- Net Ethereum flow from exchanges increased by over 6%.

- ETH remained below the resistance level.

Over the past month Ethereum [ETH] recorded a significant trend of outflows from the stock exchanges. He said investors are shifting their holdings from trading platforms.

Despite the decrease in foreign exchange balances, the volume of ETH staked continued to grow. ETH is struggling to stabilize its price amid these shifts in investor behavior and network participation.

Ethereum increases monthly outflow

AMBCrypto’s analysis of Ethereum transaction data revealed significant net outflows from exchanges. The data showed that over 1 million ETH moved from trading platforms in June.

This outflow of approximately $3.8 billion represented a significant month-on-month change of 6.4%. It indicated a substantial reduction in the amount of Ethereum held on exchanges.

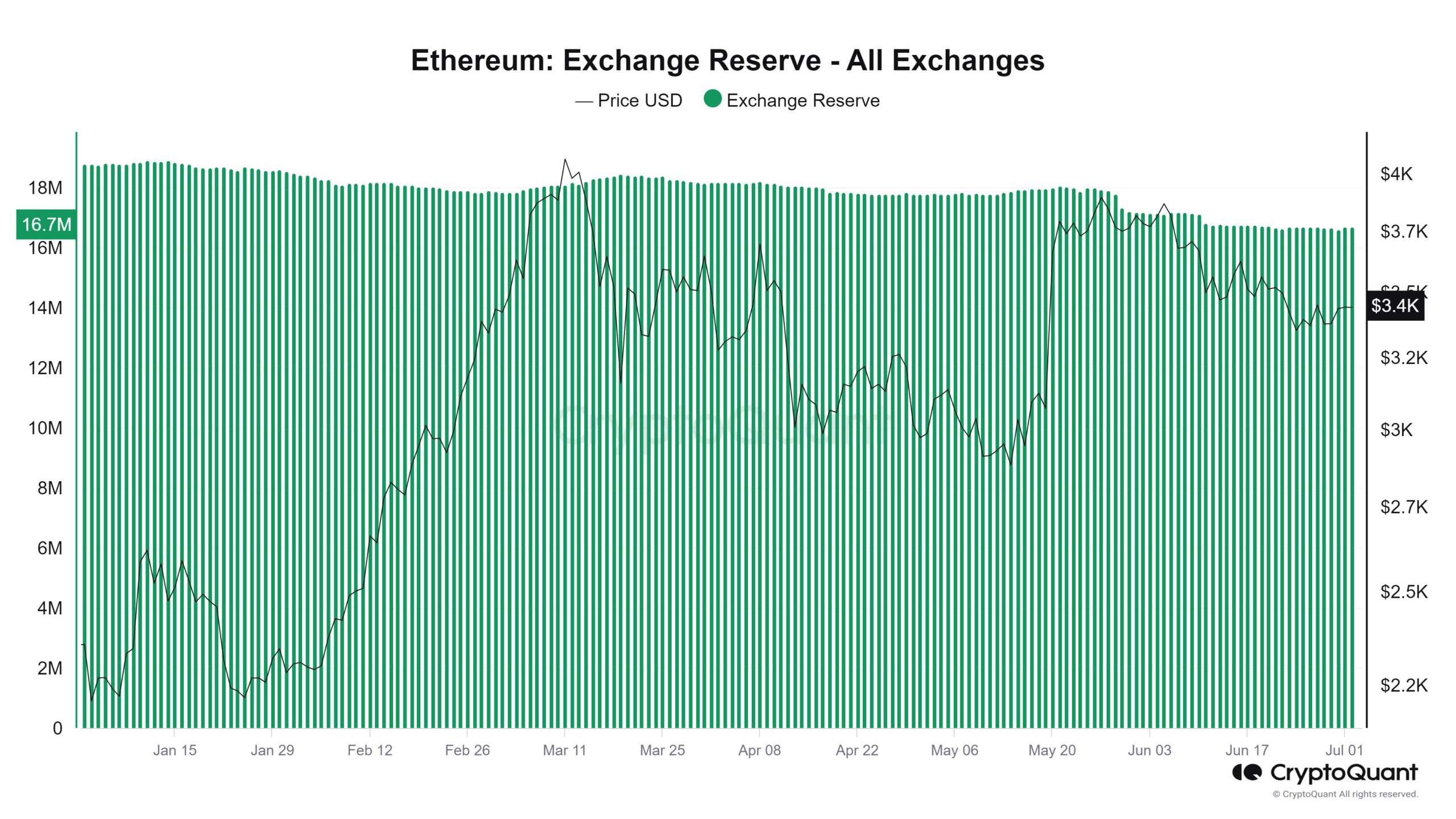

Further examination of foreign exchange reserve data from CryptoQuant highlighted the magnitude of this shift. At the beginning of June, the total ETH held in foreign exchange reserves was over 17 million.

