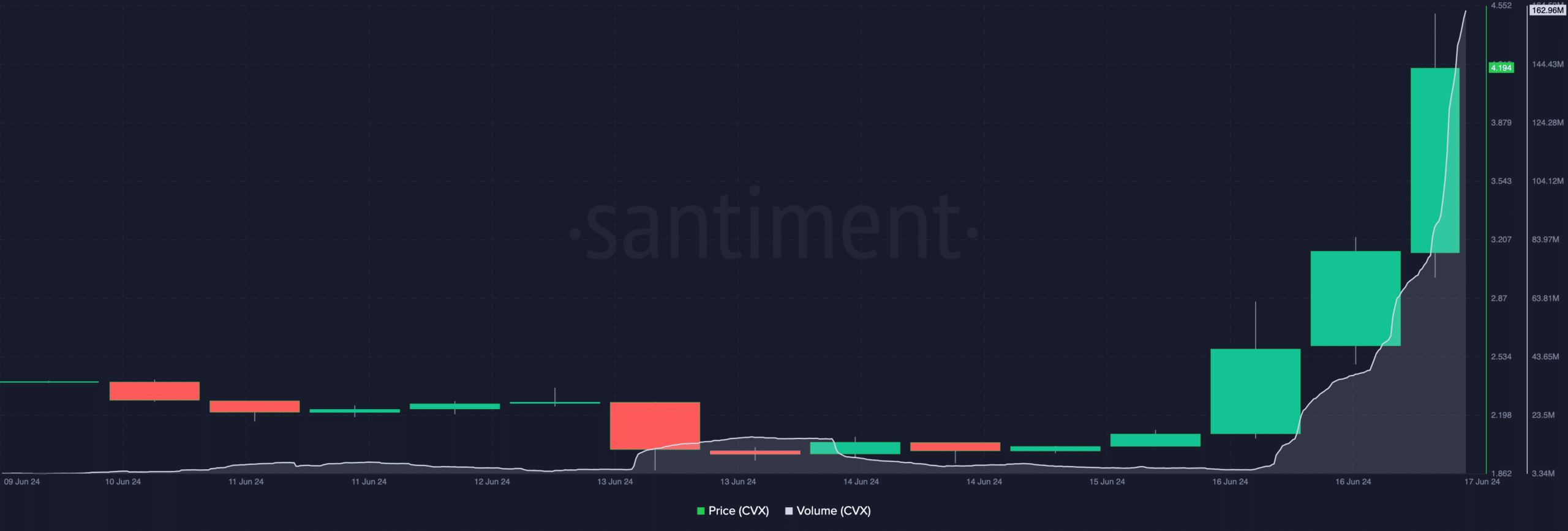

- The buying pressure, indicated by spot volume on exchanges, pushed the price to $4.50.

- Signals from the RSI and Funding Rate indicated that CVX could fall below $4 as it was overbought.

Convex finance [CVX], a native multi-protocol revenue optimizer token, stunned the market with a 90.85% increase in the last 24 hours. On June 16, crypto CVX was trading around $2.14.

But in the early hours of the 17th, the value reached $4.50. It later took a step back to 4.17, which was its price at press time. For those not in the know, Convex started out as a yield optimizer on Curve Finance [CRV] before expanding to other protocols.

This time, Curve seemed to be one of the reasons CVX was pumping. A few days ago, Michael Egorov, the founder of Curve Finance, threatened the project and CRV holders.

CVX volume surpassed the previous milestone

This was because Egorov was liquidated to the tune of $27 million on his loan positions. As a result of the event, CRV fell to an all-time low of $0.21.

However, the founder later revealed that he had paid $10 million of the debt. CRV’s collateral overhang paved the way for CVX’s incredible surge.

