Captain Faibik, a prominent market analyst, believes that XRP has bottomed out amid an ongoing downtrend and predicts an immediate mid-term rise to $2.

Chartista revealed this in one of its latest XRP price analyses, as prices fell below the $0.50 region for the third consecutive month. XRP has demonstrated greater resilience than the rest of the market during downturns. Still, it fell to a low of $0.4620 on June 24.

Analyst: XRP has bottomed

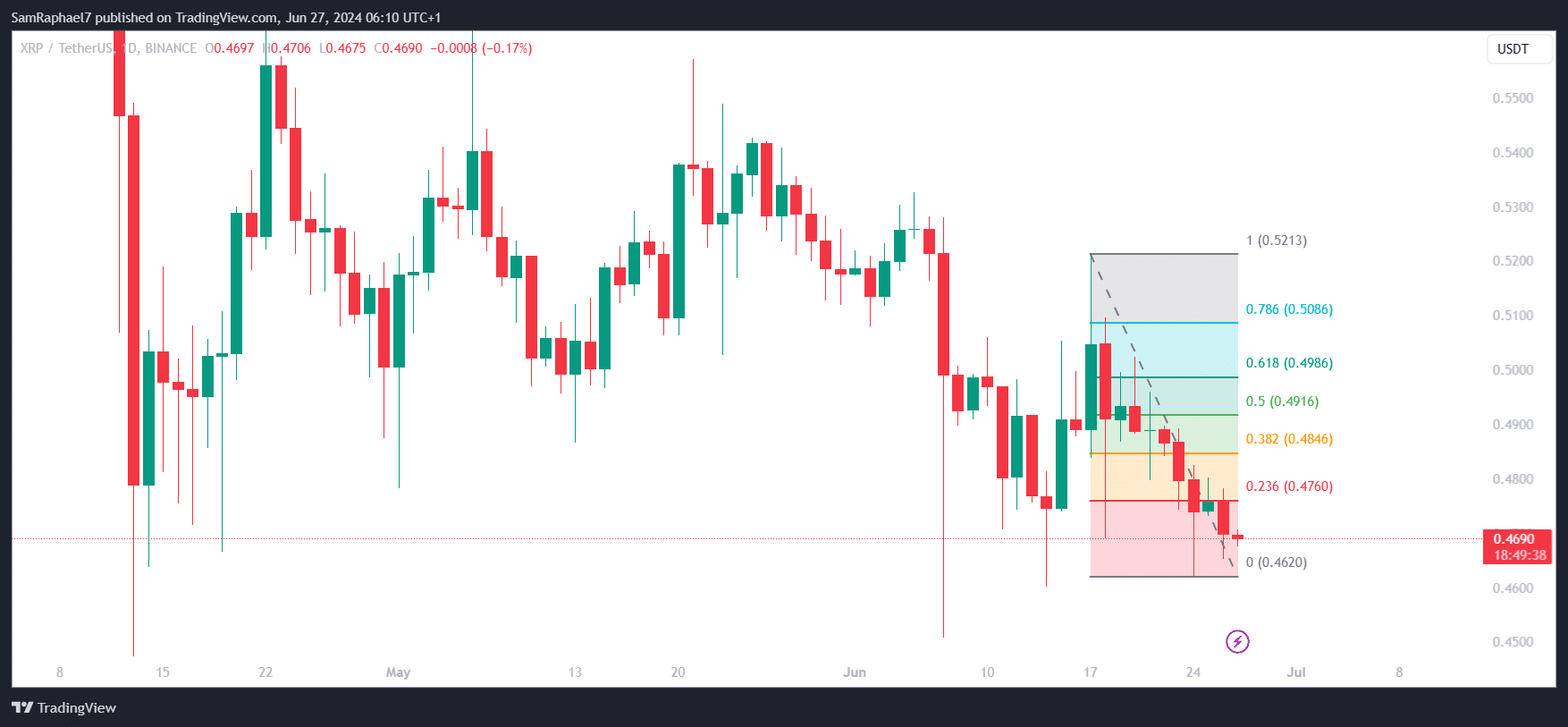

Captain Faibik suggests that XRP bottomed out at this price level, indicating that its price is unlikely to fall below this point.

