Stay informed with free updates

Simply log in to EU energy myFT Digest – delivered straight to your inbox.

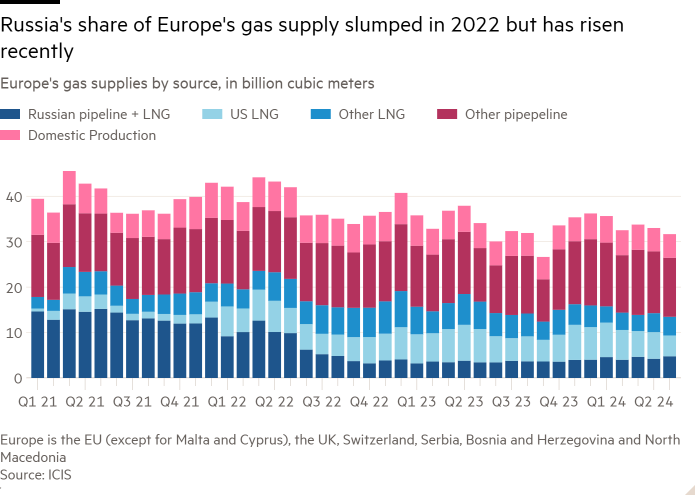

Gas imports to Europe from Russia surpassed US supplies in May for the first time in nearly two years, despite the region’s efforts to wean itself off Russian fossil fuels since the all-out invasion of Ukraine.

While the turnaround was caused by one-off factors, it highlights the difficulty of further reducing Europe’s dependence on gas from Russia, with several Eastern European countries still relying on imports from their neighbours.

“It is striking to see the market share of Russian gas [liquefied natural gas] an inch higher in Europe after everything we’ve been through and all the efforts to unbundle and de-risk energy supplies,” said Tom Marzec-Manser, head of gas analyst at consultancy ICIS.

Following Russia’s full-scale invasion of Ukraine in February 2022, Moscow cut its gas supplies to Europe and the region stepped up imports of LNG, which is delivered on specialized vessels with the US as the main provider.

The US overtook Russia as the supplier of gas to Europe in September 2022, and from 2023 it accounts for roughly a fifth of supplies in the region.

Last month, however, gas and LNG supplies from Russia accounted for 15 percent of total supplies to the EU, the United Kingdom, Switzerland, Serbia, Bosnia and Herzegovina and North Macedonia, according to ICIS data.

US LNG accounted for 14 percent of supplies to the region, the lowest level since August 2022, ICIS data showed.

The reversal comes amid a general increase in European imports of Russian LNG despite several EU countries pushing for sanctions.

Russia stopped sending gas through a pipeline connecting it to northwestern Europe in mid-2022, but continues to supply through pipelines through Ukraine and Turkey.

Flows in May were affected by one-off factors, including an outage at a major US LNG export facility, while Russia sent more gas through Turkey ahead of scheduled maintenance in June. Gas demand in Europe also remains relatively weak, with inventory levels near record highs for this time of year.

The reversal “is unlikely to last”, ICIS’s Marzec-Manser said, as Russia will be able to ship LNG to Asia via its Northern Sea Route in the summer. That, he said, is likely to reduce the amount sent to Europe, while U.S. LNG production has rebounded.

“Russia has limited flexibility to hold this share [in Europe] as a demand [for gas] rises into next winter, while total US LNG production is only growing, and more new capacity will come to the global market by the end of the year,” he added.

A transit agreement between Ukraine and Russia also expires this year, threatening flows along the route.

The European Commission supports efforts to create an investment plan to expand the capacity of gas pipelines in the southern natural gas corridor between the EU and Azerbaijan.

A senior EU official said supplies via this route are currently insufficient to replace the 14 billion cubic meters of Russian gas currently flowing through Ukraine to the EU each year.

EU Energy Commissioner Kadri Simson said she had raised concerns about LNG being diverted from Europe to meet demand in Asia en route to Japan this month.

She said Tokyo and Brussels had established an “early warning system” to monitor LNG shortages and agreed that both sides should implement energy-saving measures.

“The EU is ready to cushion any negative supply or demand events in global gas markets,” she added. “Our gas reserves remain at record high levels [and] our gas demand has stabilized at record low levels, down 20 percent from 2021.