Unlock Editor’s Digest for free

FT editor Roula Khalaf picks her favorite stories in this week’s newsletter.

Political upheaval in Paris is forcing a reassessment of the financial vulnerability of the eurozone’s second-largest economy, investors have warned.

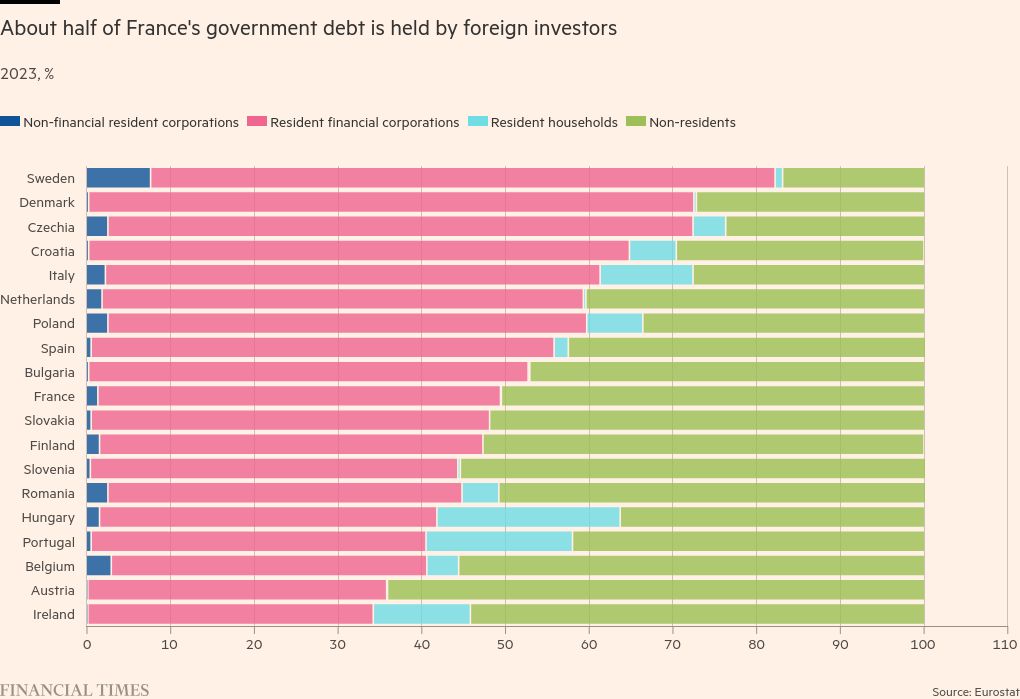

Many worry that the prospect of dysfunctional policies, faltering growth and an ever-increasing debt burden could erode France’s long-term attractiveness to foreign investors, who hold roughly half of the country’s national debt.

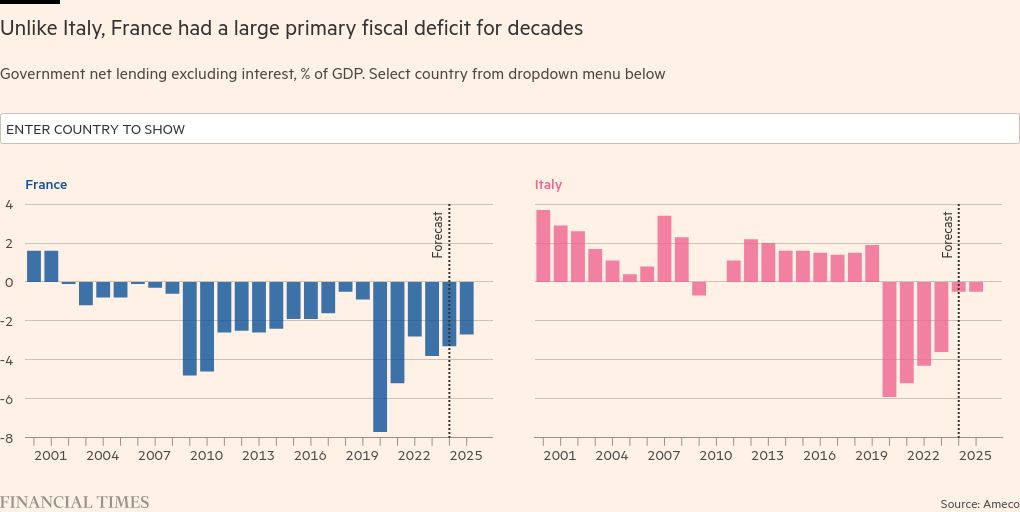

Traders doubt it will lead to an upheaval similar to the 2022 crisis in the sow market triggered by former British Prime Minister Liz Truss, as the country’s finance minister has warned. But they fear the French bond market could increasingly resemble Italy’s over time, facing persistently higher borrowing costs and becoming a potential flashpoint when bloc-wide crises strike.