By the end of the month, that number had dropped to around 16 million ETH. At the time of writing, the reserve was around 16.6 million ETH.

Source: CryptoQuant

This decline in foreign exchange reserves usually indicates several strategic moves by investors.

This is either an increase in long-term holdings as investors withdraw ETH to secure their wallets, or a move to become more actively involved in the Ethereum staking process.

This is especially true for the continued development towards Ethereum 2.0. Both scenarios indicate bullish sentiment among holders.

The total Ethereum deposit is increasing

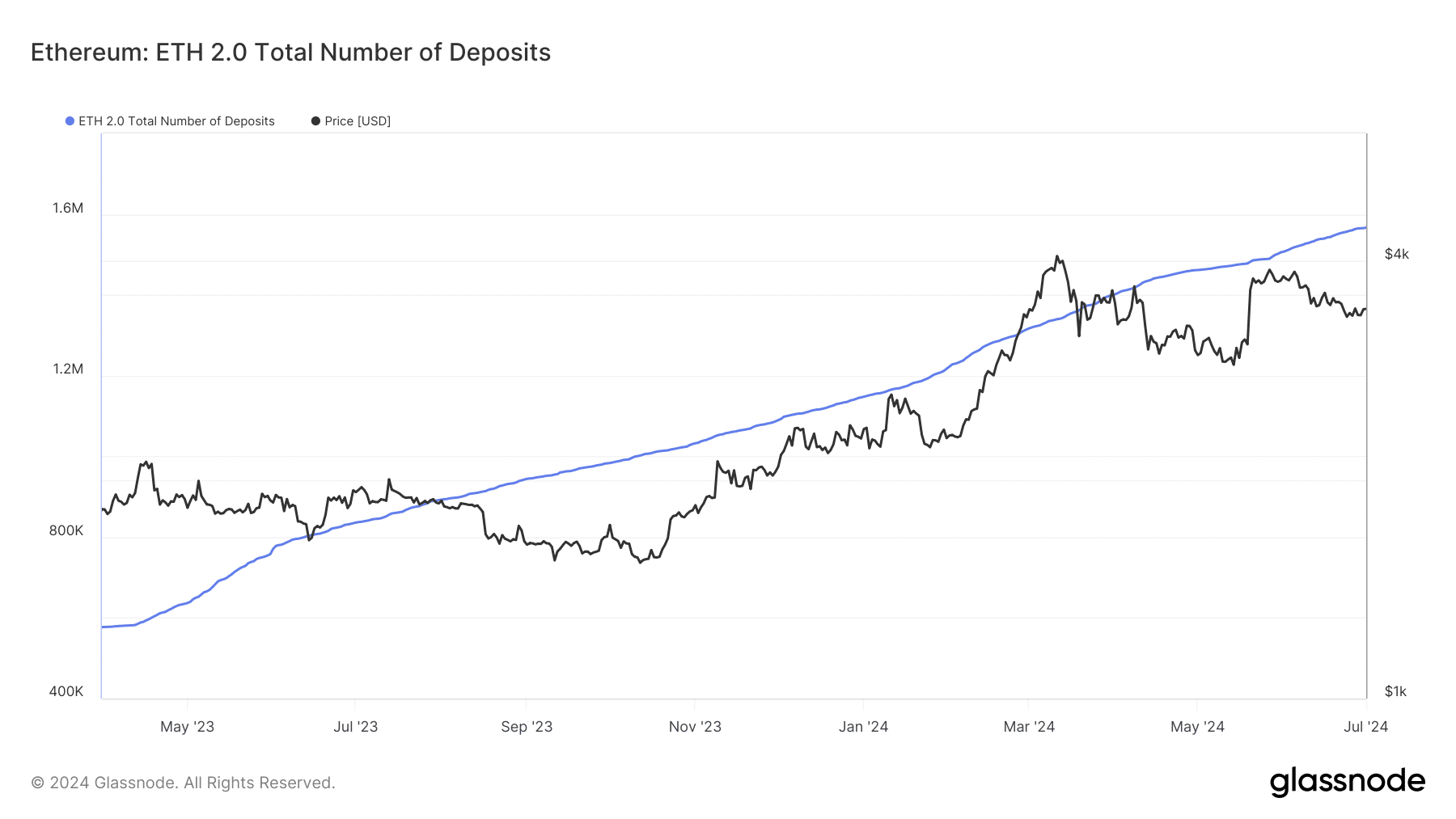

Analysis of Ethereum betting activity offers clear trends in the behavior of its holders, especially with declining balances on exchanges.

