Last year, Matthew decided to put half his pension into an annuity provided by the trustee of the St James’s Place estate. But after the transaction went through, it looked like some of the money just disappeared.

“Once I had all the numbers, they just didn’t add up,” he says. “About £4,500 missing.

A few months later, Matthew, 70, from Oxfordshire, who – like all SJP clients in this article – asked the FT not to use his real name, discovered the money lost was income tax, which neither he nor his financial adviser, expected “That’s when I threw my toys out of the pram,” he says.

Although he was satisfied with the service SJP had previously provided, he said the fact that he and his advisor were surprised by the surcharge was not acceptable.

“I’ve paid quite a lot of money to SJP, directly and indirectly, and what I expect in return is really competent advice.”

He was also disappointed by the company’s response, which sent him an unwanted Fortnum & Mason bin instead of a refund.

Before withdrawing his money recently, Matthew was one of almost a million people whose savings and investments are managed by St James’s Place, the UK’s largest wealth manager. Founded in 1991, the company prospered throughout the 1990s and 2000s, gaining clients and assets and eventually joining the FTSE 100.

But in the last year, the wealth management sector has started to undergo a major shift. New regulations introduced last summer, called Consumer Duty, shine a light on so-called “client outcomes” that force businesses to act in good faith towards customers, avoid foreseeable harm and allow customers to track their financial goals.

The impact of this has already been seen as the regulator has started to “flex its muscles”, says Ben Bathurst, an analyst at RBC Capital Markets.

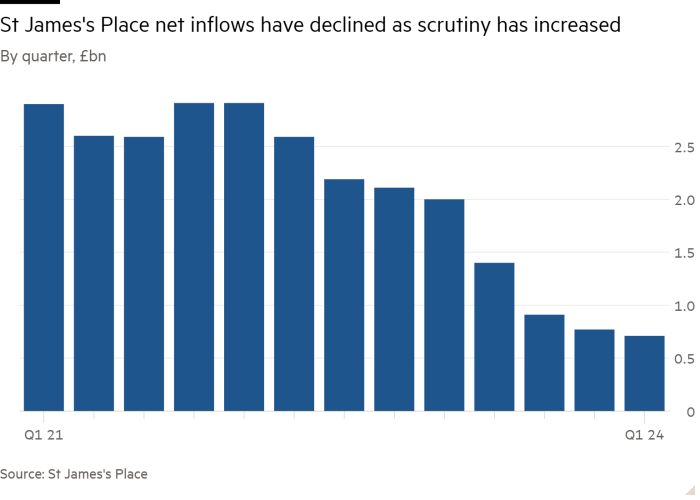

The regulations have had a major impact on SJP, which was warned by the Financial Conduct Authority last year that the adjustments it made before the introduction of the consumer tax – cutting fees for around 65,000 clients – did not go far enough. The company then announced an overhaul of its entire fee structure, including the removal of much-maligned exit fees for some products.

SJP was subsequently forced to set aside £426 million to refund potential clients over claims that some customers did not receive ongoing services they had paid for, such as annual reviews.

The company’s share price plummeted, down 60 percent in 12 months. It dropped from the FTSE 100 this month.

Now, after a year of upheaval including management changes, regulatory crackdowns, changes to the adviser network and increasingly questions being asked about the value of highly-remunerated brokerage advisers, FT Money has decided to take a closer look at what the firm’s clients think. about the service they receive.

We asked readers to share their experiences with the property manager. After receiving many responses, we spoke to more than a dozen clients and advisors at SJP about the firm and the issues surrounding it, and saw detailed correspondence between clients and the asset manager regarding the issues raised.

While many clients had positive experiences with the group, others were disappointed with the level of service they received. For example, one former Moneye client said she felt rushed in appointments with her adviser, some of which she had to chase, and never felt the fees were properly explained to her.

It is clear that Mark FitzPatrick, SJP’s chief executive, who joined the group late last year, has work to do to improve the company’s approach to clients.

SJP may be the largest in its sector, but the mixed experiences of its clients will raise instructive questions for other firms that have room to improve customer satisfaction.

As a client, it can be difficult to know what level of service to expectand where to start if you believe your property manager has not done what you want them to do.

The first course of action for any wealth management customer who does not feel they have received the service they paid for is to complain to the company.

If you find yourself in this situation, it is important to keep written and email correspondence to document what happened that you pass on to the company and the Financial Ombudsman Service if you decide to escalate the complaint. One of the reasons SJP had to set aside so much money to refund clients is because its antiquated IT system was unable to prove whether or not customers had received services such as annual reviews.

Those considering filing complaints should be aware that claims management companies have heavily advertised their services to injured SJP clients. The FCA has warned against using these firms as they can charge up to half of the compensation received.

If a customer believes their complaint has not been adequately dealt with internally, they can lodge a complaint with the FOS, a free dispute resolution service which can order businesses to pay compensation.

Not all SJP clients we spoke to reported negative experiences. When Robert and his wife were about to return to the UK for retirement after living in Brussels, they wanted some help managing their savings.

