According to Dearbail Jordan and Faisal Islam, Business reporter and economics editor

Getty Images

Getty ImagesThe Bank of England opened the door to cutting interest rates in August, which would be the first drop in borrowing costs in more than four years.

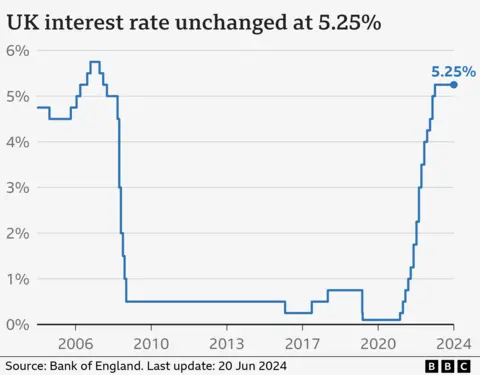

On Thursday, in a close decision, the bank voted to keep interest rates at a 16-year high of 5.25%.

Earlier this week the numbers showed that inflation – which measures the pace of price growth – slowed to 2% in May, in line with the Bank of England’s target. However, prices of some items continued to rise faster than expected.

But minutes from the bank’s rate-setting committee signaled a significant change in tone, suggesting a majority could vote for a cut when they meet again on August 1.

They say they will look to see if the areas of interest are “receding”.

“Based on that, the commission will assess how long [the] the bank rate should be maintained at the current level,” the minutes read.

While not a done deal, the language is a clear signal to markets and the public that after the bank completes its new forecasts for the economy, a rate cut is now the most likely outcome at its next meeting.

The rate-setting committee voted 7-2 to keep rates in place, but the result wasn’t as cut and dry as before. For the three members, the vote to hold this month was a “delicately balanced” decision.

Pro-tapering members of the committee, including Bank of England Governor Andrew Bailey, play down the strength of underlying inflationary pressures.

The bank’s latest decision comes in the run-up to the general election, with policy for the future of Britain’s economy a key battleground for political parties.

However, the bank stressed that the timing of the election was “not relevant to its decision”.

The Bank of England interest rate has a knock-on effect on mortgage, credit card and savings rates for millions of people in the UK.

While the bank appears to be hinting at a cut in August, many homeowners who are now coming off fixed rate deals are facing mortgage rates much higher than what they are used to.

The current average rate for a two-year fixed deal is 5.96%, although this is down from last year’s peak of 6.86%.

People in tears over mortgage costs

Ben Perks

Ben PerksMortgage adviser Ben Perks, who works in Wolverhampton, told BBC Radio 5Live that while he was not surprised by the bank’s decision to hold rates for now, he was “definitely disappointed, definitely frustrated”.

“It’s fine to say, ‘Oh, we’ll wait’, but the reality is that 125,000 people a month are ending their fixed rates, which is the population of Wolverhampton city center over a two-month period.”

He says he’s had borrowers in his office in tears when they found out how much their mortgage payments would increase.

“It’s extremely stressful. We’ve had meetings where you tell them the new payments and because everything else has gone up, they don’t know which way to turn.”

Inflation data on Wednesday showed that growth in the price of services – which reflects the cost of items such as cinema tickets, restaurant meals and holidays – remained stronger than expected.

But the bank’s note said the slow decline in services inflation reflected one-off factors, including a rise in the minimum wage and bills that automatically rise by inflation, such as broadband and mobile phones.

If the bank does indeed move to cut interest rates in August, it would be the first since March 2020, when the UK was heading into its first Covid lockdown.

“It is good news that inflation has returned to our 2% target,” Bank Governor Andrew Bailey said.

“We need to be confident that inflation will remain low, which is why we have decided to keep rates at 5.25% for the time being.

The Bank of England is independent of the government and its main role is to keep inflation stable at 2%.

In response to high inflation, the bank has raised and subsequently kept interest rates high in recent years.

The theory behind rising rates is that they will slow inflation, but they can also drag on economic growth as businesses may delay investment or hiring, which could mean fewer jobs are created.