- The capitulation of miners and the reduction in the emission of stablecoins reduce the liquidity of the crypto market.

- Significant outflows from ETFs increase selling pressure on Bitcoin.

The crypto market has seen a significant decline, with the global market capitalization falling from over $2.8 trillion to just under $2.5 trillion in a matter of weeks.

This significant drop affected the entire sector and affected major cryptocurrencies such as Bitcoin [BTC]which has seen a drop of 7.9% in the last fortnight alone.

Market analysts have been quick to identify several factors that are contributing to the current market conditions.

A closer look at Bitcoin revealed that not only has it fallen nearly 8% over the past two weeks, but it has also continued to struggle in the past 24 hours, falling another 0.1% to trade at around $65,524.

What is behind this recent decline?

Reasons for the decline of cryptocurrencies

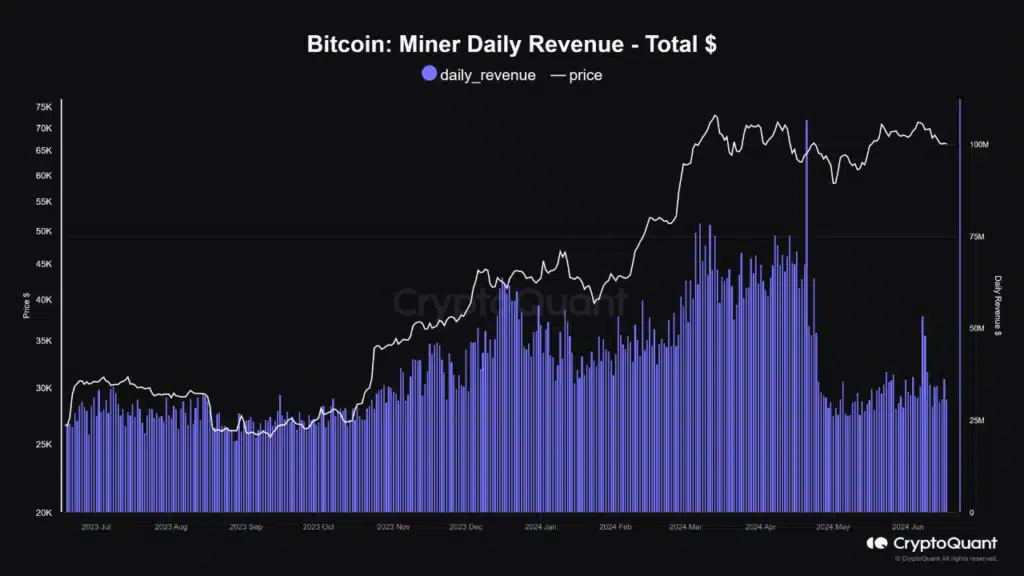

One of the primary factors is the CryptoQuant analyst cited for the recent decline in the market is the capitulation of the miners.

Analyst CryptoQuant points out that a significant drop in miner income – as much as 55% – has forced miners to offload bitcoins to cover operational costs.

Source: CryptoQuant

This surge of bitcoins moving from miners’ wallets to exchanges often precedes a drop in price as the market absorbs the increased selling pressure.

