- Spot Ether ETFs can drive the price of Ethereum down to $2,400.

- Institutional interest in Ethereum is less compared to Bitcoin, which affects ETF conversion rates.

Like Ethereum [ETH] lagging behind the performance of Bitcoin, its price has seen a 5.1% decline in the last 24 hours, bringing it to a current value of $3,315.

This recent price decline reflects broader market trends and investor sentiment. Despite this decline, analysts anticipate further declines that could be caused by new financial products entering the market.

Andrew Kang of Mechanism Capital he speculates that the introduction of spot Ethereum exchange-traded funds (ETFs) could push the price of Ethereum up to $2,400.

ETH ETF Will Bring Ethereum Price Down?

The rationale behind Kang’s prediction lies in the comparative lack of institutional interest in Ethereum as opposed to Bitcoin.

The Mechanism Capital founder revealed that the absence of strong incentives to convert spot ETH to ETFs, along with lackluster network cash flows, presents a challenging outlook for Ethereum’s immediate future in the ETF market.

These factors may contribute to Ethereum struggling to maintain its market price in the face of evolving market structures and investor preferences.

Additionally, the potential influx of ETH into the ETF landscape is estimated to attract about 15% of the flows that Bitcoin ETFs received, based on extrapolations from the performance of Bitcoin ETFs.

Initial data suggests that spot bitcoin ETFs attracted around $5 billion in new funds within six months of their launch.

Applying these numbers to Ethereum, it is estimated that Ethereum-based ETFs could see an actual inflow of around $840 million over a similar time frame.

In this context, Kang expresses skepticism about the alignment between the expectations of the crypto community and the preferences of traditional financial (tradfi) allocators, suggesting that the market may have already “priced in” the effects of the ETF launch.

Challenges in market perception

In addition, the conceptual concept of Ethereum as a decentralized financial settlement layer and foundation for Web3 applications has potential. According to Kang, however, current data suggests it may be a tough sell.

In particular, the reduction in network transaction fees due to reduced activity in decentralized finance and non-fungible tokens has shifted perspectives and perhaps compared ETH to overvalued tech stocks in terms of financial metrics.

Furthermore, according to Kang, the recent regulatory green light for Ethereum ETFs was somewhat unexpected and gave issuers limited time to create and disseminate effective marketing strategies.

He added that the removal of put options from ETF designs could further discourage investors from converting their holdings, impacting the expected inflow of capital into these funds.

Concluding the observation, Kang commented:

