USD/JPY, Yen Analysis

- The rhetoric of FX intervention shifts into high gear

- USD/JPY is completely ignoring the decline in US-Japan bond spreads to trade higher

- Markets appear to be calling the bluff of Japanese officials as every intervention level has been breached since the 2022 interventions

- The analysis in this article uses chart patterns and a key support and resistance levels. For more information visit our comprehensive educational library

Recommended by Richard Snow

How to trade USD/JPY

Japan’s Official Top Currency Declares Recent Yen Shortage ‘Unwarranted’

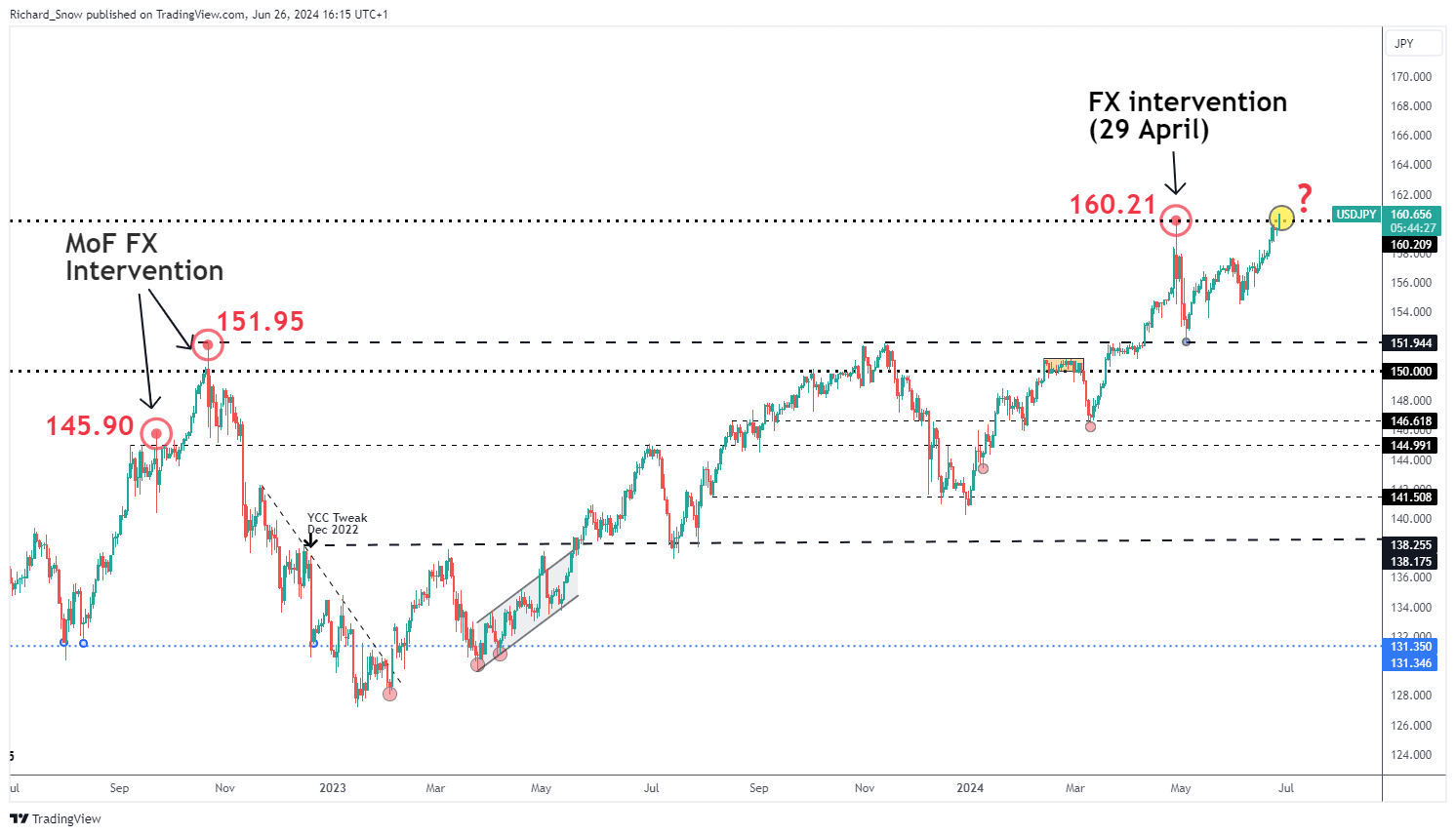

Japan’s top currency official Masato Kanda from the Ministry of Finance (MoF) has issued his strongest warning yet against unwanted speculative movements in the foreign exchange space. However, markets seemed happy to call his bluff, seeing USD/JPY effortlessly move above previous intervention levels.

Kanda said he was seriously concerned about the recent rapid weakening of the yen, which is approaching the 4% spread previously relied upon to assess a “rapid” and unwanted decline in the currency. Ahead of April’s foreign exchange intervention, Kanda clarified that a 4% depreciation over a two-week period, or a 10% drop in a month, met the definition. Since the swing in May, it has weakened around 3.15% in just two weeks, approaching the 4% rule.

USD/JPY was trading at an intraday high (London session) around 160.81 at the time of writing and has entered oversold territory on the RSI.

