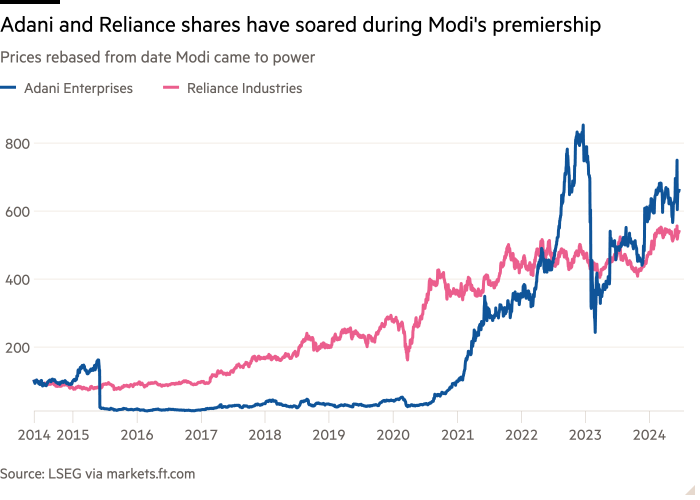

India’s two richest men, Mukesh Ambani and Gautam Adani, sweated it out with the rest of the country’s elite as Narendra Modi was sworn in as prime minister for a third term in a multi-hour outdoor ceremony on Sunday.

The presence of the two billionaires was a stark reminder of how important they have been to India, which has been presided over by Modi, a fellow Gujarati, for the past decade.

Their conglomerates, the Adani Group and Reliance, along with Tata Sons, have been deeply embedded in the prime minister’s development efforts — building roads, airports, mobile networks and renewable energy capacity that have allowed Modi to brag about India’s economic progress.

But Modi’s new term, his first without direct command of Parliament, heralds a difficult new era for some of the country’s most prominent businessmen.

While they remain central to Modi’s vision to remake the country, the election result shows voter concern over the unequal sharing of the spoils of India’s rise – and offers a reminder of the power wielded by other leaders across the political spectrum.

For now, it would be “business as usual,” said Bhaskar Chakravorti, dean of global business at The Fletcher School at Tufts University. Modi’s largely economically aligned coalition needs powerful Indian conglomerates to create major infrastructure projects to help deliver Viksit Bharatthe Prime Minister’s vision to make India a developed country by 2047.

“The central message to the Indian voter this time is: less BS, more jobs,” added Chakravorti. “National champions Adani, Reliance, Tata have the scale, momentum and relationships with enough people on both sides of the political aisle to continue spearheading these” plans.

With 240 of the 543 seats in the Lok Sabha, or lower house, the BJP is still by far India’s most dominant political force. After talks with her royal counterparts, she kept key ministries and many of her old ministers in the same portfolios, a sign that investors saw as reassuring news of continuity.

While corporate leaders say their investment plans remain unchanged, many are quietly beginning to hedge political bets in a way they haven’t been accustomed to in decades. Indian industrialists, executives, lobbyists and analysts told the Financial Times that many still fear being seen speaking out of turn about the prime minister.

Business leaders who dared to question Modi, his government or the quality of India’s economic trajectory have, like other critics, been subjected to vicious attacks or sudden tax raids.

During the weeks-long campaign, Modi veered off course with an unprecedented condemnation of Ambani and Adani, accusing them of funneling “costs” of illicit funds to his opposition rivals.

“It was quite amazing that he attacked Adani and Ambani – we are still trying to figure that out,” said the tycoon, who attended Sunday’s swearing-in and tried to read the “tea leaves” of India’s new political scene. “We will have to wait and see if there is a change in style.

This can be reflected in the Indian press. The mainstream media, dominated by large corporations with interests in various industries dependent on the government’s goodwill – the Ambani and Adani own vast television networks – played the BJP cheerleader.

“A degree of pandering to Modi may disappear, businesses will feel less need to pander and praise as before and less reticent to deal with the opposition,” said the head of one business lobby.

“People did not want to be seen with Rahul Gandhi and the Congress,” they added, referring to India’s main opposition party and leader.

In an article published after the vote, Aroon Purie, media mogul and chairman of the India Today Group, criticized the “pervasive sense of fear” cultivated by the last administration, with businesses fearing “getting on the wrong side of the government”.