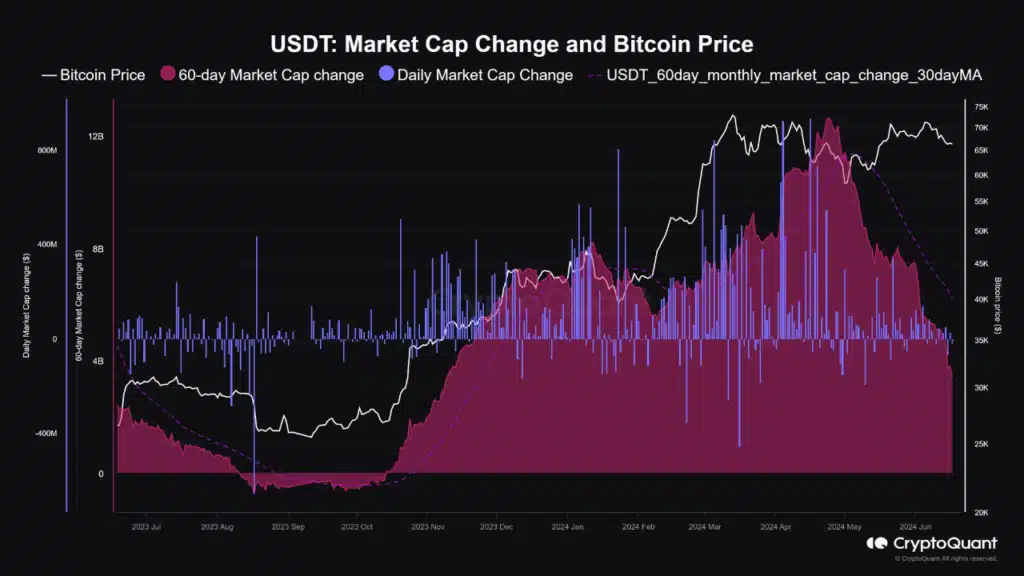

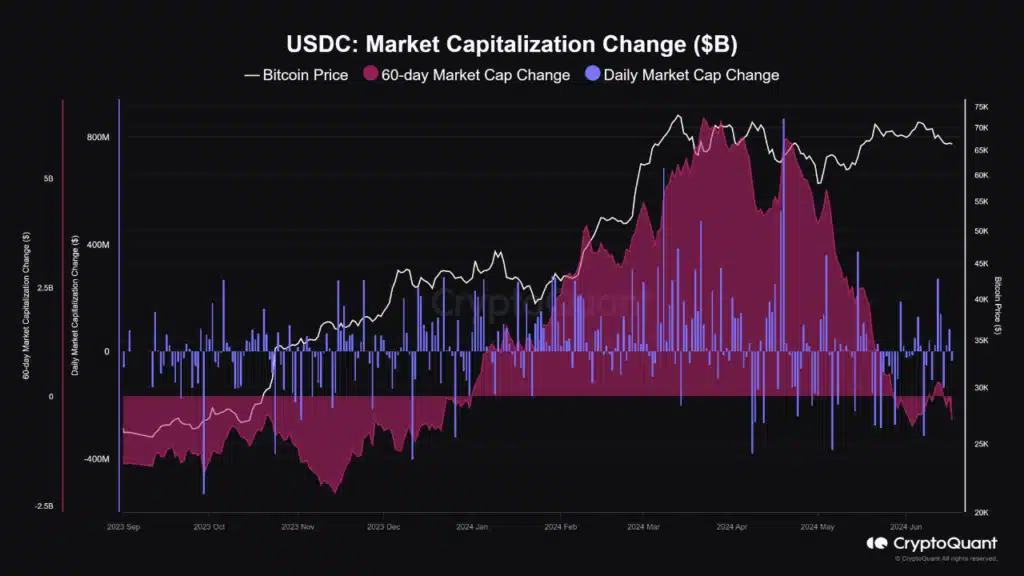

In addition, the lack of new issuance of major stablecoins such as USDT and USDC has contributed to reduced liquidity in the market.

New issues usually mean fresh capital entering the market, boosting trading volume and supporting price levels.

Source: CryptoQuant

However, with stablecoin emissions stagnating, there is less new money to offset selling pressures, leading to increased volatility and price declines.

Source: CryptoQuant

Another major pressure point comes from the outflows seen in major cryptocurrency exchange-traded funds (ETFs).

Notable withdrawals, such as the more than 1,384 BTC withdrawn from Fidelity on June 17, are examples of selling pressures that strongly affect bitcoin prices.

