After subsequent sessions of sideways trading, Bitcoin (BTC) bears appear to be gaining momentum over the premier cryptocurrency.

At press time, Bitcoin has lost the $67,000 support zone in the last 24 hours, falling as low as $65,000. Attention is now focused on further price movement with bitcoin analyst CryptoCon notes in X’s June 14 post that investors should expect more corrections in the coming days.

According to CryptoCon Analysis, a critical level of support that could strongly influence market direction has appeared at the 20-week exponential moving average (EMA), currently at $61,603. The analyst emphasized that the situation is now a “waiting game” to watch Bitcoin move further.

“Number to watch: $61,603 by the most reliable healthy support, the 20-week EMA. <…> It’s just a waiting game,” said the expert.

Historical impact of the 20-week EMA

The 20-week EMA has historically been a reliable support level across various market cycles. For example, Bitcoin experienced rapid growth during the early bull run of 2012-2013, using the 20-week EMA as a springboard for higher prices. A notable retest of the EMA in April 2013 preceded another substantial price rally.

Conversely, bear market phases such as those of 2014-2015 and 2018-2019 saw Bitcoin break below the 20-week EMA, signaling long-term declines. For example, in late 2018, Bitcoin’s dip below the EMA led to an extended bearish period before regaining support in early 2019.

In contrast, the sudden market crash triggered by the COVID-19 pandemic in 2020 briefly pushed Bitcoin below the EMA.

Debunking Bitcoin’s Sudden Decline

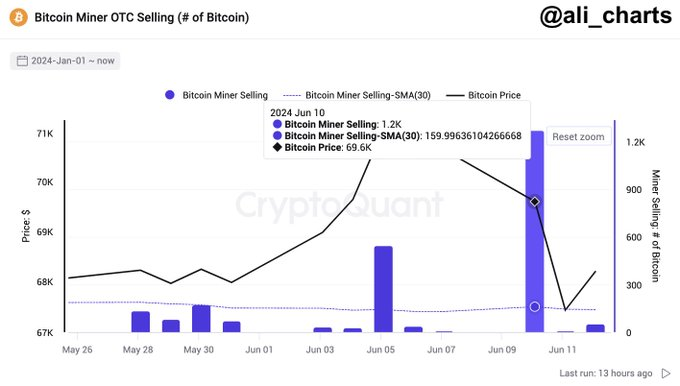

Elsewhere, several theories have been proposed to explain Bitcoin’s sharp decline, which has plunged as low as $65,000. For example, cryptocurrency analyst Ali Martinez suggested in a post on June 15 that the recent activities of miners may have contributed to the decline. Martizenz noted that miners sold more than 1,200 bitcoins worth more than $79.20 million, adding to the downward pressure.

On the other hand, cryptocurrency trading expert Michaël van de Poppe pointed out that Bitcoin and the broader crypto market were affected by a combination of hawkish signals from the Federal Reserve, a strong dollar and regulatory uncertainties.

Despite the current price consolidation, overall sentiment appears to be cautious but optimistic. This is supported by data from Martinez, which shows that investors are buying during the dip. Specifically, on the HTX crypto exchange, the Bitcoin taker Buy Sell Ratio rose to 545, signaling bullish sentiment towards the leading cryptocurrency.

Meanwhile, Bitcoin is trying to hold its price above $66,000 and target $67,000. At press time, Bitcoin was trading at $66,210, reflecting a 24-hour correction of more than 1%. On the weekly chart, it remains in the red with almost a 5% loss.

Disclaimer: The content of this website should not be considered investment advice. Investing is speculative. Your capital is at risk when investing.