According to Michael Race, Business reporter, BBC News

Getty Images

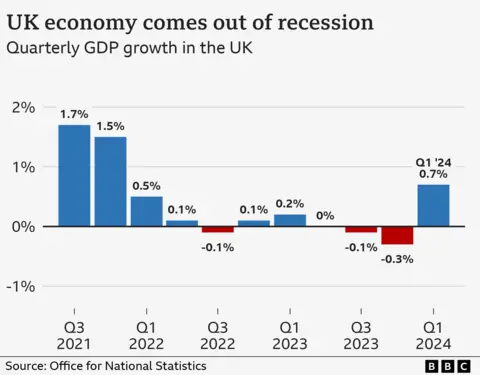

Getty ImagesThe economy grew more than originally estimated in the first three months of 2024 as the UK emerged from recession, revised official figures show.

The economy grew by 0.7% between January and March, the Office for National Statistics (ONS) said.

Data released last month initially estimated growth of 0.6%.

The strength of the economy has been a central campaign battleground, with growth sluggish in recent years.

Most economists, politicians, and businesses want GDP to keep growing because that usually means people spend more, more jobs are created, more taxes are paid to the government, and workers get better pay raises.

The initial figure for the first quarter of the year was stronger than economists had expected, and growth in the services sector, which includes businesses such as hairdressing salons, banks and hospitality, helped push it higher, the ONS said.

But while growth in services was revised upwards, gains in manufacturing were revised downwards based on more data collected.

Due to the upward revision, the UK was the fastest growing economy in the G7 group of advanced economies in the first three months of this year.

Prime Minister and Conservative leader Rishi Sunak welcomed the new revised growth, saying his party had a “clear plan to ensure a more secure future for your family”.

But Sarah Olney, a spokeswoman for the Lib Dems’ Treasury, said that despite the upward revision, the figures would “come as cold comfort to families who are beset by spiraling mortgage repayments, unfair back taxes and the cost of weekly grocery shopping going through the roof “.

Labor did not comment on the latest statistics.

Paul Dales, chief UK economist at research firm Capital Economics, said faster GDP growth in early 2024 was “mainly due to an upward revision in consumer spending”.

The ONS said there was an increase in spending on recreation and culture, as well as housing and food, but other household disposable incomes continued to rise in early 2024 as workers secured pay rises.

Mr Dales said this meant the household savings rate rose from 10.2% at the end of last year to 11.1%, the highest rate since mid-2021 when savings increased during the Covid pandemic.

He added that the new figure suggested that “whoever is prime minister this time next week may benefit from the economic recovery being a bit stronger”.

“It’s the tiniest bit of improvement, but when it comes to UK GDP growth, every little bit really helps,” said Danni Hewson, head of financial analysis at AJ Bell.

“Growth has been front and center in party manifestos, although they differ on the details of how that growth can be achieved. A growing economy creates wealth, puts more money in people’s pockets and increases the amount of tax delivered to depleted Treasury coffers.” .”

While the UK has emerged from the economic recession it entered in the final months of 2023, many households may not be feeling better as budgets have been stretched recently by rising prices.

Interest rates are currently at a 16-year high of 5.25%, meaning people are paying more to borrow money for things like mortgages and loans, although savers have also got better returns.

The latest economic data showed the economy did not grow in April after particularly wet weather discouraged shoppers and slowed construction.

The Bank of England, which sets interest rates, opened the door to cutting them in August, in what would be the first fall in borrowing costs in more than four years.

But many mortgage holders have already refinanced at higher costs and approx three million more households will see their repayments rise over the next two years when fixed rate deals end.

Sophie Lund-Yates, chief equities analyst at Hargreaves Lansdown, said that while “hotter-than-expected growth will not help those looking for a faster path to interest rate cuts, it will help boost overall optimism”.

“Deep-seated productivity problems in the UK are a bigger problem overall than the outlook for immediate interest rates,” she added.