- Solana was trading within a defined consolidation range, indicating upside ahead.

- The 200-day EMA and Fibonacci levels indicated key support and resistance points.

In recent trading sessions, Solana [SOL] experiences significant fluctuations in its market value. From a high of $172 last week, the digital asset saw a correction and has stabilized around $151 at the time of writing.

This move represented a slight increase of 0.1% over the past 24 hours. Such market behavior underscored a critical phase of price consolidation that could pave the way for future price dynamics.

Solana: Market Predictions

Altcoin cryptoanalyst Sherpa has if a look at Solana’s current market performance, showing a consolidation range between $185 and $120.

According to Sherpa, this range indicated a period of market equilibrium after a rapid rise in prices. Such phases are not uncommon and often indicate that the market is preparing for its next major move.

The 200-day exponential moving average (EMA) is a technical analysis tool used to smooth price data by creating a constantly updated 200-day average price.

The EMA is essential for identifying the overall market trend and potential support levels. A close to this average indicates a short-term support level that could encourage buying activity among traders.

Source: Altcoin Sherpa/X

Another technical analysis by Sherpa using the Fibonacci retracement highlighted critical support and resistance levels.

At press time, the 0.382 retracement level was around $138.37, potentially serving as a key point for the Solana price.

If the price breaks below this mark, the following levels – 0.5 and 0.618 – are likely to act as further thresholds where price stabilization or a reversal could occur.

Fundamental analysis

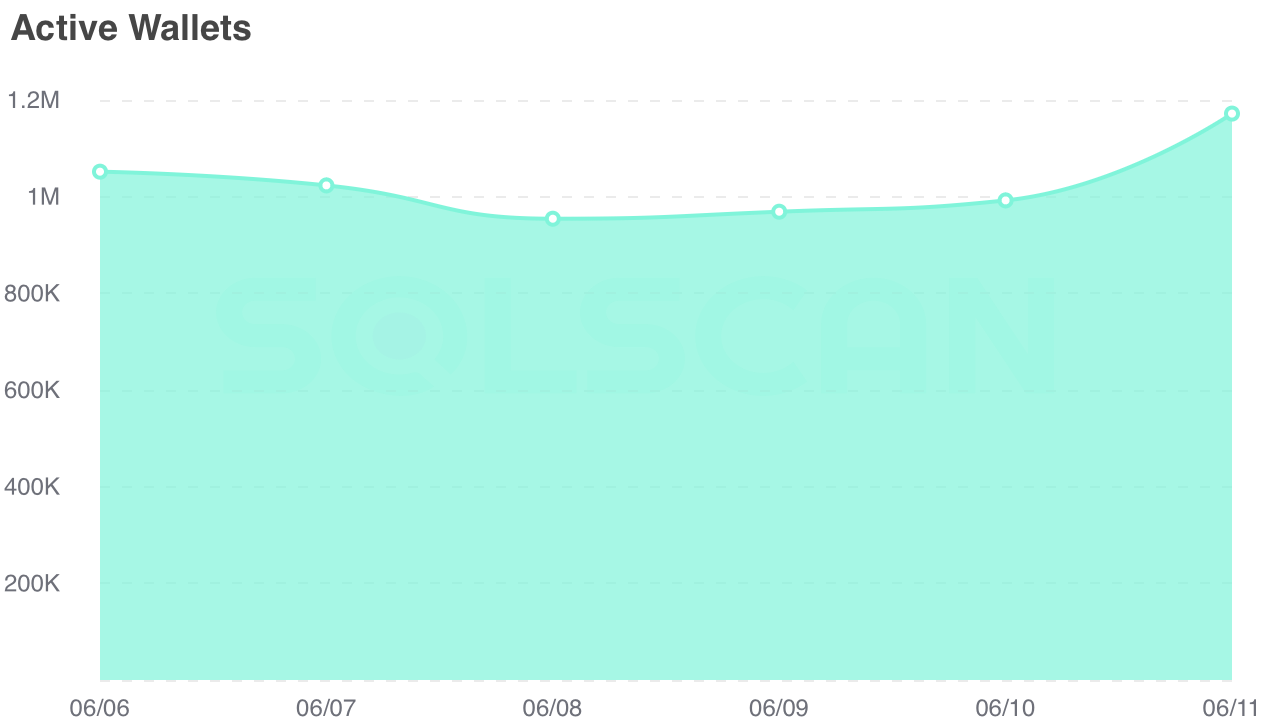

Despite ongoing consolidation, recent activity in the Solana network could indicate underlying strengths.

