Unlock Editor’s Digest for free

FT editor Roula Khalaf picks her favorite stories in this week’s newsletter.

The Philippines is seeking Western investment to further develop its nickel reserves, positioning itself as an alternative to a China-dominated supply chain for the critical battery metal.

The world’s second-largest nickel producer is seeking a critical mineral deal with the US and investment from foreign companies to build more refineries as it faces growing concerns about China’s control over the electric vehicle ecosystem.

“There is now room for the Philippines to become a major player in batteries,” Ceferino S Rodolfo, undersecretary of the Department of Trade and Industry, told the Financial Times.

Nickel production in the Philippines is just a fraction of the top player in Indonesia, where government officials say 90 percent of the industry is controlled by Chinese companies.

But concerns about the concentration of nickel supplies in the hands of Indonesia and China — as well as low prices that have curbed output by other producers — have prompted buyers to seek other sources of the commodity, which is also a critical ingredient in steelmaking.

The US, UK, Australia, Japan and South Korea are among the countries that have expressed interest in investing in the Philippine nickel industry, Rodolfo said. But so are Chinese companies.

“It’s a race between China and the US,” he said, adding that the Philippines has “a really strong case to choose a non-Chinese investor so that we can be a supplier of non-Indonesian, non-Chinese nickel”.

The pressure on the Philippines also comes as it seeks to build closer economic ties with the US and its allies amid escalating tensions with Beijing in the South China Sea.

Last week, Chinese coast guard vessels bumped and boxed Philippine military supply boats, an incident that seriously injured one Filipino soldier.

The Philippines wants to sign a critical mineral deal with the United States that would allow it to get tax breaks. It also asked to join the existing agreement between the US and Japan, Rodolfo said.

But no deal is on the table yet because of U.S. reluctance to sign a deal in the middle of an election year, officials in Manila said.

The Philippines is also looking to produce “greener” nickel with the help of investors, using renewable energy to power smelters, Rodolfo said — setting it apart from Indonesia, which relies heavily on coal-fired power plants, earning it a reputation as a producer of “dirty” nickel.

But Washington is concerned about high energy costs, Manila’s ambassador to the US, Jose Manuel Romualdez, told the FT. “One of the main obstacles now is energy. . . We need to be able to introduce a better, more coherent type of energy that is cheaper,” he said.

Manila is ready to invest in cheaper and cleaner energy options and is considering a combination of hydro, solar and wind power and natural gas, he added.

There are currently two nickel processing plants in the Philippines, both operated by Nickel Asia Corp, in which Japan’s Sumitomo Metal Mining is the largest shareholder.

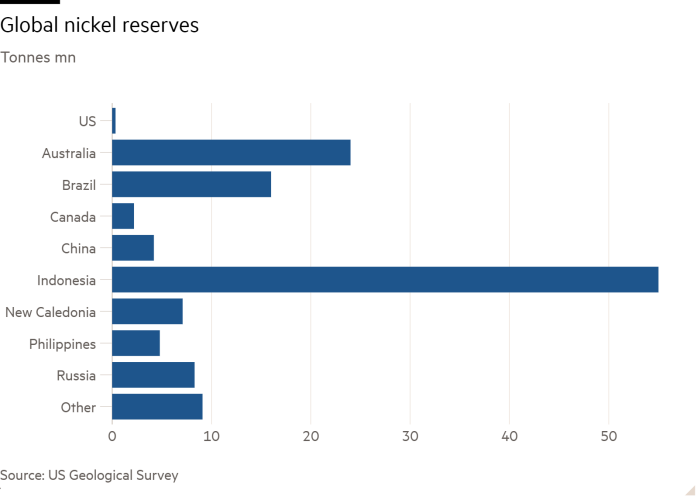

Indonesia accounts for 57 percent of global refined nickel production – 4.5 times more than the Philippines in 2023 – and is projected to grow to 69 percent by the end of the decade, according to Benchmark Mineral Intelligence. Its reserves also far exceed those of the Philippines: with 55 million tons, Jakarta has 11 times more nickel, according to the US Geological Survey.

Meanwhile, nickel mines in Australia have been shut due to lower prices – which have fallen 23 percent over the past year. Production in New Caledonia, a French overseas territory, was also disrupted by political unrest.

Adam Webb, cathode product director at Benchmark Mineral Intelligence, said obtaining financing in the current low price environment would be a challenge for the Philippines.

He said tax breaks and policies that favor non-Chinese companies could attract investment to the Philippines, which could prove a viable alternative for Washington to de-risk its nickel supply chain.

“For the West, the Philippines offers an opportunity to diversify away from the Chinese-dominated Indonesian nickel industry and mitigate the risks of growing nickel concentration in a single country,” he said.

More news from Demetri Sevastopulo in Washington