Support ships.

H&W also owns another important facility – the Belfast Dry Dock – the only one in the UK that can accommodate a QEC aircraft carrier in all tide states. Although Babcock Rosyth has a carrier maintenance contract, access is not easy and Belfast Dock could prove an important alternative if emergency docking is required and Rosyth is unavailable.

In addition to the FSS work, the order book looks healthy as H&W recently commenced a comprehensive refit of the SeaRose Floating Production Storage and Offloading (FPSO) vessel on a contract worth up to £100m. They are also the Falklands Government’s preferred bidder for the delivery of at least £100m worth of new port facilities. In addition, they announced proposals to build and operate two new ferries on the Penzance to Isles of Scilly route. They also built barges for KBR / BAE Systems for Portsmouth Naval Base as well as an £18 million contract for 23 Coby waste management barges for use on the Thames.

Appledore

In August 2020, H&W bought the small Appledore shipyard in North Devon for £7 million. Formerly owned by Babcock and closed in March 2019, the yard had a history of narrowly escaping closure, but most believed it was truly over. Instead, H&W invested in rejuvenating its aging infrastructure, secured small commercial projects, pledged participation in the FSS, and built a workforce of 200 people.

As a first step back into naval work, Appledore began a £55 million MoD contract in 2022 to refurbish ex-HMS Quorn for future service in the Lithuanian Navy. Ex-HMS Atherstone was also acquired for spare parts and could be refurbished for non-military use. H&W recently signed a memorandum of understanding with Austal (Australia) for the transfer of technology to build aluminum vessels at Appledore to bid for a mill replacement for the UK Border Force and other projects.

Scotland

In February 2021, H&W acquired the former BiFab shipyards in Methil and Arnish, Scotland. These facilities are primarily focused on steel production for the renewables, oil and gas industries, but also have the potential to contribute to defense activity. H&W Methill has two unloading quays, a large open assembly area and a 7,500 m² covered production hall. H&W Arnish on the Isle of Lewis has around 100 employees and specializes in steelwork. She has worked on a variety of projects including parts for the Hinkley Point nuclear power station, pier construction and the mining industry. The two Scottish sites will also play a key role in the development of new offshore wind farms planned by the Scottish Government. H&W acquires barges to transport work between its four locations to balance capacity and maximize employment efficiency.