For example, the number of active addresses on the Solana network has soaredwhich went from under a million to over 1.1 million in just one week.

Source: Solscan

This increase in active addresses usually signals increasing user engagement or preparatory activity for upcoming transactions, which could lead to increased demand for SOL.

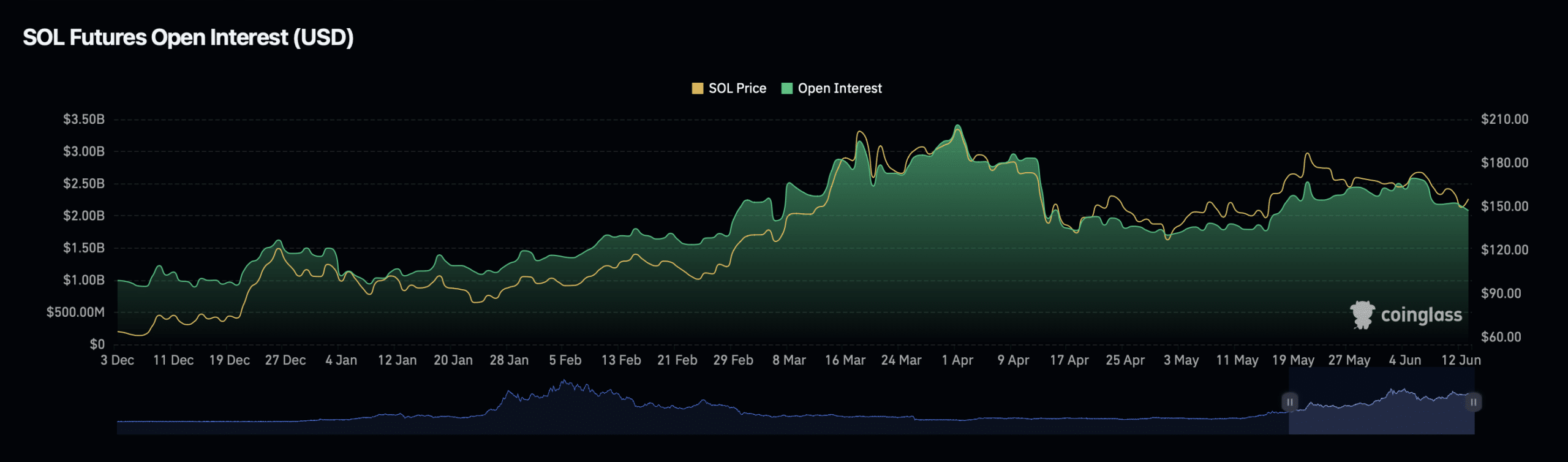

When it comes to market derivatives, Solana’s Open interest—representing the total number of outstanding derivative contracts such as options or futures that have not been settled—showed an interesting pattern.

While Open Interest saw a slight decline of about 3%, Open Interest volume increased by 19.54%.

Source: Coinglass

This indicated that while fewer contracts were opened, those remaining included larger volumes, indicating increased market activity and potential expectations of significant price moves.

There has also been a spike in Solana price volatility recently Sentiment.

Volatility refers to the degree to which trading prices fluctuate, with higher volatility often leading to wider price swings that can create opportunities for traders.

Source: Santiment

Is your portfolio green? Check out the SOL profit calculator

Meanwhile, AMBCrypto recently announced that the Money Flow Index (MFI) and Relative Strength Index (RSI) recent increases for Solana shownindicating increased buying pressure and the potential for price increases.

Conversely, Chaik’s Money Flow (CMF) remained in bearish territory, suggesting that while buying pressure is rising, overall money flow into Solano could be better, representing mixed sentiment among investors.