“Perhaps the previous regime would not have faced this electoral fate if it had not lived in its own echo chambers,” Purie wrote.

The BJP’s “tight control” of institutions such as the media “will show some cracks”, said Nirmalya Kumar, a former Tata executive and now the Lee Kong Chian Professor at Singapore Management University.

“Those people are now worried that if the other party comes to power, it will not be seen that we are so close to Modi,” he said. “They want to start hedging their bets.

Some Indian executives privately grumbled at the government’s top-down demands for investment in BJP stronghold states like Gujarat. “Maybe there is diversification across states to appease some coalition parties,” said one Western diplomat.

Analysts expect Modi’s alliance to continue building India’s infrastructure after boosting that spending to a record.

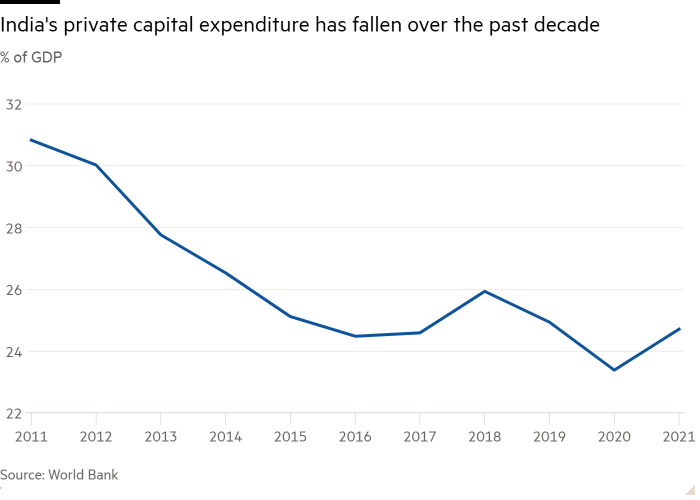

But after promoting a “billionaire Raj” during his tenure, where 1 percent of India’s 1.4 billion people earn more than a fifth of its wealth, according to a recent study by economists including Thomas Piketty, the main question is whether Modi will aggressively pursue more social spending.

More gifts would boost consumption and boost private capital investment, which has calcified to about 25 percent of GDP, one firm executive said. “This little knuckle tapping is good. [Modi] and the economy,” they said. “My concern is that this does not lead to any paralysis of reform.”

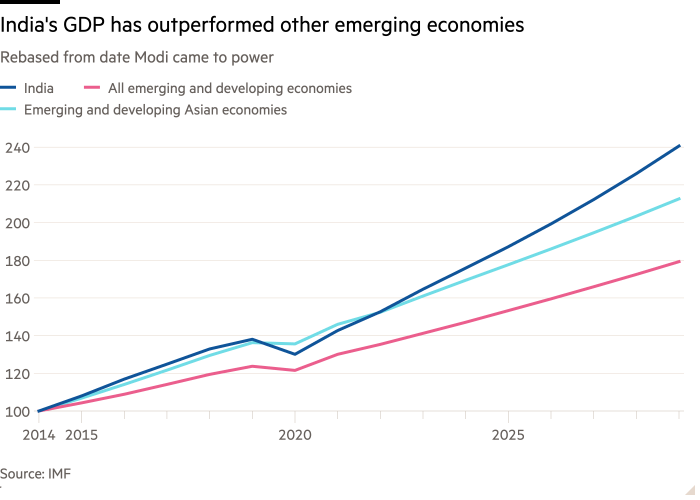

While economists expect Modi to fight land and labor reform to make India a more attractive manufacturing destination, foreign corporations are unlikely to change their view of the world’s fastest-growing major economy.

“Bottom line, things are not going to change – economically, the coalition parties are not that different,” Kumar said. “With the slowdown in China, this is a must-win market for any multinational company.”

At Sunday’s swearing-in in New Delhi, Adani and Ambani mingled with other business leaders, politicians and Bollywood stars Shah Rukh Khan and Akshay Kumar.

“It would seem [Modi] decided to back certain horses, they are Hyundais, they are India’s Samsungs,” said Swaminathan Aiyar, a research fellow at the Washington-based Cato Institute, referring to chaebol conglomerates that dominate the South Korean economy. “They think these guys can handle it.

Data visualization from Janina Conboye