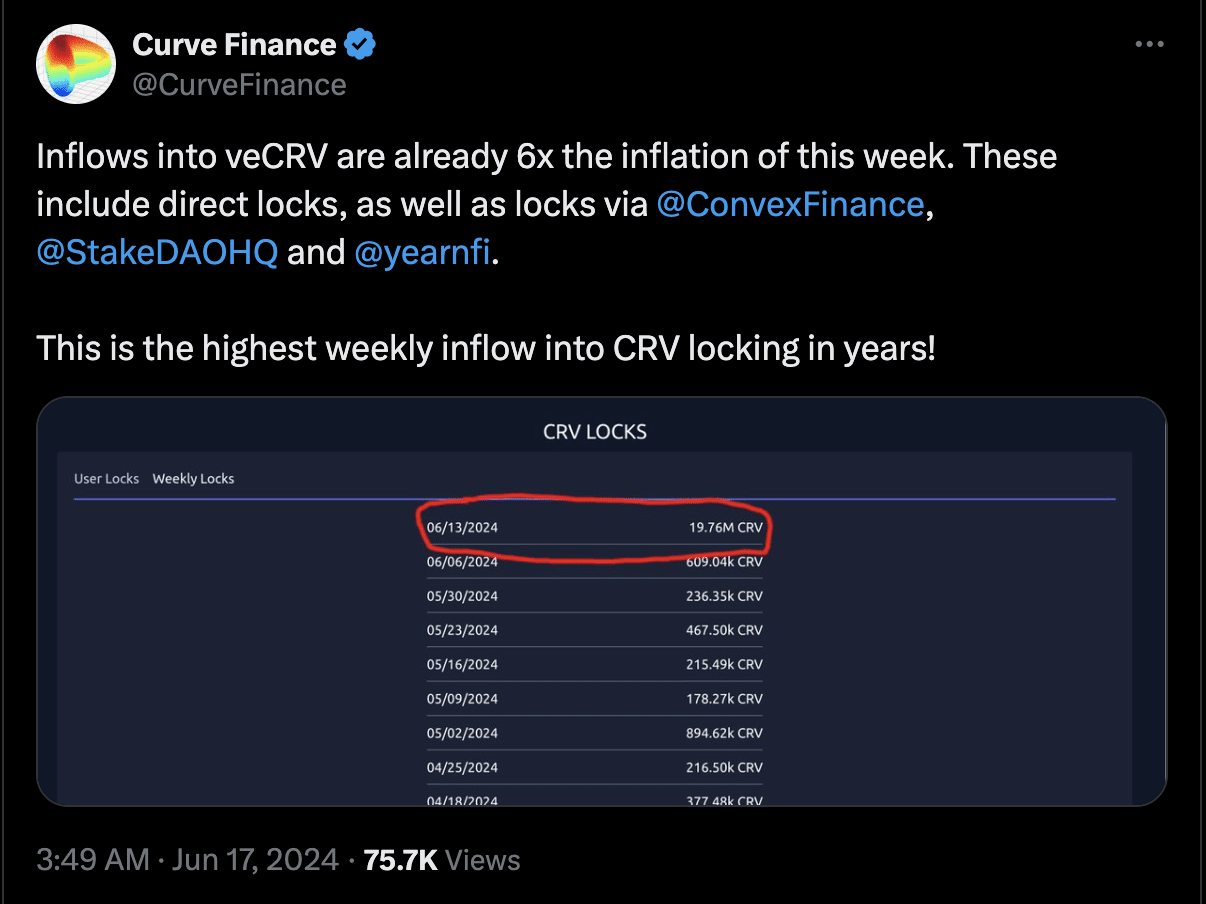

The evidence was also reflected in inflows to veCRV, of which Convex Finance was a part. This increase in inflow meant that many users locked their assets on Convex expecting a good return.

Source: X

As for the development, Jason Hitchcock, an analyst, explained that Convex might not. In explaining his thesis, Hitchcock noted that

“Convex has caught the curve, frax, f(x)n, Prisma and more are coming. They get a large portion of all their fees and have created significant incentive markets for them. Stablecoins and pegged assets have found a home on Curve and these markets are developing as expected.”

Meanwhile, CVX cryptocurrency price was not the only significant increase. According to Santimento, the token’s volume has jumped by an amazing 2677% in the last 24 hours.

At the time of writing, the total 24-hour trading volume was $161.61 million. Additionally, AMBCrypto found evidence of increased interest in CVX crypto.

For example, CVX/USD spot volume on Binance almost reached $32 million, indicating a new one-day high for the token. However, traders in the derivatives market were not left out either.

Source: Santiment

Like spot volume, derivatives fall in line

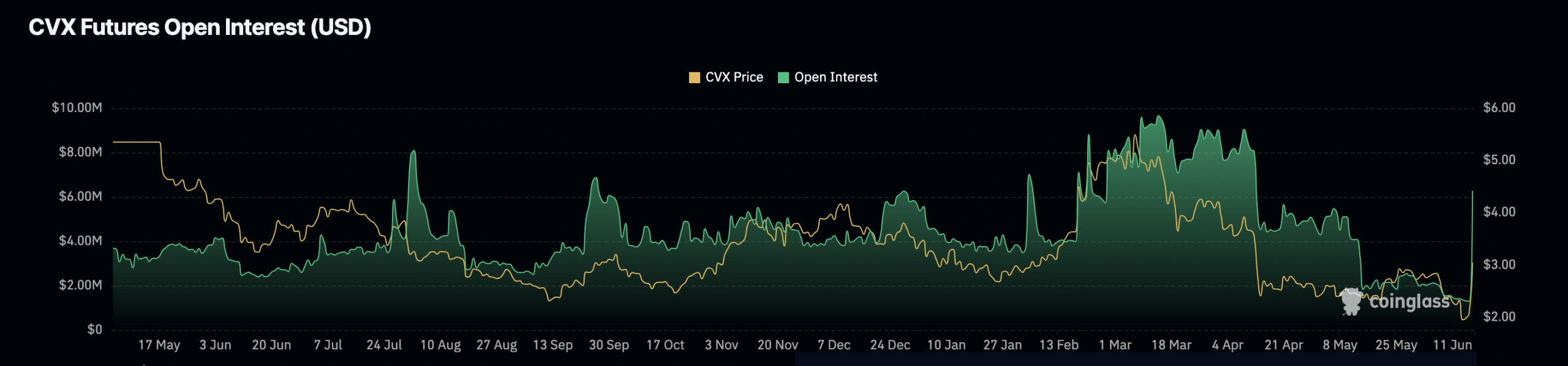

According to data from Coinglass, Open Interest (OI) jumped 759.50%. An increase in OI means that new money is coming into the market. However, when OI falls, it means that traders are closing their positions in the market.