These withdrawals reflect a broader sentiment of caution among crypto investors, particularly in response to an uncertain macroeconomic environment.

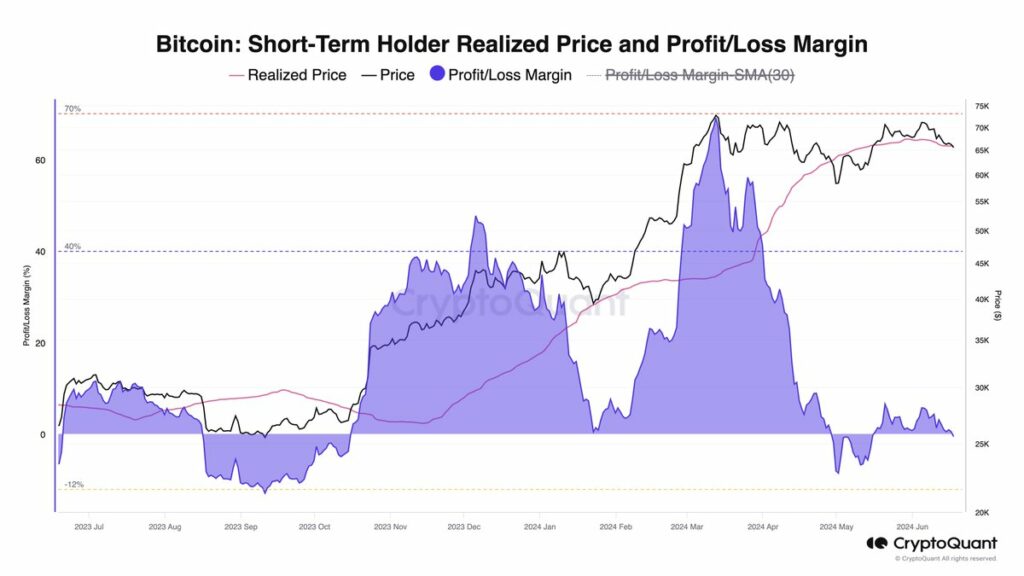

Selling behavior is not isolated to institutional investors; also applies to short-term holders.

The Spent Output Profit Ratio (SOPR) indicator for this group has not reached the highs typical of market tops, indicating that we are not yet at the top of the cycle.

Instead, we see a market still dominated by long-term holders, providing a strong level of support that could moderate further cryptocurrency declines.

Looking ahead

Despite the current decline, there are signs that the market could be nearing a bottom.

Another CryptoQuant analyst, Julio Monero, highlighted on Platform X (formerly Twitter) that Bitcoin has fallen below key near-term support levels, potentially indicating a further decline to around $60,000.

Source: CryptoQuant

Factors such as subdued activity by traders and large investors, along with limited liquidity from stablecoins and reduced interest from US investors, are currently dampening crypto market momentum.