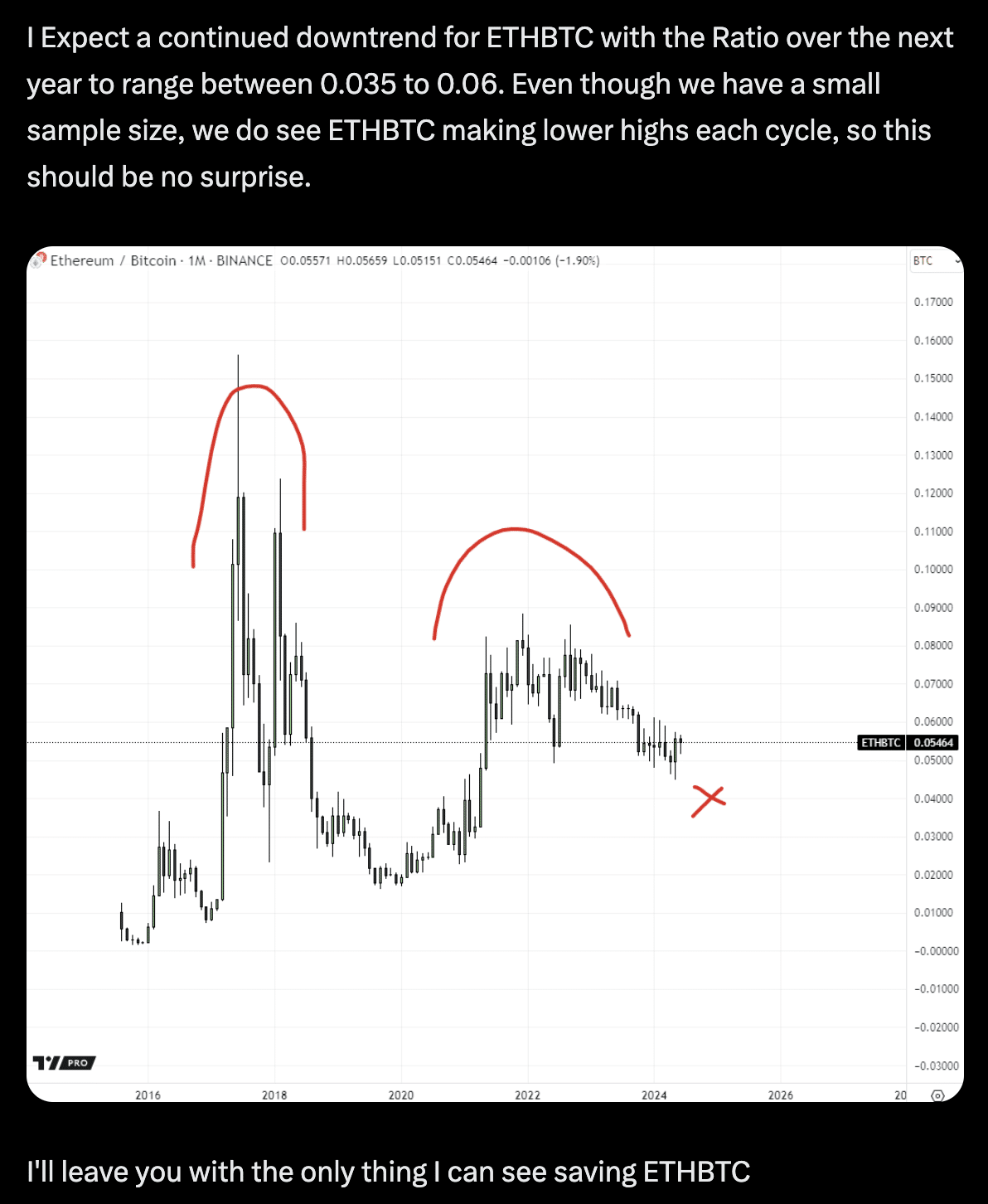

“Does this mean ETH will drop to zero? Of course not, at some price it will be considered good value and when BTC goes up in the future it will be dragged with it to some extent. Before the ETF launch, I expect ETH to trade between $3,000 and $3,800. After the ETF launches, my expectation is $2,400 to $3,000. However, if BTC moves to $100,000 at the end of Q4/Q1 2025, then this could drag ETH along with the ATH, but with ETHBTC lower. “

Source: Andrew Kang at X

Are there bearish signs from ETH?

In light of Andrew Kang’s pessimistic view of Ethereum, it’s worth examining Ethereum’s fundamentals to confirm these concerns.

