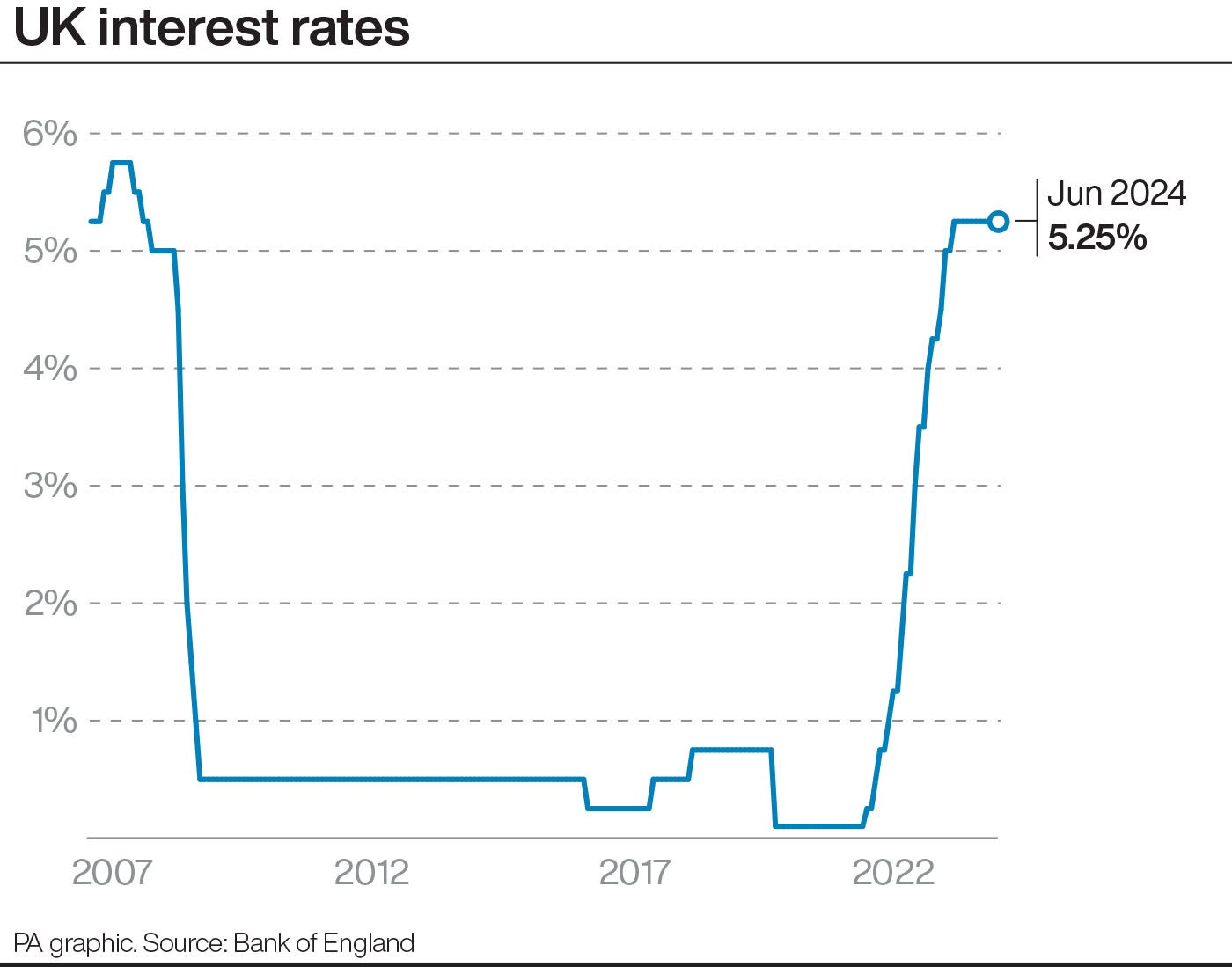

The Bank of England has refused to cut interest rates from their 16-year high – despite inflation finally falling and meeting its 2% target.

Homeowners struggling with soaring mortgages will be forced to wait at least another two months for borrowing costs to fall after the bank’s nine-member monetary policy committee decided on Thursday to hold the key rate at 5.25 percent for a seventh straight month.

Bank of England Governor Andrew Bailey opened the door to a rate cut earlier last month, saying he was “optimistic that things are moving in the right direction” and that a June rate cut was a possibility – though by no means a certainty.

But despite Wednesday’s data showing headline inflation fell from a recent 40-year high of 11 percent to meet the bank’s target for the first time since July 2021 – hitting its target faster than the United States or the euro zone – the medium-term picture is now less reassuring.

Services price inflation fell less than the bank had expected at the time of the last meeting – only falling to 5.7 rather than 5.3 percent – and private sector wage growth is almost double the rate the bank considers compatible with 2 percent inflation.

Interest rates will remain at 5.25 percent until at least the next Monetary Policy Committee meeting in August. Seven committee members voted against the 0.25 percent cut on Thursday, while two — Dave Ramsden and Swati Dhingra — voted in favor.

Bank governor Andrew Bailey said policymakers “need to be confident that inflation will remain low, which is why we have decided to keep rates at 5.25 percent for the time being.”

However, financial markets have reduced bets on a rate cut that will also take place in August. On Wednesday, they were priced at just a 30 percent chance, with the first move more likely in September and the risk of a delay until November, similar to the Fed’s expectations.

Homeowners have been hit hard by the sudden increase in interest rates. Around 1.6 million mortgage holders will end their fixed-rate deals this year and face an average increase in their repayments of £1,800 a year, the Resolution Foundation previously estimated.

The latest figures from the Bank of England suggest that the value of outstanding mortgage balances in arrears will rise by 50 per cent from 2022, taking the total to over £21bn.

And analysts at investment firm Hargreaves Lansdown calculated last month that 2.1 million homeowners – one in four – will have mortgage payments exceeding 25 per cent of their disposable income by the end of this year, putting them at risk of default.

However, the Monetary Policy Committee warned on Thursday that it “will need to remain accommodative long enough for inflation to return sustainably to the 2 percent target over the medium term”, warning of the risk that inflation – which is expected to rise again a year later – could would “build in” above 2 percent.

The committee “will continue to monitor closely for signs of persistent inflationary pressures and resilience in the economy as a whole, including a range of measures related to tight labor market conditions, wage growth and service price inflation,” it said.

The pound fell slightly by 0.2 percent and 0.1 percent against the US dollar and the euro after the bank’s decision not to cut rates.

Federation of Small Businesses chairman Martin McTague said the decision was widely anticipated but “no less disappointing for him”, warning that “high stagnant rates are now undermining growth as small businesses struggle to access affordable finance to help them expand”. .

And Union boss Sharon Graham of Unite said: “Once again the Bank of England has failed to negotiate for working and hard-pressed families. Major economies around the world have cut interest rates and the UK must follow suit.

“High interest rates are boosting the profits of City bankers, but they have hit all of us with mortgages and rents in our pockets. It’s time for the bank to step up.”