XRP$ It seems to be at rock bottom and almost ready to bounce back 📈

Medium term goal: $2 🔜#Crypto #XRP #XRPUSDT pic.twitter.com/zMLICiKbV4

— Captain Faibik (@CryptoFaibik) June 27, 2024

As shown in the chart below, the Fibonacci 0 level is in line with the $0.4620 low. This Fib area acts as a robust support level for XRP, with bulls trying to defend it against any breach.

If support is strong enough, a retest of this level could serve as a springboard for a much-anticipated bounce. However, such a retest must occur at a time when the broader market is poised for recovery. Crypto Basics confirmed earlier this week that Bitcoin (BTC) has already reached its highest oversold level since last August.

Estimated mid-term target of $2

This metric suggests that the leading cryptocurrency could be on the verge of a recovery. Notably, such a move would positively impact the rest of the market and give XRP bulls enough power to make a comeback. Captain Faibik has already set a mid-term target of $2 when this bounce occurs.

Interestingly, he last saw XRP $2 level was in 2018 during its historic rally. XRP failed to break $2 in 2021 despite most assets hitting new all-time highs. Many attributed XRP’s underperformance to legal pressure from the SEC’s lawsuit against Ripple.

Faibik Chart Reveals Symmetrical Triangle XRP Has Been Struggling On Weekly Chart Since 2020 With SEC Case now on appealAnalysts expect XRP to recover after seeing a decisive finish. This rally could set the stage for a breakout of the upper triangle trend line, allowing XRP to reach Faibik’s mid-term target of $2.

