Friday, June 14, 2024 10:51 AM

Jeremy Hunt and Rachel Reeves have weighed in on Britain’s pensions sector in recent months with threats to strong fund managers to prop up domestic British companies.

However, the data suggests that it would be a good idea to start closer to home.

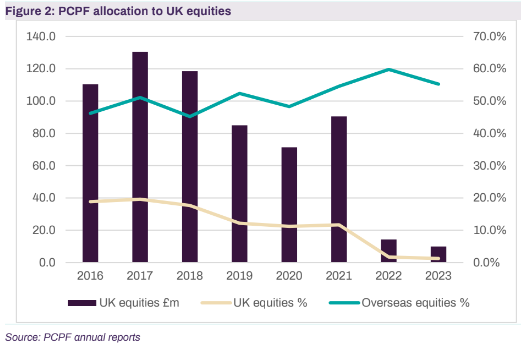

MPs’ pension fund – the Parliamentary Contributory Pension Fund (PCPF) – which pools MPs’ retirement cash and counts Treasury Select Committee Chair Harriet Baldwin as one of its trustees – has rapidly divested UK stocks over the past seven years.

At its peak in 2017, the fund held £130 million in UK equities. But at the end of last year, that number had fallen by 92 per cent to just £10m.

According to Peel Hunt, which analyzed the data, this holding represents a 1.3 percent holding in UK stocks and just 2.3 percent of its total equity portfolio, meaning the fund has dramatically tilted its allocation towards overseas equities.

The figures are likely to embarrass UK lawmakers who have been banging the drum for more domestic investment in Britain in recent years. Chancellor Jeremy Hunt outlined plans in his Budget in March to force domestic pension funds to disclose the geographical makeup of their investments by 2027 in a bid to boost domestic investment.

However, figures from the MPs’ Pension Fund suggest that Westminster’s own pension fund may fall below the UK average allocation.

“This means that the fund has not only sold its UK holding at a very low level, but is also materially underweight compared to the UK’s holdings in global equities,” said Charles Hall, head of research at Peel Hunt.

“In some ways this is similar to Coutts’ decision to move to global fund allocation. It may work for them but disastrous for the UK!’

Coutts diverted its funds from the UK earlier this year. Hall added that most MPs would probably be “stunned” to realize how little their pension funds were invested in UK shares.

Pension investment has become a political football between the two parties as Westminster seeks to spark a wave of investment in the London Stock Exchange and UK start-ups.

The nearly £2.5 trillion of capital locked up in funds is seen as a potential game-changer in addressing London’s public market malaise. After accounting changes in 2000, pension funds dramatically fled the UK stock market in favor of safer bonds.

Just four percent of UK stocks are now held by pension funds, down from 39 percent 20 years ago, according to think tank New Financial.

Labor suggested in its manifesto yesterday that it would push for a government push to shake up domestic pension investments, something it left out of the Conservative manifesto.

Last year, the Tory government forced ten of the City’s leading pension fund managers to dedicate five per cent of their assets to UK growth companies, a move that Rachel Reeves had previously supported.

“Labour is backing the way forward from the Conservative Mansion House speech – trying to get UK pension funds to invest in UK assets – which is not mentioned in the Conservative manifesto,” said Adrian Kennet, director of Dalriad Trustees.

A spokesman for the House of Commons said: “Like most large diversified investors, PCPF has financial exposure to a range of companies, sectors and geographies including the UK.

“PCPF invests globally in a wide range of asset classes, including illiquid and alternative asset classes. In addition to listed equities, the fund invests in a range of productive assets, including a 10% allocation to UK real estate and 10% tied capital to infrastructure funds that include UK investments.