Stay informed with free updates

Simply log in to Chinese Trade and Finance myFT Digest – delivered straight to your inbox.

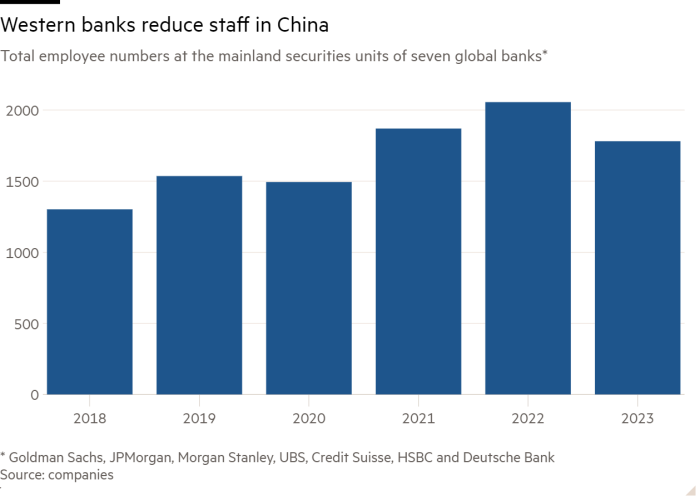

Western financial institutions in China have cut their investment banking workforce by the most in years after a market slowdown hit profits and halted years of expansion in the country.

The 2023 cuts came as five out of seven Chinese securities units, which are part of Wall Street and European banks, either posted a loss or posted declining profits, according to recently published annual reports. These seven units employed 1,781 people last year, which is 13 percent less than in 2022.

China’s capital market activity has slowed amid a weaker economy dominated by a prolonged slowdown in real estate and the impact of rising geopolitical tensions between Washington and Beijing.

“Western investment banks are caught in a vicious circle,” said Han Lin, director of the China branch of consultancy The Asia Group. “Weak deal flow means less investment in ground capacity, which limits further deal flow.”

Some banks are “running out of patience as opportunities in India, Southeast Asia and the US look more promising,” he said.

International financial groups have been able to take full control of their mainland securities houses since a wave of regulatory changes in 2020. The units represent a small part of the banks’ global profits, which declined to comment.

Banks to cut more than 60,000 jobs globally in 2023 as falling deals and IPOs cause fees to plummet. The decline in China contrasts with earlier hopes that their business in the country would continue to grow even as it slowed elsewhere.

Jamie Dimon, JPMorgan’s chief executive, told a conference in May that part of its investment banking business in China had “fallen off a cliff”.

The number of employees has grown almost continuously since 2018. Even in 2020, when Covid-19 restrictions made recruitment difficult, the number of employees at the units fell by less than 3 percent.

At the Credit Suisse unit that UBS took over after buying the bank last year, headcount fell 46 percent to 126. UBS agreed this month to sell the unit to a state-backed fund. Staff numbers at UBS’s own onshore unit were held at 383, the only one not to cut staff last year.

Morgan Stanley’s China unit posted a loss for the first time since 2019, while at JPMorgan’s business in the country, profits fell 55 percent to Rmb119 million ($16 million). The Morgan Stanley unit said in its annual report that the environment was “challenging”.

The number of employees fell much less at JPMorgan and Deutsche Bank than at rival Chinese units. Deutsche Bank only owns 33 percent of Zhong De Securities, its onshore joint venture.

Goldman Sachs China, which was spun off from the joint venture last year, recovered from a loss-making year in 2022, but its profit of Rmb193 million was lower than in any other year since 2018.

The number of employees at the China securities unit fell from 500 to 370 as the bank cut jobs worldwide. Some staff were moved to other units at the bank and some remained with its former joint venture partner Beijing Gao Hua Securities, the spokesman said. Goldman Sachs previously outlined a plan to double its workforce in China to 600, the Financial Times reported in 2021.

Dealogic sales data from May showed just $8.3 billion of initial public offerings in China, the lowest total for the same period since 2009. Overseas listings must be approved by Chinese regulators under rules introduced last year. Cross-border activity, including mergers and acquisitions, also remained weak.

The performance of investment banking units may not capture the full picture of banking business in China. Some banks have additional units in the country, and many use relationships established through mainland business to generate income that is booked in Hong Kong or elsewhere.

The 2023 figures are in stark contrast to 2021, a record year for investment banks globally, when six out of seven made a profit in their onshore operations.

HSBC’s onshore unit bucked the trend and turned a profit for the first time. “This impetus came from HSBC’s growing client base and expanded product options,” the spokesman said.