At press time, CVX crypto OI was $6.28 million. If the value continues to rise, this could serve as a force for the price.

If this were to happen, the native CVX token could try to reach $5 in the short term.

Source: Coinglass

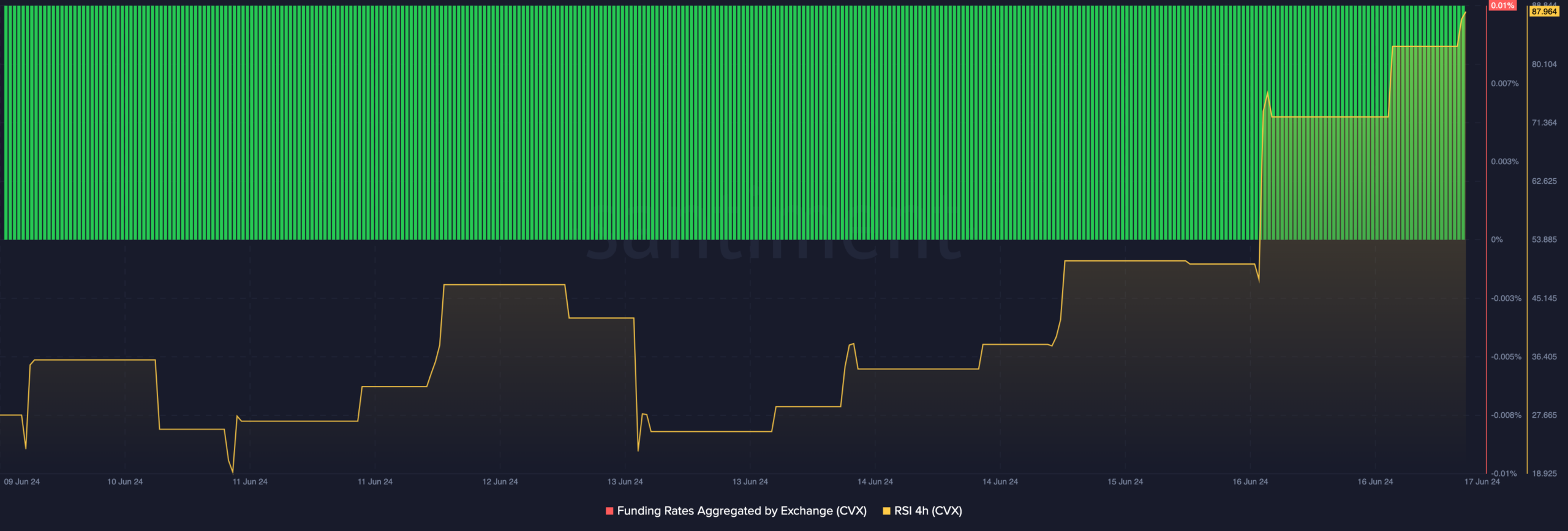

However, it is important to evaluate other indicators as well. In order to assess the further direction of CVX, AMBCrypto analyzed the funding rate.

CVX Price Prediction: Is A Drop Coming?

Funding rate measures whether market sentiment is bullish or bearish. In doing so, the metric tracks fees for longs and shorts.

If funding is positive, it means that longs are paying shorts an amount to keep their positions open. In this case, broader trader sentiment is bullish.

Conversely, negative funding means shorts are paying a fee and sentiment is bullish. At press time, the CVX cryptocurrency funding rate was positive, indicating that the perp price was at a discount to the spot price.

However, the price seemed to have started to move lower. When this happens alongside positive financing, it means buyers don’t trust the offenders. This also means that spot traders are starting to book profits aggressively.

If this continues, the price of CVX could fall from the highs. Additionally, AMBCrypto examined the Relative Strength Index (RSI) on the 4-hour chart. RSI measures momentum.

Source: Santiment

When the value is below 30, it means that the cryptocurrency is oversold. On the other hand, a value above 70 means overbought positions. At press time, the indicator was at 87.96, indicating that CVX is overbought.

Is your portfolio green? Check out the Convex Finance Profit Calculator

Given the state of both of the above indicators, the token may struggle to continue growing. As it looks like, if the selling pressure intensifies, CVX could fall as low as $3.70 in the next few days.

The forecast could also be invalidated if market participants continued to place buy orders.