According to data from Glassnode, there has been a steady increase in the total number of deposits. This indicates that more holders have decided to stake their ETH.

This activity is significant because it indicates a shift from trading or holding Ethereum on exchanges to securing it in staking contracts. According to the latest data, the number of deposits exceeded 1.5 million.

Source: Glassnode

Data from Dune Analytics further reinforces this trend, revealing that more than 33.2 million ETH have been staked. This significant amount of ETH staked represents almost 28% of the total ETH supply.

Taken together, the increased staking activity and the corresponding drop in exchange-held ETH underscore a strategic shift among holders toward long-term investments.

ETH finding resistance

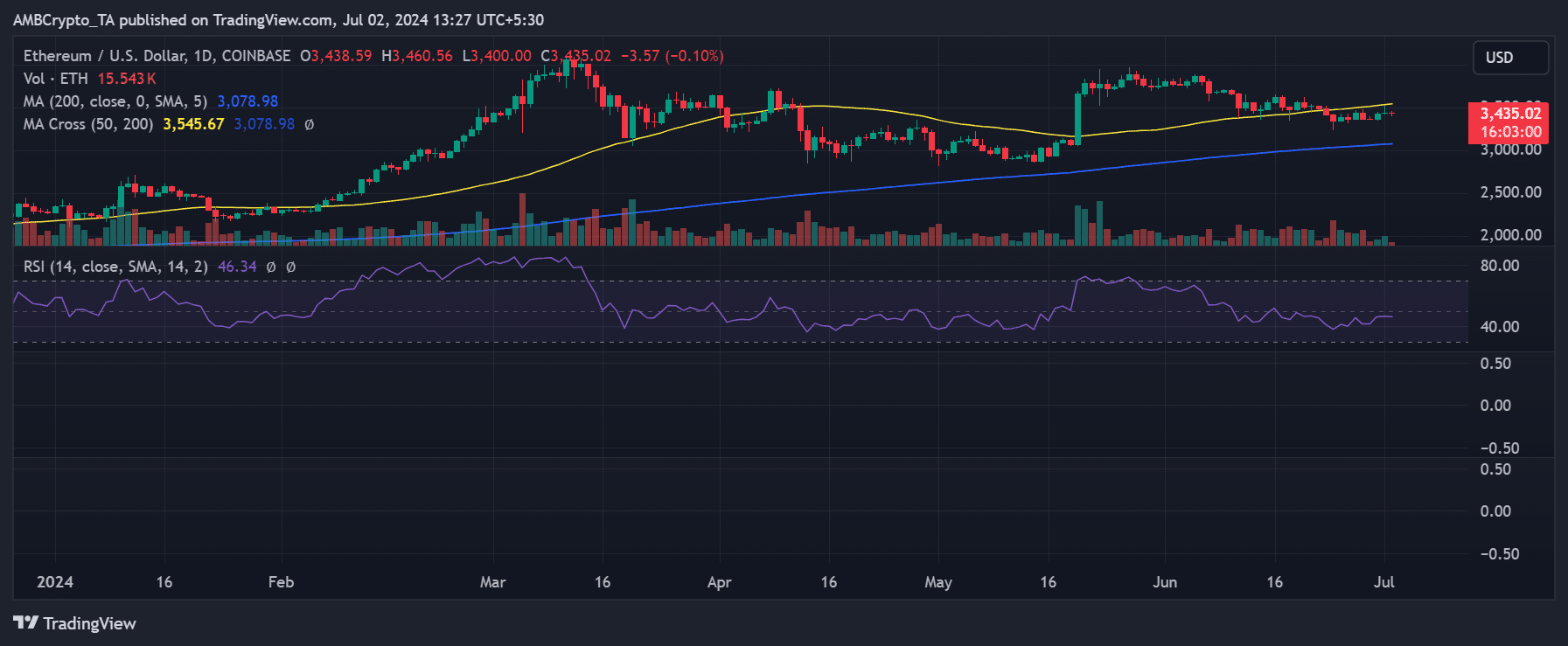

AMBCrypto’s analysis of Ethereum on the daily time frame chart has indicated a shift in market dynamics, with the price recently falling below its short-term moving average (yellow line).

This moving average, which used to act as a support, now acts as a resistance level due to the recent price decline.

This reversal from support to resistance is a common technical pattern that indicates a change in market sentiment where a price level that once supported buying interest now represents a barrier to upside moves.

Source: TradingView

Read Ethereum [ETH] Price Prediction 2024-25

At the time of writing, Ethereum was trading at around $3,430, down slightly by less than 1%.

The immediate resistance defined by the short-term moving average is currently located between $3,500 and $3,600.