Robert, a former civil servant and director general of the European Commission, wanted someone to manage a portfolio of money in an Isa as well as trusts for tax planning purposes, but wasn’t sure who to ask until he attended the SJP seminar. . “We went together and were amazed,” he says. “That was in 1996 and we’ve been with them ever since.

Robert and his wife have £2.2m with SJP across trusts and Isas and are happy with the level of service they receive.

“Their approach wasn’t ‘give us your money and we’ll make you a quick fortune.’ They were longer-term people, they were highly respected,” he says.

Another reader in her 70s wrote that she had a very positive experience with a property manager over the past 14 years. “My portfolio has grown, which is satisfying – but it’s the relationship with my St James’s [Place] partner and the trust we have in him, which is more satisfying.”

However, Mary, who hails from London, had a less positive story. She says a friend introduced her to SJP’s counselor.

“She came to my house and explained that she had a young son and said that if my pension doesn’t make money, she doesn’t make money and he can’t go to school.

Mary was quite happy to work with this adviser and felt some camaraderie: “a bit of female power and all that”.

However, the relationship deteriorated. Mary needed to start chasing her advisor to some appointments.

“Every review was . . . she was in a hurry and I was blindsided by the speed and lack of explanation,” she says. “[The] the charges were never explained to me. But I thought they were working for me, so I trusted them.”

But after speaking to an independent financial adviser who explained how her pension worked “very simply”, she became uncomfortable with the amount of fees SJP was paying.

She decided to move her pension but was sent conflicting messages about whether she would be charged early withdrawal fees and it took months for her pension to be withdrawn from the company’s funds.

“I would never sign anything [over to SJP] if I knew it wasn’t flexible.”

Some SJP matters are not limited to clients. Mark, who recently left his consultancy practice after almost a decade, said SJP had been a largely positive experience and helped train him in the profession.

But he said he came under pressure from the company over a loan scheme SJP would give partners to buy clients from retired advisers and the need to acquire clients to make it economical.

When advisors in the SJP network leave, they typically sell their client books to other SJP advisors who use SJP-brokered loans to do so. The wealth manager underwrites some of these loans, which are drawn from a consortium of external banks.

Rising interest rates contributed to the doubling of the total value of non-performing loans provided by SJP to its advisers last year.

“When I started, you agreed to this debt, without a real network of people as clients,” says Mark. “We were bound by this loan and [were] not getting quality leads to help us repay the loan. If you are not making any money, your loan increases. Any money you make will pay off the previous month’s fees.”

He said this led to some questionable practices around fees charged to clients as advisers tried to make as much money as possible to help pay off their loans.

“To get the most out of the fees, we would have to shift investments to make them cheaper,” he said. “It wasn’t about putting clients in dead funds, but there were cheaper funds, which meant we kept more fees.”

That meant their diversification was reduced, “sometimes from seven funds to two or three,” he says.

SJP said in a statement: “We take our commitment to client satisfaction very seriously and always strive to do the right thing through the service and support we provide. The anonymous nature of comments means we are unable to investigate what happened in these individual cases.

“We regularly seek feedback from clients and earlier this year we spoke to over 61,000. This feedback showed a high satisfaction rate of 82 per cent and 79 per cent saying they would recommend SJP. Through our client community, we are also in constant dialogue with over 3,000 clients, which helps us better understand how they feel and their evolving needs.”

Five years ago, SJP was forced to review its “salaries and benefits” following criticism of luxury cruises and expensive cufflinks given to advisers who hit certain income targets. The business is also known for its wine and catering clients, taking to Ascot and shipping champagne.

Frank – a consultant who has worked for SJP for eight years and describes it as “a very caring place, like a big family” – told FT Money he was frustrated by the negative coverage of the awards.

“Many of my clients are in banking. When they get their bonuses, we’ll help manage them. As we are technically self-employed, we do not receive bonuses, but if we have reached a certain level of production [of sales] then SJP will appreciate the work you’ve done and you could get a set of Mont Blanc cufflinks which cost about £200,” he says.

“So I have clients earning six-figure bonuses and yet we get criticized for being accommodating to our clients.”

For John, 70, from London, SJP has already enacted the changes were positive. He has worked with the manager for more than ten years and has been satisfied with the service he has received from the three advisers he has had in that time.

“I approve of the fact that SJP responded to the pressure. . . be more transparent.”

As the UK population ages and the transfer of wealth between boomers and their children gathers pace, the number of people seeking financial advice is expected to rise. That, combined with savers’ growing interest in investing their money, is “reason for optimism” among wealth managers, says Chris Kroeger, UK head of asset and wealth management at consultancy Alpha FMC.

For those seeking financial advice for the first time, it is vital that they understand how they are charged and what services are provided – and most importantly, what they should expect from their adviser in the future.

Meanwhile, if SJP is to take advantage of the growing number of people seeking advice, it must adapt to the new regulatory environment. It has already started doing this with the revision of fees, which is due to enter into force next year. But more are likely to come.

This article has been edited to correct that Ben Bathurst is an analyst at RBC Capital Markets