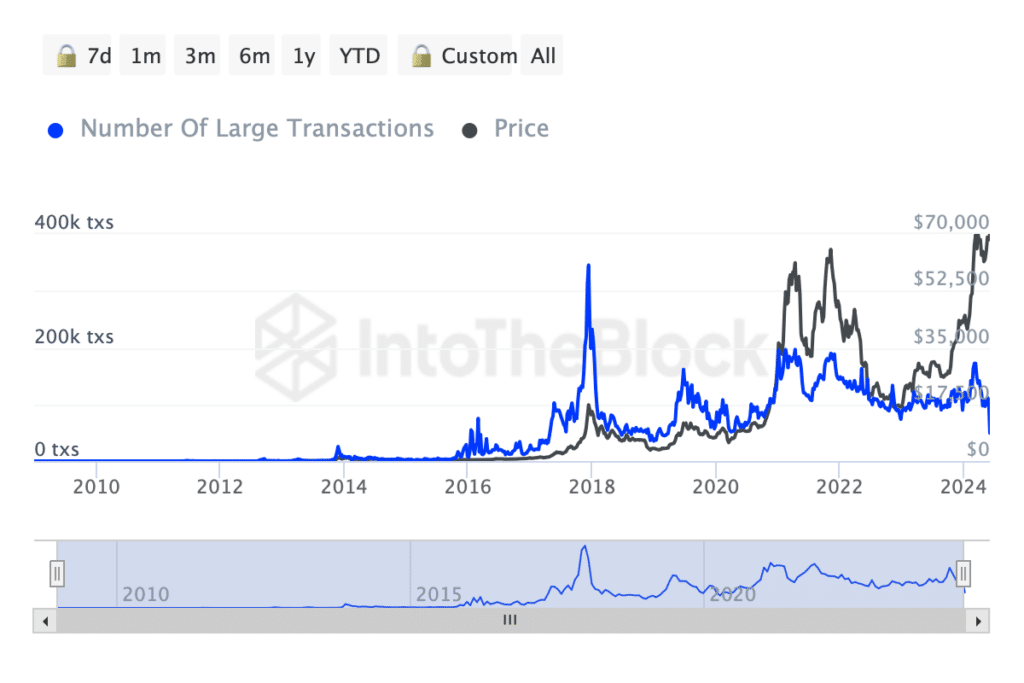

Further exploration using IntoTheBlock data exposed a notable increase in Bitcoin transactions exceeding $100,000, signaling increased activity by large investors, which could herald a shift in market momentum.

Source: IntoTheBlock

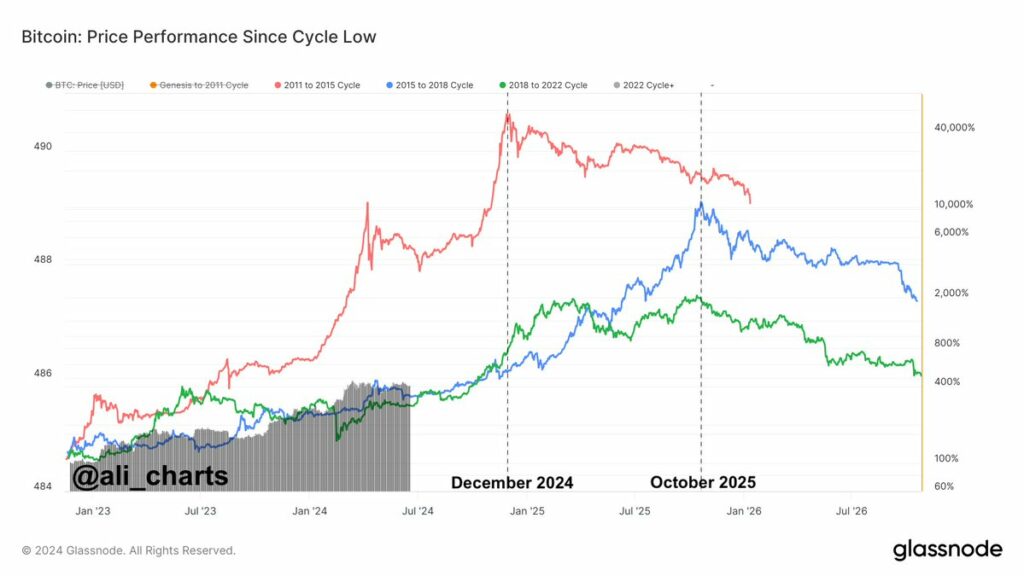

Prominent cryptoanalyst Ali, analyzing the historical price trends of Bitcoin, suggested that if the current market cycle follows previous patterns, we may not see a peak until late 2024 or 2025.

Source: Ali Charts on X

Read bitcoins [BTC] Price prediction 2024-2025

This analysis was shared along with a chart showing Bitcoin’s performance since its most recent low.

Meanwhile, despite all these declines, we are still in a crypto bull market, according to AMBCrypto’s recent report.