Rising political heat is complicating interest rate decisions in the US and UK, where central banks are weighing whether to cut borrowing costs as voters head to the polls.

The Bank of England and the Federal Reserve want to avoid any appearance that they were cutting interest rates to help incumbent governments, former officials and economists said, so they are more likely to deflect moves too close to election day.

The situation is particularly tricky for the BoE, according to former monetary policy makers, given that its next meeting is just two weeks before the July 4 general election. Governor Andrew Bailey has hinted that a rate cut is close.

“Central banks don’t want to appear to be playing politics at all, so the easiest thing to do is to do nothing,” said Charles Goodhart, a former member of the BoE’s monetary policy committee. “[But] if not [move rates] this month, you can do it next month.”

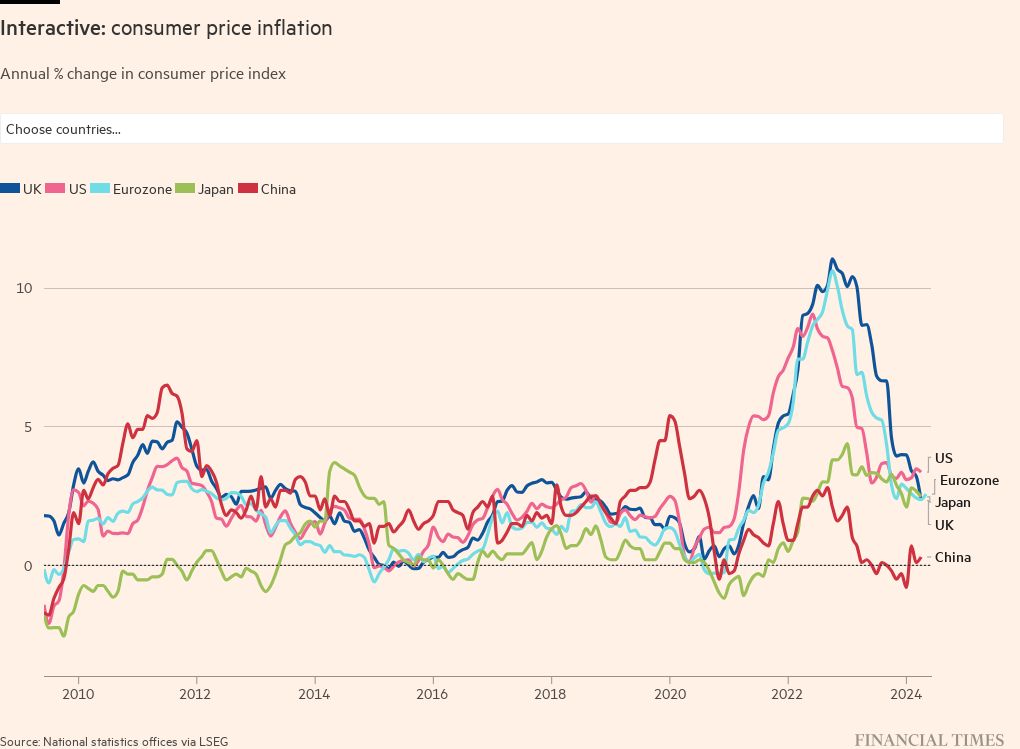

Western central banks, which raised rates to multi-year highs in response to the worst rise in inflation in a generation, are now under intense pressure to reverse course. The Bank of Canada and the European Central Bank are among those that have already taken the first step toward looser monetary policy, making the first cuts last week.

However, the Fed and BoE are lagging behind as they weigh the effects of sticky services inflation.

In the US, the Fed faces a much more protracted election campaign than the accelerated process in the UK. Markets still expect the Fed to cut rates in mid-September, its last meeting before the Nov. 5 presidential election, despite Friday’s strong jobs report.

But some think it could be difficult for American politicians.

Adam Posen, director of the Peterson Institute for International Economics and a former member of the MPC, said the strong US economy meant the Fed was unlikely to take center stage by cutting rates ahead of the election.

“The Fed cannot suspend itself indefinitely, nor should it suggest that it will,” he said. But he added that a rate cut was unlikely until September and “if the data allows them, they will try very hard not to do anything until November”.

While President Joe Biden faced political pressure from some Democrats, he and his Treasury secretary, former Fed Chair Janet Yellen, were adamant that they did not want to jeopardize the independence of the US central bank.

The data could buy the Fed time. Personal consumption expenditure inflation at 2.7 percent remains well above its 2 percent target. The labor market is cooling more slowly than expected.

Eswar Prasad, a professor at Cornell University, said the May jobs numbers almost certainly determine the July shortfall.

“Any Fed action that appears unlikely over the summer could now come uncomfortably close to the November election,” Prasad said. “The combination of strong employment and wage growth, in tandem with persistent inflationary pressures, underscores sustained growth momentum.”

The Fed has already postponed its November meeting until after the election. This gap also occurred in 2020.

But others say the Fed is unlikely to let the timing of the general election play a role. Former Fed Vice Chairman Donald Kohn, said Chairman Jay Powell, “it’s very clear that their decisions are not driven by politics, but by economics. I’m sure he’ll stick with it.”

He added: “So if we get to September and the labor market weakens and inflation stays low, I see no reason why they wouldn’t cut rates.”

In the UK, Sushil Wadhwani, another former MPC member, said there was no reason in principle why the BoE could not act before the election. He voted to cut rates just a day before the June 2001 general election, even though the majority chose to keep them unchanged.

But he added: “The current economy is much more difficult for the bank because they [politicians] they said more [about rates].”

Bailey said last month that MPC members “never discuss politics” in their meetings. “Our job is to make decisions in accordance with our powers.”

But Prime Minister Rishi Sunak suggested last month that a vote for his Conservatives rather than the opposition Labor Party would be a vote for cheaper borrowing costs, in a move that appeared to be a shock to the BoE’s independence.

“This latest government has been much more willing to offer views on monetary policy than past governments; it doesn’t seem to really understand the concept of operational independence,” said Martin Weale, a member of the MPC from 2010-16.

“If I were an MPC I would think I needed a particularly good reason to change shortly before a general election.

UK inflation data for April was stronger than expected, while growth in the services consumer price index eased only slightly to 5.9 per cent, well above the 5.5 per cent level forecast by the BoE.

But if May’s inflation figures, due on June 19, show a significant softening in consumer prices, the case for an immediate rate cut from 5.25 percent at the BoE’s next meeting could trump any policy considerations.

“If the data from the 19 [is] convincing enough, I don’t think anyone can argue with cutting them,” Wadhwani said.