Unlock Editor’s Digest for free

FT editor Roula Khalaf picks her favorite stories in this week’s newsletter.

Bermuda’s financial watchdog, at the heart of the world’s reinsurance industry, is cracking down on related-party investments by life insurers following problems at 777 Partners and its reinsurer based in the British overseas territory.

The Bermuda Monetary Authority is examining the firms’ exposure to associated assets, including looking for conflicts of interest, the regulator confirmed to the Financial Times. Insurers will now have to seek his prior approval for new investments of this type and will have to demonstrate that they match their commitments.

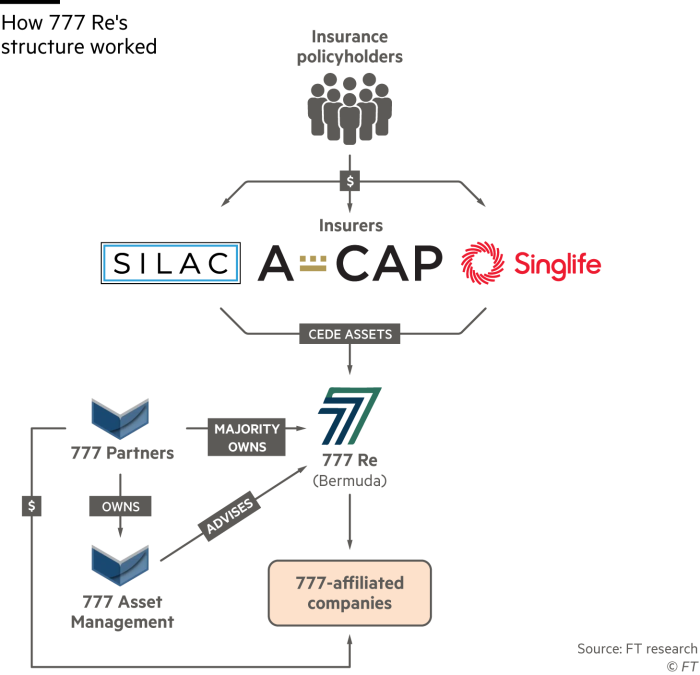

Events at 777 Re – which plunged into crisis after taking significant exposure to assets linked to Josh Wander’s Miami investment firm, from soccer clubs to low-cost airlines – have raised questions about the regulation of life insurers in Bermuda.

The saga has also shone a light on investment strategies used by private equity-backed insurance groups in particular, which seek to match long-term liabilities such as annuities with illiquid investments in private loans from their parent company.

The BMA wrote to insurers in December, just weeks after it intervened on the 777 Re. The watchdog alerted firms to their exposure to related parties and their rationale for investing in them, warning of the risk of “undue influence” on investment decisions, the BMA said.

The “watchdog” has stepped up scrutiny of companies’ investments through “reporting and on-the-spot checks” and by requiring how associated parties benefit from the insurer’s investments, he added.

The BMA said in a statement: “The hurdle for insurers to demonstrate that the associated investments are suitable to cover policyholders’ liabilities is extremely difficult for insurers to meet.”

Bermuda changed its regulations at the end of March to require insurers to pre-authorize new investments that have credit exposure to an affiliate, related or connected party of the insurer.

The firms argued that the regulator’s pre-approval requirements should not extend to so-called modified co-insurance arrangements – the structure used by 777 Re – where the assets invested by the reinsurer technically remain on the balance sheet of the insurer, which “cedes” the asset. . Because insurers’ investments are regulated in their home market, insurers objected to the new rule, which would cause “regulatory duplication and regulatory inconsistency.”

The BMA stuck to its guns, saying in November that its “supervisory experience has shown that the assets of associated, related or connected parties can be complex and prone to potential conflicts of interest, creating additional risks and governance challenges”.

Suzanne Williams-Charles, chief executive of trade body Bermuda International Long Term Insurers and Reinsurers, said insurers were “committed to operating in a jurisdiction with regulations that promote financial stability and help ensure policyholder protection”.

Life insurers and reinsurers typically back up their promises to retirees by investing in low-risk government and corporate bonds. A combination of lower capital charges on some investments and more flexible rules has led insurers in the US and Bermuda to have a larger share of securitized loans and other types of private credit than in Europe, for example.

Emphasis was placed on asset-backed reinsurance deals. These raised hundreds of billions of dollars in insurance liabilities, and the assets that covered them moved American firms abroad—most notably to Bermuda—with some of the investment going into private loans. One banker said a tougher stance by Bermuda’s regulator was likely to weigh on future cross-border deals.

Growing scrutiny and financial pressure on 777 Partners escalated dramatically this year after its bid to buy English soccer club Everton, eventually dropping its bid for the club and one of the lenders being sued for fraud. He denied 777 allegations.

American insurance group A-Cap and other insurers have now recovered the assets they ceded to the group. Earlier this month, rating agency AM Best withdrew its rating for Re 777, citing the “absence of any insurance liabilities” with the reinsurer.

777 did not immediately respond to a request for comment.

More news from Samuel Agini in London