- The altcoin market remained bearish, with no significant growth triggers.

- Analysts suggest a potential recovery only after Bitcoin reaches the $100,000 milestone.

The cryptocurrency market has seen a substantial decline in the altcoin sector, which has struggled to gain traction amid a broader market focus on Bitcoin. [BTC].

In recent weeks, the market capitalization of altcoins has seen a significant decline from a peak of $1.182 trillion in late May to a current value of just over $1.06 trillion.

The shift reflects a broader sentiment of caution and bearish momentum that appears consistent with a lack of substantial new narratives driving investor interest compared to past cycles, according to analyst Crypto Ash.

Bitcoin is waiting for 100 thousand dollars

Crypto Ash poked out that the much-anticipated “Mega Altseason” remains elusive as the total market cap of altcoins has returned to levels not seen since December 2023.

Current market conditions do not point to any significant drivers similar to the innovations of previous years, leaving the altcoin sector in a state of limbo.

According to Crypto Ash, the potential for significant increases in altcoins depends on the performance of Bitcoin, suggesting that the true altcoin season may not begin until Bitcoin reaches the $100,000 breakthrough price.

Meanwhile, he advised that this period could be ideal for accumulating undervalued utility-based tokens.

He pointed out that although retail interest remains muted, savvy investors and whales are actively positioning during this downturn, suggesting a strategic increase in anticipation of future gains.

Meanwhile, Crypto Distilled, another crypto analyst, offered observations to the conditions necessary for the rebound of altcoins.

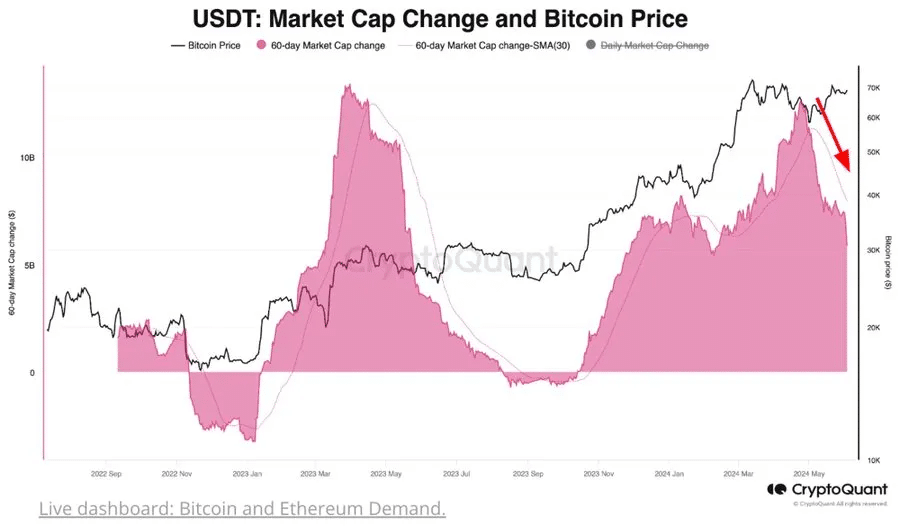

He emphasized the importance of liquidity, especially from stablecoins like Tether [USDT]which are necessary for the liquidity of altcoins on decentralized exchanges (DEXes).

…

Source: X/Crypto Distilled

He noted that USDT’s growth has been minimal since February 11th, and the resurgence of stablecoin liquidity is critical to sustainable altcoin price growth.

Crypto Distilled further suggested tracking the Smart Contract Platforms Index, as these platforms are critical to decentralized applications (dApps) and significantly influence market trends.

The presence of layer 1 governance tokens adds liquidity to their ecosystems and the potential adoption of Ethereum [ETH] ETFs could be a significant driver of liquidity.

He revealed that JamieCoutts, chief crypto analyst, pointed to two crucial indicators to watch: the uptrend in the Smart Contract Platforms (SCP) sector and the rise of the Altseason index.