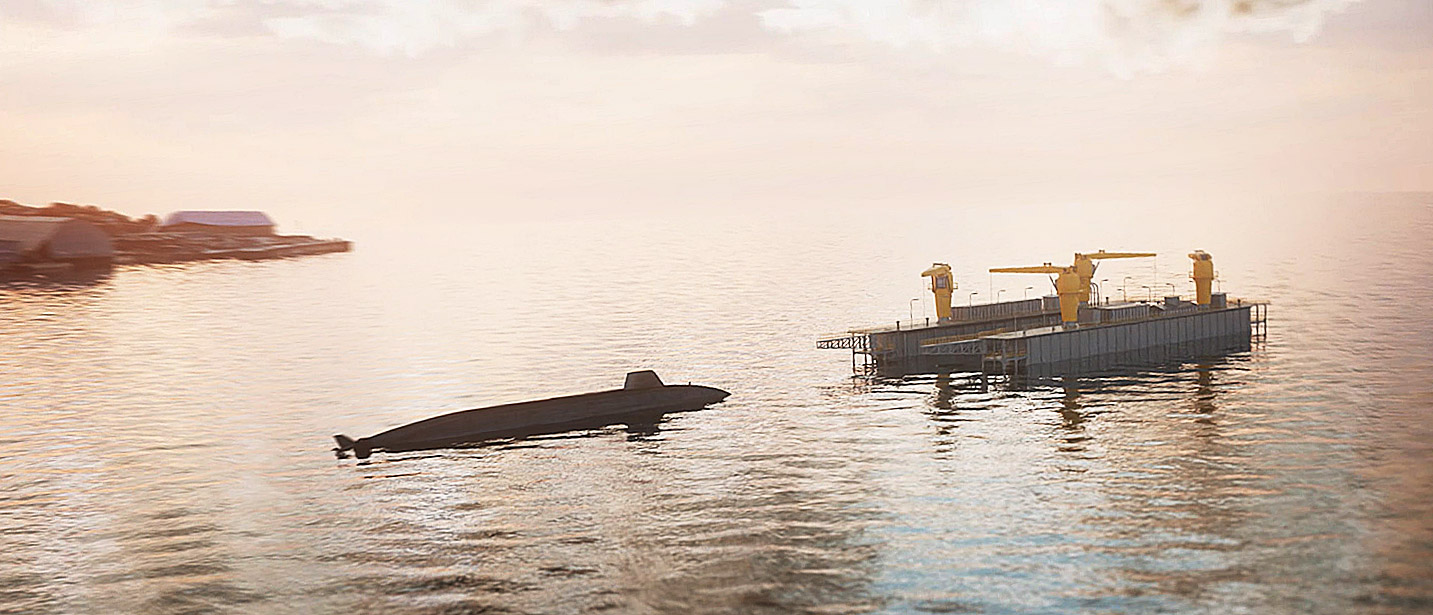

In November 2023, the MoD published an announcement on market involvement in the EUSTON project. The Additional Fleet Time Docking Capability (AFTDC) project aims to acquire two floating dry docks and associated submarine maintenance infrastructure at Faslane. No floating dry docks have been built in the UK since the 1960s and it will be a challenging project as they will need to be large enough to accommodate the 17,200 tonne Dreadnought class SSBNs. H&W believe their Methil site would be ideal for building these docks as it has the space, capacity and skills to match.

Strategy and the future

It has been known since the 1980s that commercial shipbuilding in the UK is almost at an end and the few yards that remain can only survive on government contracts or building small vessels under 500 tonnes. While the UK is unlikely to return to the building scale of the past, The National Shipbuilding Strategy (2017) identified plenty of opportunities for shipbuilding and marine engineering. With the right investment, the UK could take the lead in edge markets through innovation in new propulsion systems, autonomy and renewable energy. The 30-year forecast also suggests there is plenty of government work for UK shipyards, provided future administrations properly fund the ships the navy and other agencies will need.

As part of the “Team Resolute” arrangement, H&W has a subcontract with Navantia worth about £700-800m, around half the value of the £1.4bn FSS project. They are confident they will be ready to cut the first steel in Belfast in March 2025 as agreed. There is still a lot of controversy over the work going overseas, but Navantia’s involvement will effectively sign off on the project and ensure RFA gets the ships on time and on budget. (“Team UK” never believed the boats could be built domestically at this price). Perhaps the most overlooked benefit is the transfer of skills to Belfast, which will also set H&W competitive for future work.

There is probably a need for more shipbuilding capacity in the UK, both for strategic reasons in a world returning to more coastal industrial use, and because there are also very few dry docks where large ships can be consolidated. H&W says that even at the peak of the FSS program, it will use only 30% of the company’s potential capacity. With the MRSS confirmed and the Strategic Sealift vessels (Point class replacements) on the horizon, perhaps the MoD should follow a carrier alliance approach instead of failing to meet the competition and seek industry cooperation to deliver these ships.

H&W’s strategy is to avoid reliance on a single sector for contracts that spread risk. They will compete for jobs in the deep sea, cruise ships, ferries, energy and renewables, as well as defence. If this growth can be sustained, this is potentially good news for RNs in the long run. An efficient high capacity shipbuilder that is successful in the commercial sector is likely to be well placed to support future maritime requirements, particularly for larger vessels and a place to consolidate blocks contributed by other yards.

It is not an easy task for H&W to resume building large ships, which is a change from ship repair. There are plenty of people who believe they will struggle to pull off a project on the scale of FSS, but given how much has been achieved in just 5 years, there are reasons for optimism. The company itself is very confident that it will overcome the inevitable obstacles and challenges it will face.