Unlock Editor’s Digest for free

FT editor Roula Khalaf picks her favorite stories in this week’s newsletter.

The number of foreign direct investment projects in the UK fell to an almost 12-year low, fueling concerns about the country’s foreign investor appetite in the run-up to next week’s general election.

Some 1,555 FDI projects landed in Britain in the fiscal year ending March 2024, according to figures released by the Department of Trade and Commerce on Thursday.

The figure was 6 per cent down on the previous financial year and 31 per cent below the peak in 2016-17, the year of the Brexit referendum. It was also the second lowest number recorded since 2011-12 when there were 1,406 new projects.

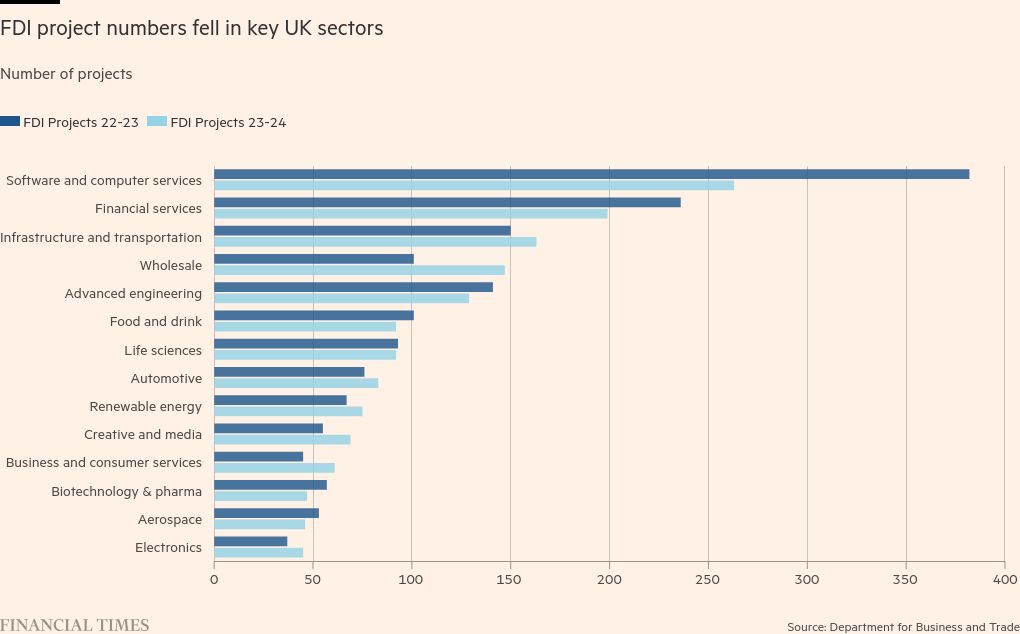

Software and computer services remained the strongest sector for FDI, but saw the largest year-on-year decline, with new projects down 31 percent to 263.

Foreign investment is the main driver of growth in productivity and living standards, but the number of new projects in the year to March was slightly higher than the 1,538 registered in 2020-21, the first year of the pandemic when travel and business activities were severely curtailed.

Nigel Driffield, professor of international trade at Warwick Business School and head of FDI research at the Productivity Institute think tank, said “high government uncertainty has made the situation worse”.

“For the last 40 years, the UK’s value proposition for inward investors has been that it has been a bridge between Europe and the rest of the world,” Driffield said, adding that he now expects investors to “focus on the UK market rather than exporting to the EU”.

The UK is trying to attract more inward investment after the US and EU launched ambitious programs in the form of the Inflation Reduction Act and NextGenerationEU.

The IRA, signed into law by President Joe Biden in 2022, offered nearly $370 billion in tax credits, subsidies and grants to clean energy developers, spurring new investment in the US.

Adopted in 2020, NextGeneration EU is a joint €800 billion borrowing program to help the bloc build a greener and more digital economy.

A UK government-commissioned review into boosting foreign direct investment last year urged ministers to adopt the US and European government’s strategic state-backed approach to attracting foreign investors.

Lord Richard Harrington, the Tory peer who led the review, also recommended appointing a cabinet-level minister to co-ordinate the work in Whitehall. He described central government departments as too often “disorganised, risk-averse, stale and inflexible”.

The estimated number of jobs created by foreign direct investment fell 10 percent year-on-year to 71,478, Commerce Department data showed Thursday.

The year-on-year decline in the number of projects in the year to March reflected a broad decline across sectors, investment type and country of origin. The number of projects decreased for new investments, expansion of existing investments and mergers and acquisitions.

The US, Britain’s biggest overseas investor, created 10 per cent fewer FDI projects than in 2022-23. India, the second largest investor, saw an 8 percent decline.

Financial services, the second largest sector for FDI, saw a year-on-year decline of 16 percent. However, investment projects in renewable energy sources increased by 12 percent.

The Harrington Report, published in November, showed that FDI capital expenditure on wind farms had boosted the value of UK FDI in recent years, but warned of “limited spillover potential”.

Joe Marshall, chief executive of the National Center for Universities and Enterprise, said the new data painted a “worrying picture” and pointed to the impact of the fall in FDI “on jobs and the signals it sends about the attractiveness of Britain’s innovation system”. .

“Increasing investment will be essential for the next UK government to grow the economy. Research and innovation is a global endeavor and foreign direct investment is a key ingredient that is vital for sustainable growth,” he added.