XRP records bull market metrics

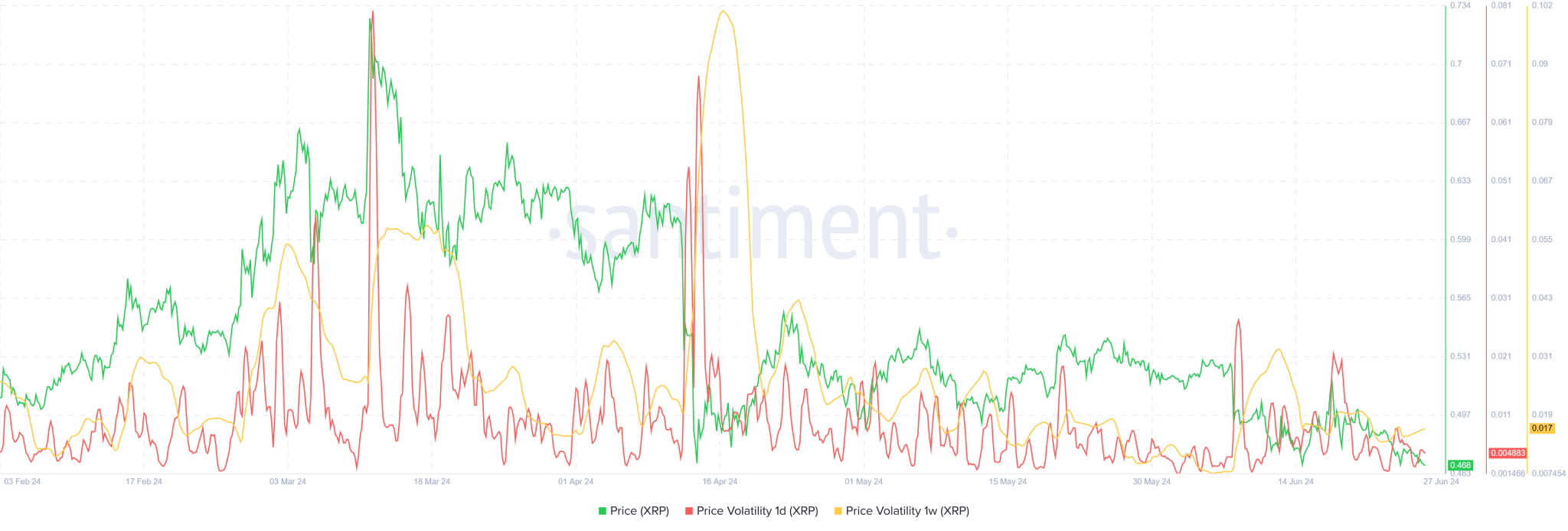

Meanwhile on the market data by Santiment suggests that XRP price volatility has continued to decline over several time periods. Daily volatility (red) dropped to 0.004883, while weekly volatility (yellow) dropped to 0.016566. These figures represent the lowest values since the beginning of this month.

Reduced price volatility during a downtrend can mean market consolidation, with buyers and sellers reaching a temporary balance. This could indicate that the downtrend is losing momentum and may be coming to an end or preparing for a reversal.

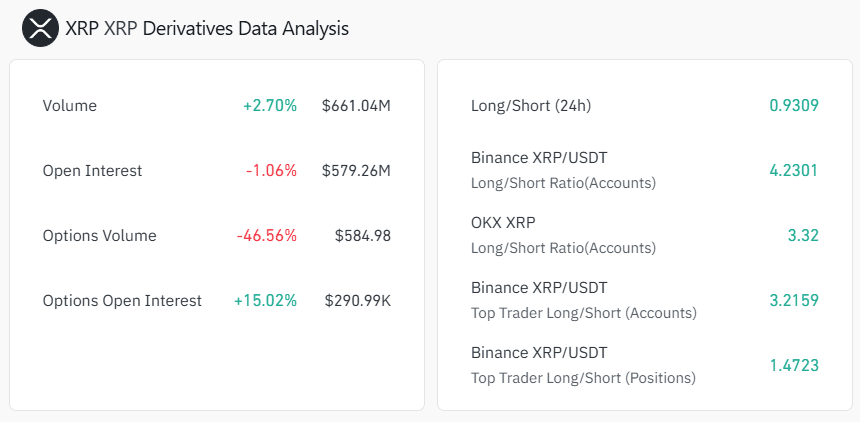

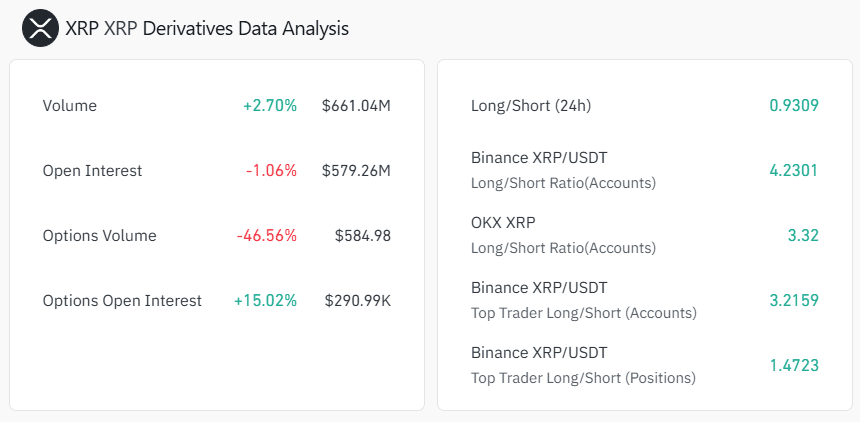

XRP currently changing hands at $0.4690 at press time, down 0.17% this morning. Coinglass data shows that the token’s Long/Short ratio remains below 1, currently at 0.9309. This represents a preponderance of shorts, a trend that could support the strength of the rebound if a recovery clears out those short positions.

Disclaimer: This content is informative and should not be considered financial advice. The opinions expressed in this article may include the personal opinions of the author and do not reflect the opinion of The Crypto Basic. Readers are advised to do their due diligence before making any investment decision. Crypto Basic is not responsible for any financial losses.

-Advertisement-