USD/JPY Daily Chart

Source: TradingView, prepared by Richard Snow

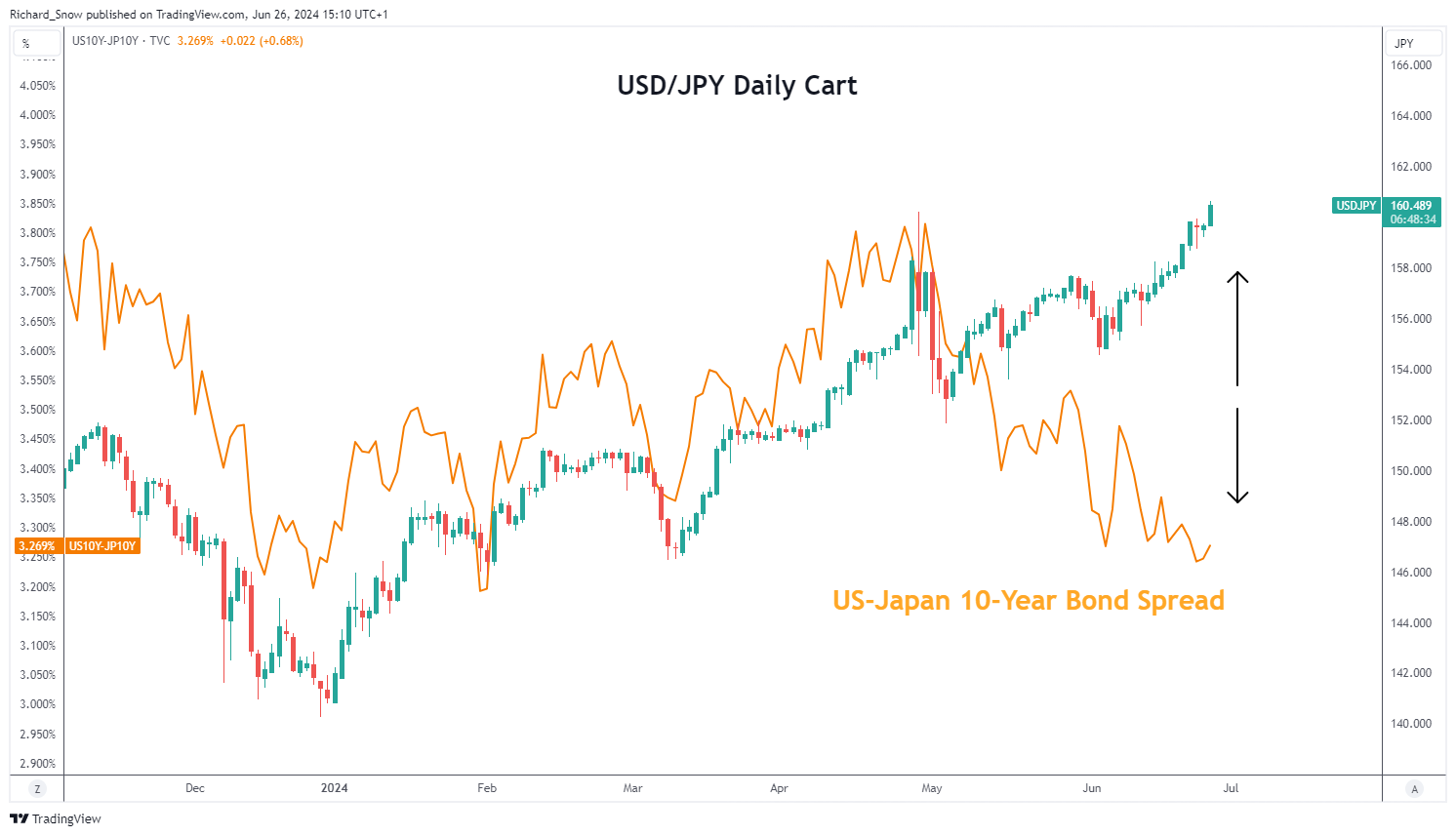

USD/JPY is completely ignoring the decline in US-Japan bond spreads

Recent developments in Japan have seen Japanese government bonds rise above the 1% mark again, but USD/JPY has found no relief, still trading near and above 160.00. The US-Japan bond spread typically follows USD/JPY as seen below, but the pair appears to have separated from the yield differential.

The BoJ did not provide details on the much-anticipated reduction in its bond portfolio at its last meeting, where it previously talked about tapering purchases to keep Tokyo’s borrowing costs low. However, the BoJ said it would be available at the July meeting at the end of next month.

Meanwhile, Friday could provide an insight into the bank’s bond-buying appetite as the BoJ plans to unveil its new bond-buying plan. The combination of a limited bond buying schedule combined with potentially lower US PCE could provide some respite for USD/JPY ahead of the weekend, but that seems a tall order given the recent reluctance to stop the rally.

Recent Break Between USD/JPY and US-Japan 10-Year Bond Spread (Orange)

Source: TradingView, prepared by Richard Snow

A Dangerous Game of Bluff: Markets vs Treasury

Markets appear to be calling the Treasury’s bluff, trading comfortably above 160.00 – the last level that prompted officials to sell tens of millions of dollars to fund massive yen purchases. Whatever happens, it remains a pair with excessive potential volatility that can emerge without warning – underscoring the importance of prudent risk management. Previous hits have attracted moves of around 500 pips.

Previous, surpassed instances of FX intervention

Source: TradingView, prepared by Richard Snow

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX