From the beginning of July, crypto exchanges and stablecoin issuers will operate in the EU according to the rules established by the MiCA law.

The entry into force of the Markets in Crypto Assets Act (MiCA) on 30 June means significant changes for the crypto-currency industry in the EU. One of the key provisions of MiCA is the regulation of stablecoins, as well as rules for a wide range of crypto-assets and exchange platforms.

What MiCA says

MiCA is a regulatory framework that clarifies and uniformly regulates the cryptocurrency market. It defines the classification of digital assets and specifies the laws and areas of responsibility for their implementation.

Last April, members of the European Parliament voted in favor of the draft law on the regulation of cryptocurrencies MiCA. The EU has become one of the first jurisdictions in the world to introduce comprehensive regulation of cryptoassets.

Companies will have to provide full information to customers, present a public business model, implement an effective governance system, including risk management, register with the European Banking Authority (EBA), implement a buyback mechanism and have sufficient reserves.

In addition, issuers of asset-related tokens (ARTs) and electronic money tokens (EMTs) must publish sustainability information from June 30, and crypto service providers must start applying for disclosure requirements by the end of the year.

ART issuers (other than credit institutions) may continue to operate if tokens were issued prior to June 30 until they are granted or denied authorization under MiCA, provided they apply for authorization by July 30.

Entities that do not comply with MiCA may be fined and may be banned from operating in the European Union.

What restrictions have crypto companies put in place?

Due to the introduction of MiCA legislation in the EU, some crypto firms have started to restrict the use of stablecoins.

In March, OKX suspended trading of the largest stablecoin Tether (USDT) for users in the European Union.

In early June, the Binance exchange announced that it would limit access to unregulated stablecoins for customers from the European Union. Binance will also limit the number of services that can include unregulated stablecoins. The copytrading service and participation in the Launchpad and Launchpool programs will be completely unavailable to European clients of the exchange.

Crypto exchange Bitstamp said it will delist EURT, European stablecoin Tether and other stablecoins that do not comply with new EU cryptoasset laws by June 30.

European company Lugh has also announced that it will stop issuing its EURL stablecoin before the MiCA regulation comes into force.

Stable market condition

According to CoinGecko, during 2023, the EURT stablecoin quickly lost its popularity in the European crypto community. By October of last year, the capitalization of cryptoassets had fallen almost tenfold compared to the peak in 2022 – from $231 million to $32 million.

EURT is the second largest euro-pegged stablecoin by capitalization. Compared to USDT from the same Tether, the volume of EURT in circulation is small – only 32.1 million coins as of June 26.