Historically, the alignment of these trends has signaled significant gains for altcoins, sometimes exceeding tenfold returns.

In his closing thoughts, Crypto Distilled drew parallels to the last market cycle, where Bitcoin reacted strongly to liquidity changes after COVID.

He noted that in the current climate of global uncertainty, liquidity growth is not meeting expectations. So this cycle may see a focus on Bitcoin, with altcoin catalysts playing a background role.

Market dynamics and investor behavior

The difference in performance between Bitcoin and altcoins is significant. As Bitcoin nears its all-time highs, altcoins are plunging, mimicking bear market conditions.

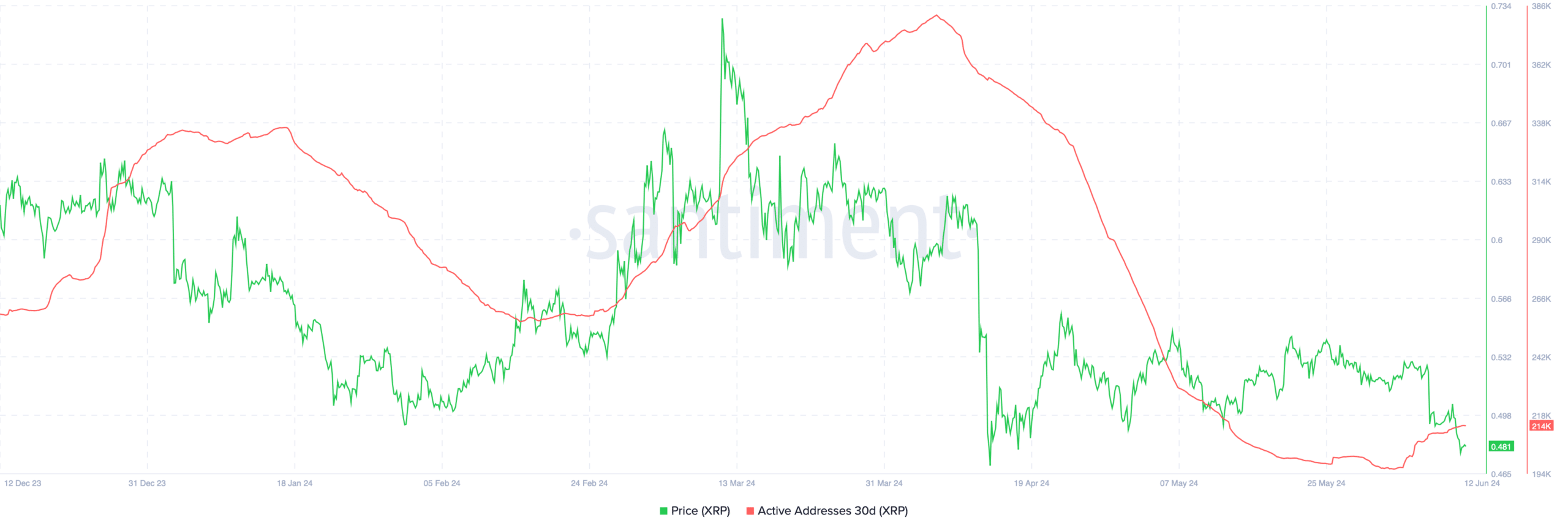

This divergence is particularly evident in the performance metrics of leading altcoins such as XRP, which have seen a near 10% drop in recent weeks.

further data by Santiment highlighted a significant drop in active XRP addresses, indicating waning user engagement and possibly predicting further price declines.

Source: Santiment

Despite the decline, there is a silver lining as reported by AMBCrypto increasing the number of XRP holders by 100,000 in early June, indicating a base rate despite prevailing challenges in the market.

Read bitcoins [BTC] Price prediction 2024-2025

This complex landscape suggests that the altcoin market faces short-term headwinds.

However, the foundation for future rallies may be forming behind the scenes as investors recalibrate their strategies in response to evolving market dynamics.