Unlock Editor’s Digest for free

FT editor Roula Khalaf picks her favorite stories in this week’s newsletter.

British retail sales rebounded much more than expected as consumers gained more confidence amid slowing inflation, providing some good economic news ahead of the election.

The amount of goods bought increased by 2.9 percent between April and May after a sharp fall in the previous month and recorded the fastest growth since January, the Office for National Statistics said on Friday.

Warmer weather helped boost spending on clothing and furniture, the ONS said, with the increase beating the 1.5 percent expansion forecast by economists polled by Reuters.

Public finances were also better than expected in the first two months of the financial year, separate data released on Friday showed, but continued to signal huge challenges facing the next prime minister.

The ONS revised April retail sales up from a fall of 2.3 per cent to a fall of 1.8 per cent. According to Rob Wood, an economist at Pantheon Macroeconomics, the revision, along with last month’s strong sales growth, suggests that economic growth in the second quarter may be stronger than the 0.4 percent currently forecast.

The economy grew by 0.6 percent during the first quarter, the fastest in two years and enough to lift Britain out of recession.

Although the figures show a significant economic improvement, they may be too late or too modest to boost the electoral chances of the Conservative Party, which trails Labor by 20 points and is less than two weeks away from polling day on July 4.

Separate data released by research firm GfK showed consumer confidence rose for the third straight month in June to the highest level since November 2021, although it remained well below its pre-pandemic average of 2015-19.

UK business activity grew at its slowest pace since November, according to a closely-watched survey that suggested spending decisions had been delayed by the general election. It also pointed to the “stubbornness” of inflationary pressures.

Andrew Wishart, an economist at Capital Economics, said retail sales data for May showed “preliminary signs that the strengthening of real income growth now that inflation is back on target is being translated into stronger spending”.

He added: “With inflation falling back to target and consumer confidence improving, retail sales may continue to strengthen.”

Public sector borrowing came in at £33.5bn in the first two months of the financial year, up £0.4bn on the same two-month period a year earlier, but £1.5bn less than the £35bn the Office for budgetary responsibility, the UK’s fiscal watchdog. Borrowing in May was also higher than last year as government spending on utilities and benefits rose, but the increase was less than OBR had predicted.

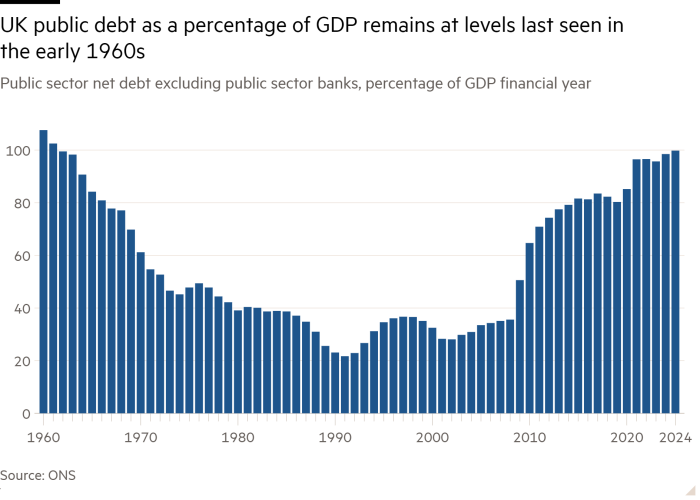

However, the issue of public finances remains significant for any incoming government. Public debt – the sum of past borrowing over time – relative to the size of the economy rose to 99.8 percent in May, up 3.7 percentage points from a year earlier and the highest level since the early 1960s.

Alex Kerr of Capital Economics said May’s public finance data “provided better news on the fiscal position after a recent period of worse-than-expected results”. But he added that they would “do little to reduce the scale of the fiscal challenge that awaits the next government after the general election”.

S&P Global flash UK composite PMI output – where anything above 50 represents growth – fell below analysts’ expectations to 51.7 in June from 53.0 in May, according to data also released on Friday.

The slowdown was caused by businesses in the services sector announcing that spending decisions had been delayed ahead of the general election. Worryingly, the survey also showed that price growth charged in the private sector rose to a four-month high in June.

Chris Williamson, economist at S&P Global Market Intelligence, said that while the slowdown in economic growth may prove to be temporary if businesses respond positively to the policies announced by the next government, “the stubbornness of underlying inflationary pressures above the Bank of England’s target still looks somewhat”. entrenched”.