Stay informed with free updates

Simply log in to Exchange traded funds myFT Digest – delivered straight to your inbox.

China’s exchange-traded fund industry has surged in recent years, buoyed by record inflows into equity strategies and amid a slump in active fund adoption, according to Morningstar research.

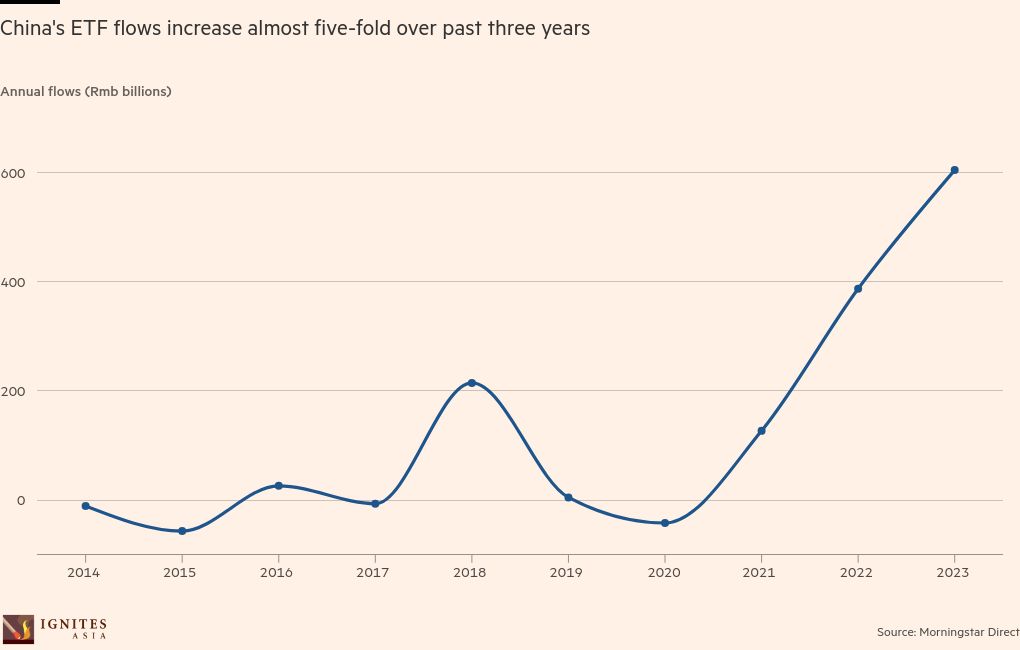

Total annual inflows into Chinese ETFs will reach Rmb604.3 billion ($83.3 billion) in 2023, according to the latest China ETF Asset Flows report.

This figure is nearly five times the 127.2 billion Rmb in inflows recorded in 2021 and nearly double the 387.2 billion Rmb in 2022.

It also means a full turnaround from Rmb5.1bn in 2019 and Rmb41.8bn in outflows in 2020, according to the data.

This article was previously published by Ignites Asia, a title owned by FT Group.

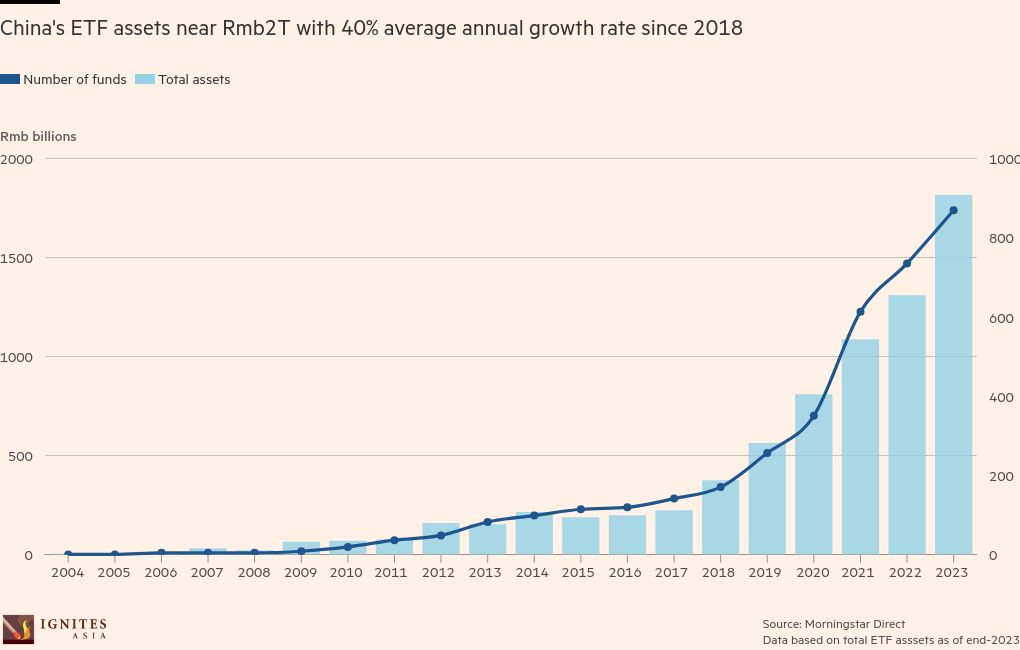

Strong inflows into Chinese ETFs helped the sector realize 1.82tn Rmb in assets at the end of December, according to the report.

The researchers noted a “stunning” average annual growth of 40 percent in total assets between 2018 and 2023, noting that the “explosive” growth came amid a “lukewarm” performance in China’s broad A-share market, which pulled back actively managed funds.

Chinese investors have instead flocked to thematic ETF products, such as those focused on alternative energy or technology, according to Wanda Wang, Morningstar research manager and author of the report.

Regulator-led fund fee reforms have also led Chinese fund companies to cut fees on large broad-based ETFs, further attracting inflows, she said.

The total number of ETFs in China rose to 870 at the end of 2023, according to the report. Equity products made up 96 percent of all ETFs, 834. There were only 17 bond ETFs, 17 commodity ETFs and two convertible ETFs on the market.

Equity ETFs made up the majority of total assets and accounted for most of the flows into the space. These products reached total assets of Rmb1.72t last year, accounting for 94 percent of the industry’s total volume.

Their growth largely mirrored the development of the ETF industry as a whole. Equity ETFs “gained tremendous traction over three years” with annual inflows of Rmb575.6 billion.

Morningstar attributed this to robust buying by institutional investors of broad-based index-tracking ETFs such as Huatai-PineBridge CSI 300 ETF, E Fund Seeded CSI 300 ETF, ChinaAMC China 50 ETF, Harvest CSI 300 ETF and ChinaAMC CSI 300 ETF.

China’s ETF industry is also concentrated on leading providers. The top three asset managers in the sector – China Asset Management, E Fund Management and Huatai-PineBridge Fund Management – have topped the rankings for the past three years.

As of the end of December, they accounted for about half, or 46 percent, of the total market share, with ChinaAMC leading the pack with Rmb392.2 billion in total assets and holding 21.6 percent of the market.

The manager booked Rmb152.4 billion in underwriting during the year, representing a 67 percent increase in inflows from 2022.

This was closely followed by E Fund with Rmb256.9 billion in total assets as of last year, 14.1 percent of the total market share. Huatai-PineBridge had assets of Rmb193.8 billion, accounting for 10.7 percent of the ETF market.

*Ignites Asia is a news service published by FT Specialist for professionals working in the asset management industry. Trials and subscriptions are available at ignitesasia.com.