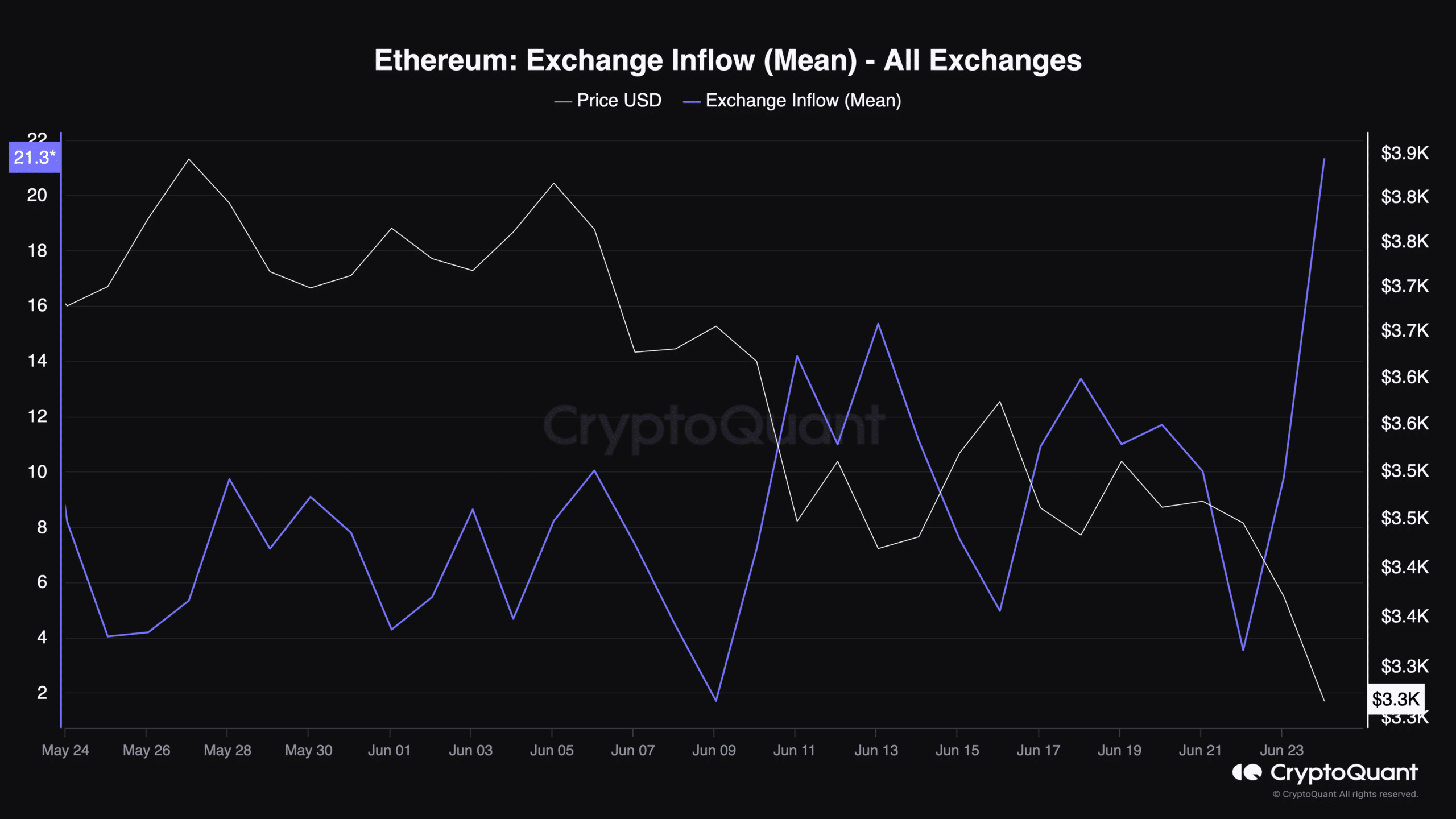

Data by CryptoQuant reveals a worrying trend in one of Ethereum’s key metrics – there has been a significant increase in Ethereum deposits on exchanges, indicating a potential increase in selling pressure.

Source: CryptoQuant

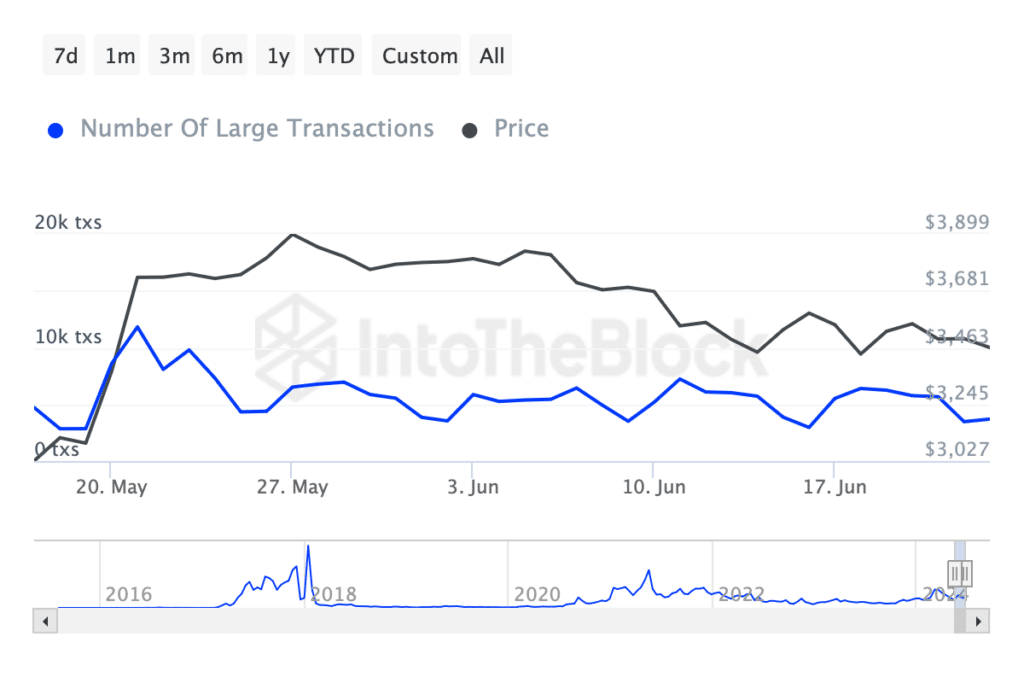

This indicator is in line with IntoTheBlock data showing a significant reduction in large ETH transactions (over $100,000).

Read Ethereum [ETH] Price prediction 2024-2025

Those transactions have dropped from more than 10,000 late last month to less than 4,000 today.

Source: IntoTheBlock

Despite these bearish signs, a recent report from AMBCrypto highlights increase in daily active Ethereum addresseswhich adds a layer of complexity to market dynamics.