UK house prices are overvalued, suggesting they will fall in some regions across the country. But the big question is how far do prices have to fall? And where are the prices most overrated?

New data from Zoopla this morning shows UK house prices are currently 8% “overvalued” but will be “fairly valued” by the end of the year due to rising incomes.

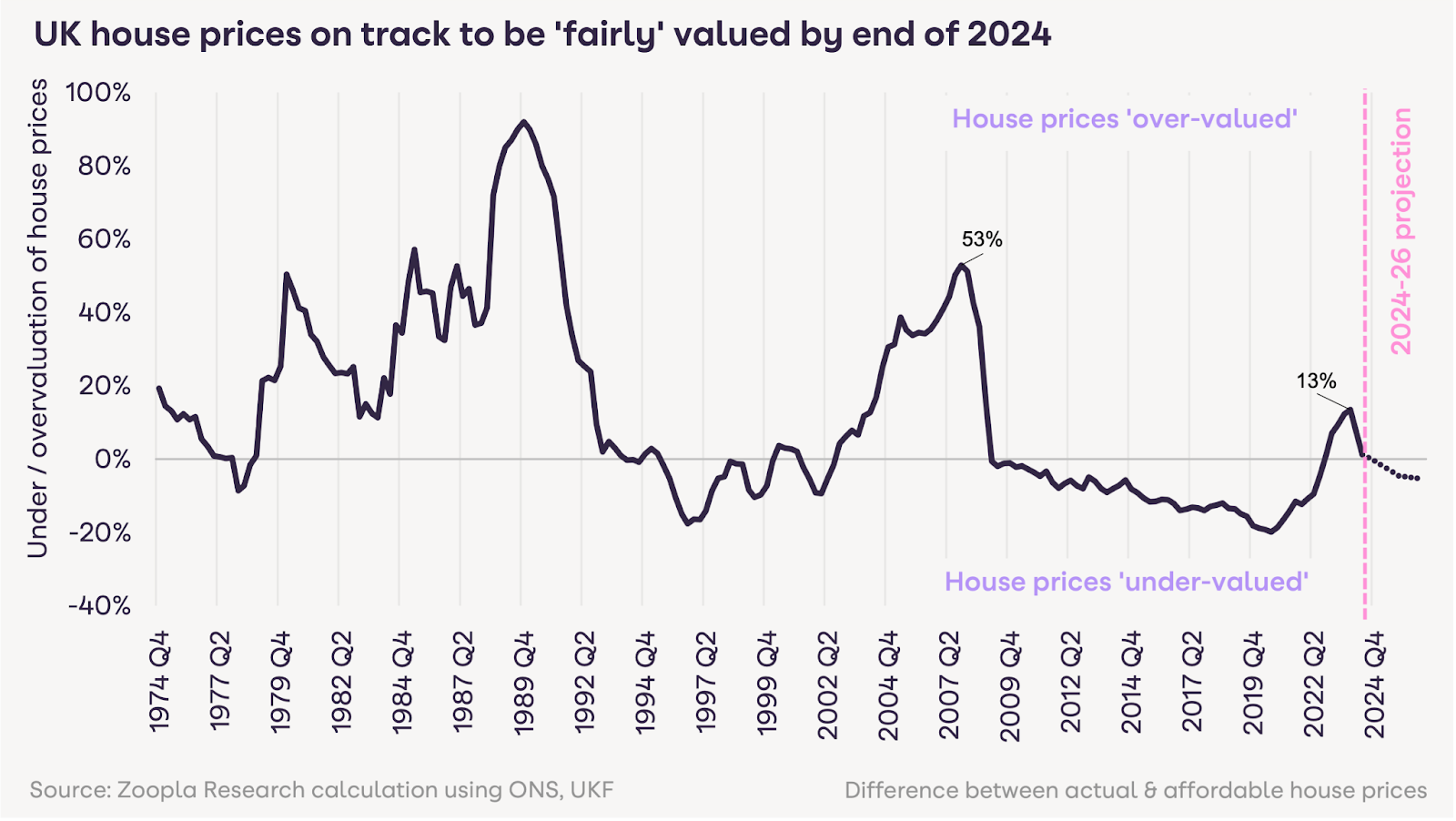

Zoopla has a long-term model that tracks whether UK house prices are too expensive or fairly valued. This, the property portal says, highlights that UK house prices were more than 50% overvalued in the run-up to the global financial crisis in 2007 and even more so during the housing boom of the late 1980s. In both of these cases, the economic recession led to a double-digit decline in real estate prices.

The latest analysis found that the 2023 mortgage rate spike resulted in UK house prices being 13% overvalued by the end of 2023. This overvaluation of house prices explains why there has been a slight year-on-year decline in prices over the past year. for the previous period.

UK house prices are currently estimated to be 8% overvalued (Q1 2024), but this overvaluation will disappear by the end of the year assuming house prices rise by 1.5% by the end of this year – which Zoopla thinks. will happen – and mortgage rates will remain at 4.5%. Rising incomes and longer mortgage terms are helping to improve affordability, which in turn will support continued improvement in sales volumes and single-digit home price growth in the second half of 2024.

In contrast to the reduced sales during 2023, Zoopla data shows that the market remains on track for 1.1 million sales in 2024. 75% of those sales expected in 2024 are either completed or agreed and in the process of completion – with a quarter million sale still negotiable. The 1.1 million sales figure is 10% higher than in 2023 but still below the 20-year average, however rising sales are positive and show more realism on the part of sellers and renewed, cautious confidence among buyers.