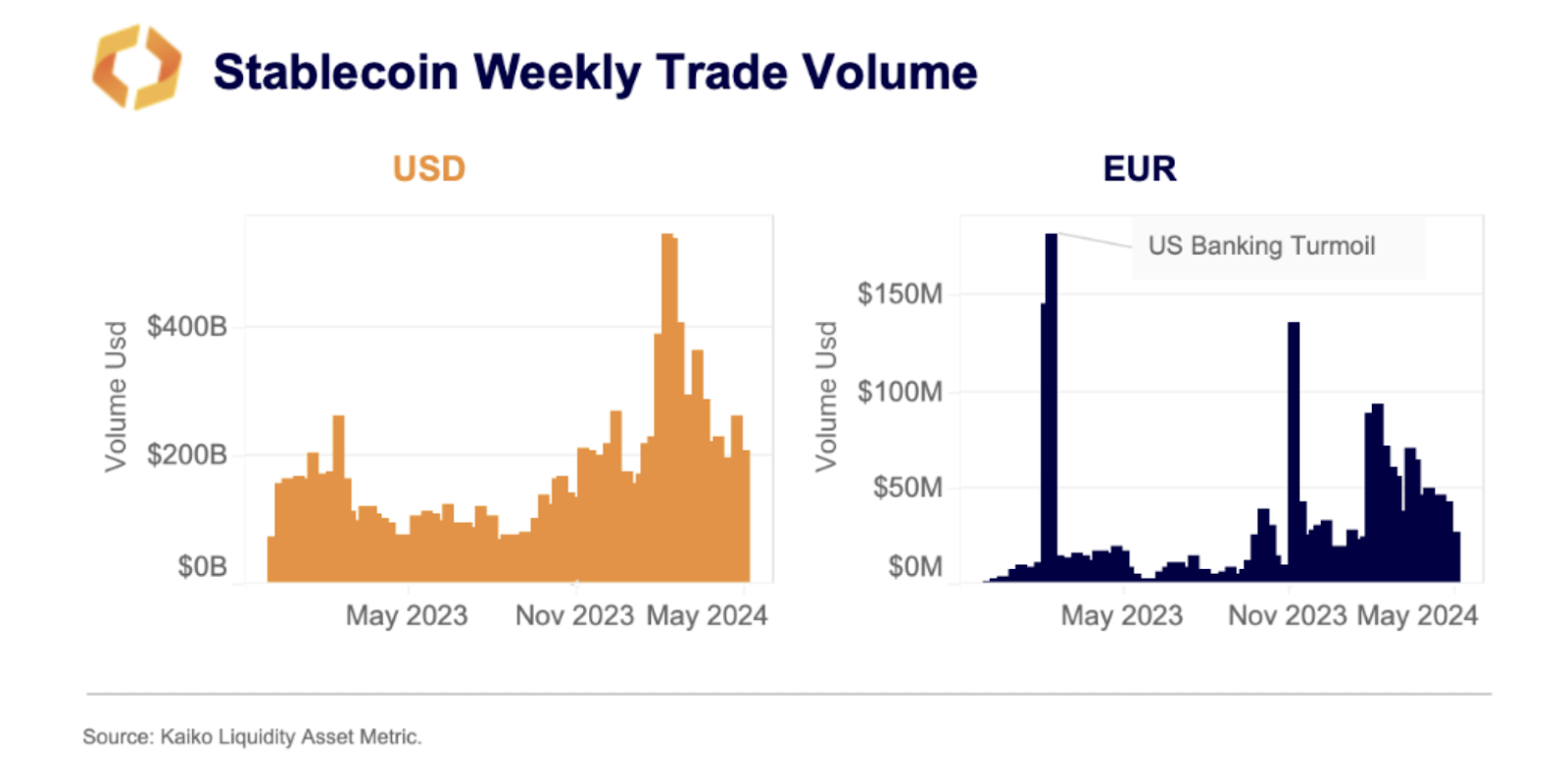

According to a report by analyst firm Kaiko, euro-backed stablecoins account for only 1.1% of the total volume of fiat-backed stablecoin trades.

The study also shows that the majority (90%) of stablecoin transactions take place in US dollar-backed assets. Only 10% of stablecoins are backed by reserves in other currencies and real assets, including gold.

Weekly trading volume for dollar-denominated stablecoins such as USDT exceeds $270 billion. Meanwhile, the total turnover of Euro stablecoins EURT, EURS, EURCV, AEUR and the like is only about $40 million per week. Analysts, however, expect growth in this segment as European regulators pressure exchanges to withdraw dollar-denominated assets from circulation.

What the experts say

Analyst MartyParty generally expects an explosion of stablecoins after the implementation of MiCA. He believes that banks, institutions and stablecoin issuers in the European Union will start minting trillions of euro-backed stablecoins in July.

Alexander Ray, CEO and co-founder of Albus Protocol, notes that the new regulations will require all organizations involved in business transactions using asset-linked tokens to implement many regulatory measures, such as KYC and AML protocols.

He said that the implementation of KYC and AML protocols will definitely increase the operating costs of crypto firms and users will end up paying for it.

Sven Mohle, Managing Director of BitGo Europe GmbH, added that by adopting MiCA, Europe is helping to set the bar for enforcing international standards regarding anti-money laundering and anti-terrorist financing rules and regulations. However, users are unlikely to see fully standardized international rules across all areas.