- Bitcoin remained in the $64,000 price range.

- Almost 2 million addresses bought BTC in this price range.

bitcoin [BTC] it recently dropped below a key support level that has held for several weeks. Although he broke this line of support, there is another, less visible level of support.

If BTC falls below this invisible line, it could trigger a series of declines due to a potential sell-off.

This situation is already worsening as miners have sold a record number of BTC in response to the price drop.

Bitcoin’s former support continues as resistance

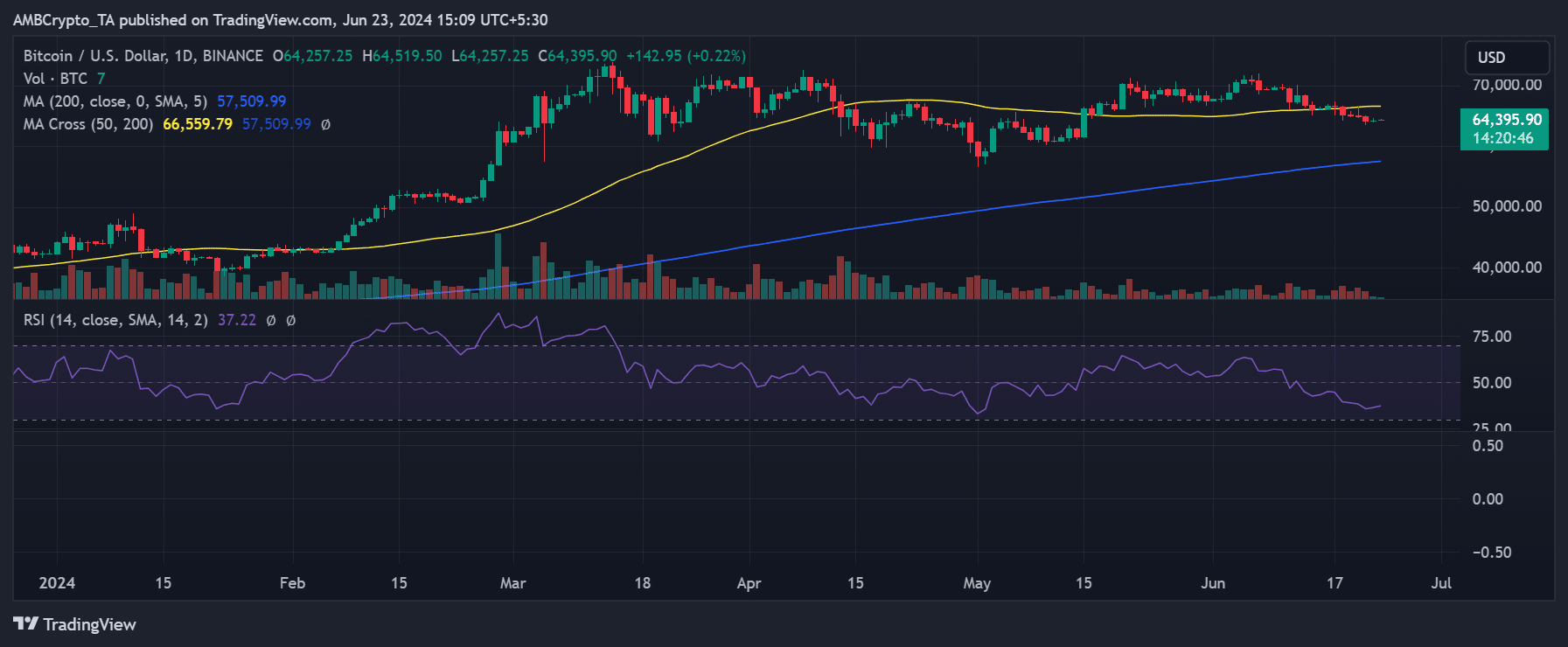

AMBCrypto’s analysis of Bitcoin on the daily time chart revealed that it recently broke its support level. The level was previously set around the $66,000 price range.

This support was marked by its short-term moving average (yellow line). It lasted roughly from May 16 to June 17. The breach signaled a significant shift in bitcoin’s market behavior.

Source: TradingView

Since the last update, Bitcoin was trading around $64,380, showing a slight increase. It also closed with a modest profit on June 22, ending the day at around $64,252.

However, these figures are still well below the earlier support level of $66,000, which has now turned into a resistance level. This indicated a challenge for Bitcoin to regain this price point in the near term.

The importance of this price level, around $66,000 per bitcoin, is underlined by the significant number of addresses that bought BTC in this range.

This high concentration of buying creates psychological and technical significance for the price level.