Looking ahead, Zoopla says the short-term outlook for the retail market will depend on the outlook for mortgage rates, which are a function of the outlook for interest rates. Based on the City’s forecast for prime rates, mortgage rates are expected to remain in the 4-4.5% range, which is sufficient to support sales volume and low single-digit house price growth.

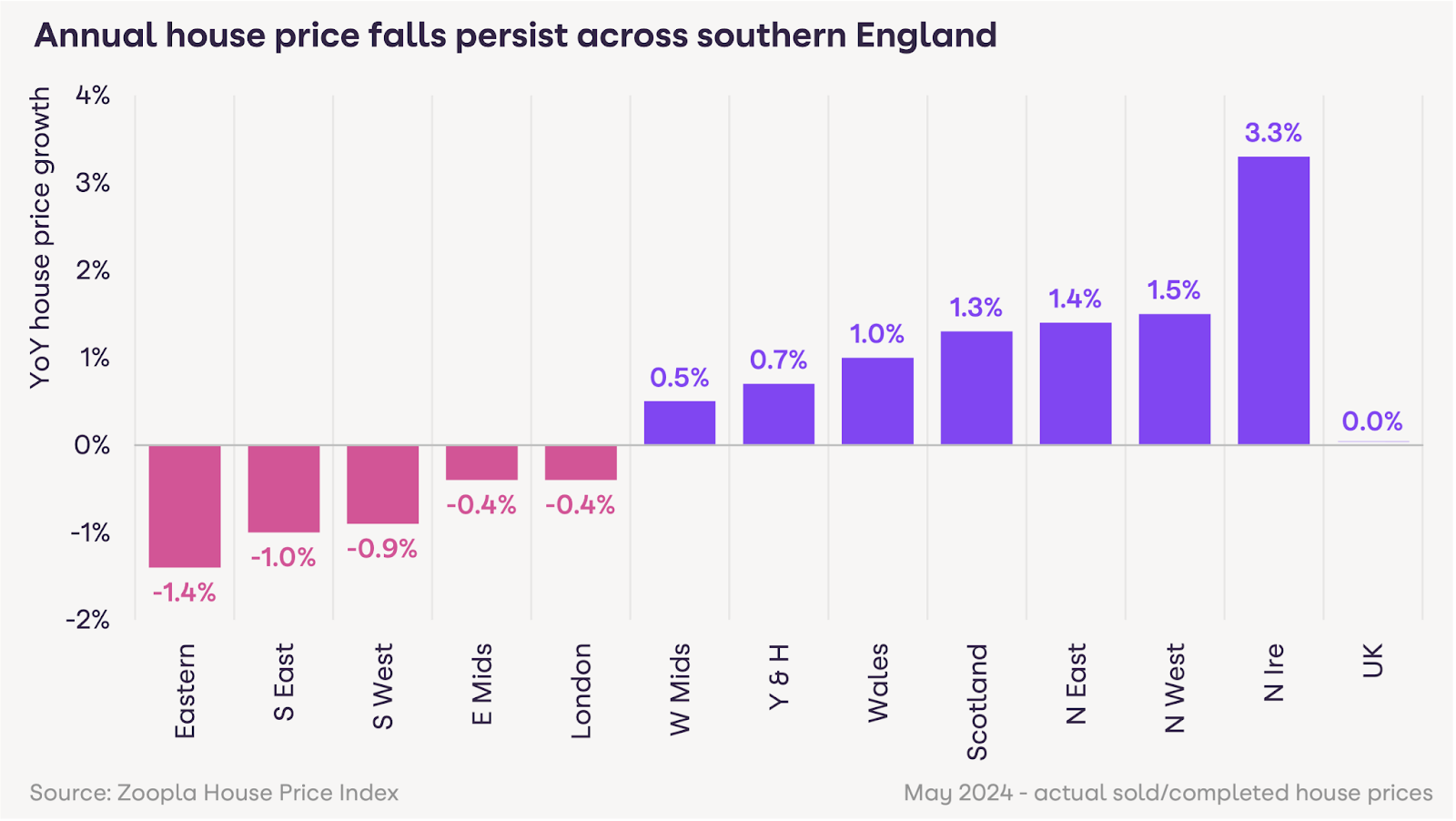

House prices in the south of England are expected to continue to be below the UK average as they catch up with incomes again, as income growth is key to supporting sales and demand until 2025. The decline in prices is currently greatest in the eastern region (- 1 .4%) and the South East (-1%), with Canterbury in Kent leading the way with the biggest fall in prices (-4.1%). Prices are rising by up to 3.3% in Northern Ireland and 1.5% in the North West region, with Sunderland seeing a 5.2% rise in prices.

Richard Donnell, chief executive of Zoopla, said: “The housing market continues to adjust to higher borrowing costs through a modest fall in house prices and rising incomes. Mortgage buyers also rely on longer mortgage terms to get those extra few percentage points of purchasing power to afford a home.

“The election campaign had a limited impact on market activity, although the seasonal summer slowdown is approaching. Negotiated sales continued to rise and more homes for sale means more buyers are looking to move in the second half of the year. The timing of the first rate cut is key and will support both market sentiment and selling activity. Overall, we expect house prices to be 1.5% higher than in 2024.