Stay informed with free updates

Simply log in to British inflation myFT Digest – delivered straight to your inbox.

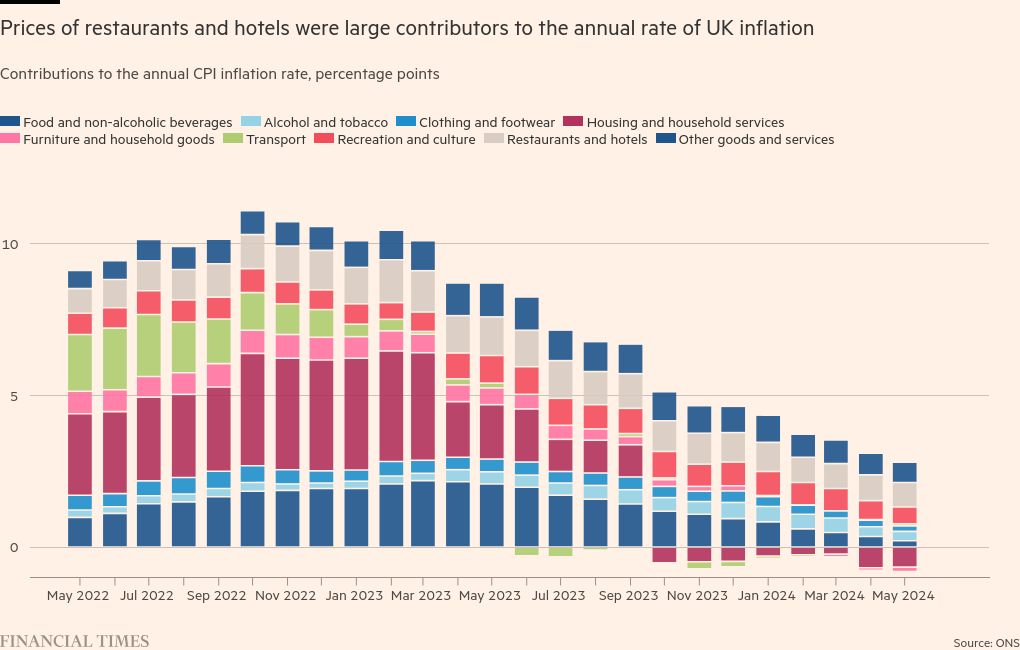

Inflation may have fallen to a three-year low, but anyone paying for services – from pub meals to hotel stays – is still facing prices that are rising faster than expected.

Although food and energy price inflation has cooled, an analysis of official data released on Wednesday shows how consumers are still facing pressure on their spending ahead of the general election.

Services inflation is also a key indicator of underlying price pressures for the Bank of England as it considers interest rate decisions. The increase in service prices was higher than the BoE forecast in the May monetary policy report and above analysts’ expectations.

“The big problem at the moment is that the prices of services are still rising rapidly,” said Thomas Pugh, an economist at consultancy group RSM UK.

Britons paid an average of more than £124 per night in a hotel in May, up 12 per cent on the same month last year and 48 per cent more than in May 2019, before the pandemic, according to detailed figures released by the Office for National Statistics.

Similarly, the cost of a range of services – a hot meal in a pub, a main course in a restaurant, babysitter fees, fish and chips, theater tickets, pool tickets or car services – rose by between 6% and 11%. with the highest prices since detailed records began in 2018.

The figures suggest households continued to face increased prices, which are still rising rapidly in many services, despite headline inflation falling to the BoE’s 2% target for the first time in three years.

The drop in overall inflation was welcomed by Rishi Sunak’s Conservative Party, which is about 20 points behind Labor in the polls and has made reducing inflation one of its key campaign promises. But Rachel Reeves, Labour’s shadow chancellor, said working people were still “worse off”.

Chris Hare, an economist at HSBC, said there was “broad grip” in the data despite the swings, which included a 14.9 percent monthly rise in volatile air tickets.

With the BoE widely expected to hold interest rates at 5.25 percent on Thursday, Hare said “the dynamics of wage and services inflation will probably have to show clear signs of easing over the next few months” to consider reduction.

There are several reasons why service inflation remains stubbornly high, including the rising cost of broadband or mobile phone contracts that are renewed each spring.

Businesses also pass on higher wages through prices, which is more important in the labor-intensive service sector. The national living wage rose by 9.7 per cent in April and overall regular wage growth in the three months to April was still running at 6 per cent.

Services inflation rose at an annual rate of 5.7 percent in May, a worryingly high rate for policymakers, although it fell slightly from 5.9 percent the previous month. The prices of accommodation services grew annually by 7 percent and the costs of stays with complex services by 9 percent.

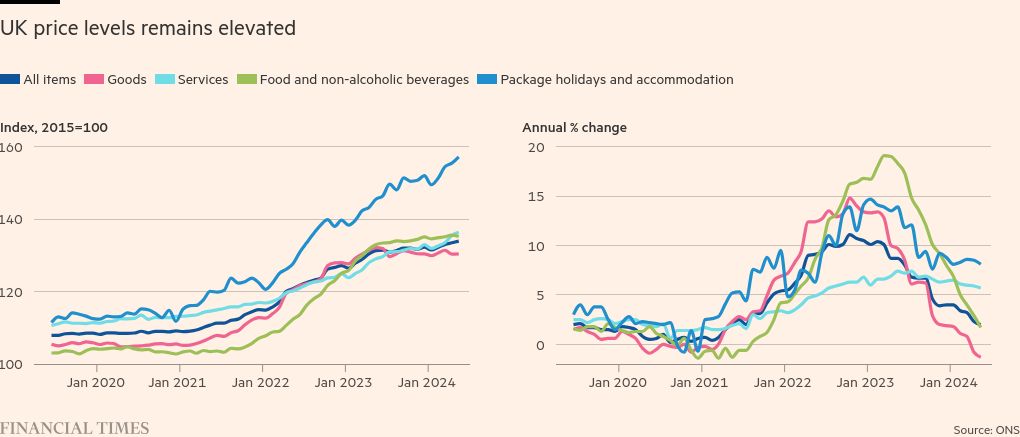

While wages are now rising faster than inflation, real earnings remain largely unchanged since the end of 2020, while overall consumer prices are still up 21 percent since May 2021.

As a result, consumers “couldn’t feel better,” said Paula Bejarano Carbo, an economist at the National Institute for Economic and Social Research. “Households are still very much feeling the impact of the post-crisis increase in the price level,” she added.

The prices of energy, many foodstuffs and goods are below their maximum. For example, cheddar cheese cost £8.78 a kilo in May, down from £9.65 in May last year, with prices falling for frozen prawns and fresh salmon, milk, butter, cereals, pasta, chicken breast and baked beans.

The prices of furniture, household appliances and tableware decreased compared to last year. Overall goods prices fell in May, the second month of deflation, at an annual rate of 1.3 and to the lowest level since 2016, while food inflation eased to 1.6 percent last month from a 45-year high reached in March 2023.

That’s because lower energy prices are trickling down the supply chain and demand for goods has weakened after a pandemic-induced surge. Because of low demand, “retailers have recently been forced to start cutting prices”, said RSM UK’s Pugh.

However, overall food prices are still 30 percent higher than in May 2021, before they spiked after Russia’s invasion of Ukraine. While falling year-on-year, energy and commodity prices have increased by 40 percent and 21 percent since May 2021, respectively.

James Smith, director of research at the Resolution Foundation, said: “The legacy of a long period of very high inflation means that there is unlikely to be much comfort among families as they continue to face higher costs of essentials.”