How many addresses bought bitcoins in this range?

Data from IntoTheBlock indicated that Bitcoin’s current price range, between approximately $63,493 and $64,931, is particularly significant due to the high number of addresses involved in transactions at this level.

Specifically, about 1.9 million addresses bought BTC in this range. Additionally, the average purchase price for these transactions was around $64,237. T

its concentration of buying activity at these levels highlights their importance in the market.

They represent key points where a significant volume of Bitcoin has changed hands, affecting potential resistance or support dynamics in the market.

With many investors at or near this price, it may act as a strong resistance level when the price tries to rise back to this point.

These investors may be looking to liquidate their investments and potentially sell their holdings, increasing selling pressure at this level.

Conversely, if the price falls back into this range, the same investors may buy more to average out their costs. They can also delay sales to avoid losses and provide potential support.

Miners panicking?

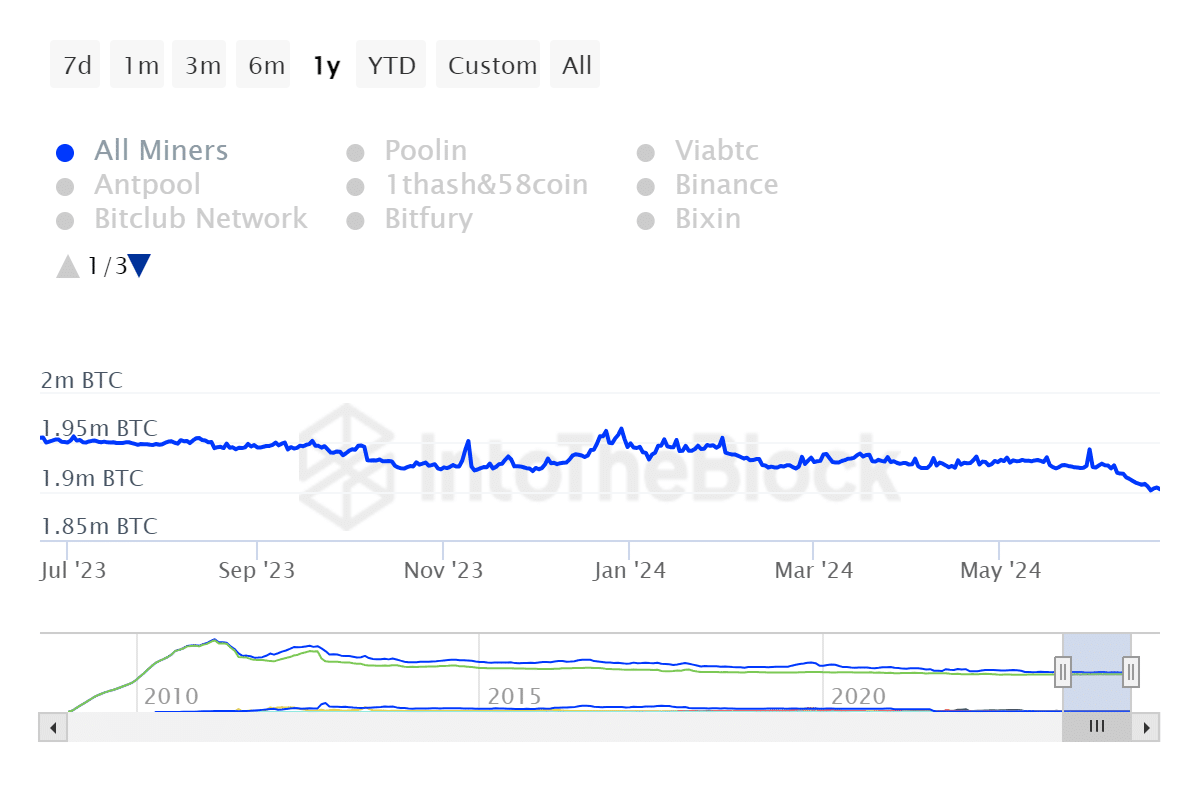

Additional data from IntoTheBlock reveals that Bitcoin miners have significantly increased their selling activities since the beginning of the year.

Miners have sold approximately 30,000 BTC worth around $2 billion since June. This volume of sales is recorded as the highest from the mining community in more than a year.

Source: IntoTheBlock

This substantial selling by miners could be in response to various market conditions, including price volatility or the need to cover operating costs.

Read bitcoins [BTC] Price Prediction 2024-25

However, it plays a vital role in influencing the dynamics of the Bitcoin market, especially affecting supply and price.

The importance of miners selling large amounts of Bitcoin is even more pronounced when we consider the number of BTC held by different addresses in the current price range.