“This is causing some consternation among those investors who may have become complacent about French political and fiscal sustainability risks,” said Mark Dowding of RBC BlueBay Asset Management.

If France enacts bad policies over time, “there’s no reason why it can’t end up in a situation similar to Italy today,” he added.

Borrowing costs have already risen in response to the prospect of the far-right Rassemblement National forming the next government, or the increasingly likely prospect of an unstable hung parliament.

Since President Emmanuel Macron announced snap elections early last month, the spread between French and German 10-year bond yields – a measure of risk – has rocketed from 0.48 percentage point to 0.85 percentage point last week, although since dropped to 0.71. percentage points.

According to Barclays’ Rohan Khanna, the yield on French bonds is the highest compared to the combination of yields on ultra-safe German bonds and traditionally riskier Spanish bonds since the start of the 2000s.

Sunday’s first-round victory by RN Marine Le Pen and her allies and the NFP’s second-place finish fueled fears of more political turmoil ahead of the July 7 runoff. Market fears of political gridlock or a potential shift away from pro-market policies have also intensified, which could damage confidence after the election.

Pollsters believe the most likely results after the second round are a hung parliament or an outright majority for the RN. In the event of a strong finish for the RN, President Emmanuel Macron could face an awkward power-sharing arrangement with the far-right known as “coexistence”.

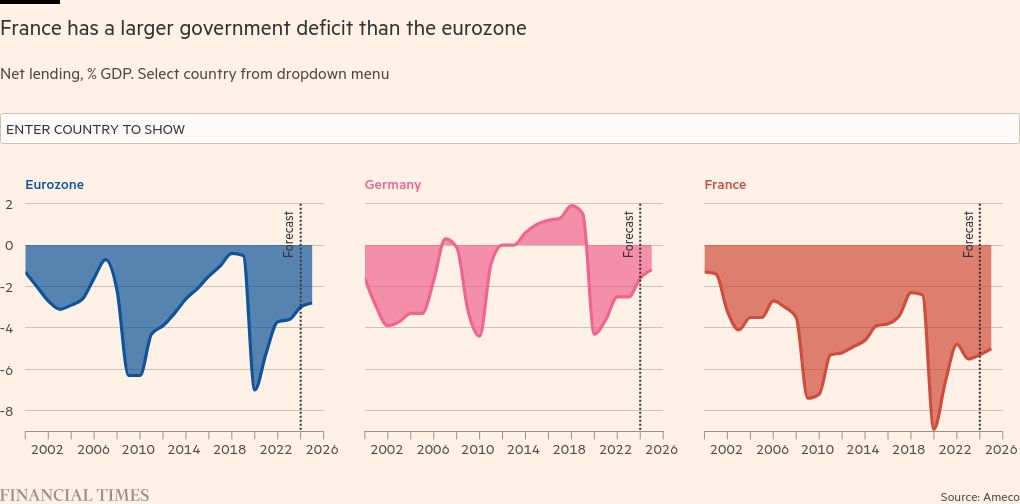

The uncertainty comes at a time of fiscal tightening in France. S&P Global downgraded its credit rating in May following a downgrade by Fitch. France is expected to run a budget deficit of 5 percent of GDP next year, down slightly from this year’s 5.3 percent, according to the European Commission, but still one of the highest in the EU and higher than Italy.

France is also dependent on overseas investors – including a large cohort of Japanese institutions seeking safe European sovereigns – to buy its bonds. While that makes it a more diversified investor base than some others, it also makes it more vulnerable to a sharp shift in sentiment, analysts say.

Half of France’s government debt is held by non-residents, compared with around 27 percent in Italy and 43 percent in Spain, according to Eurostat data. While Italian households hold 11 percent of the country’s debt, in France it is 0.1 percent.

Markets are nervous about what Japanese investors will do specifically, as shifts in Japanese monetary policy could reduce the profitability of their deals, said Tomasz Wieladek, an economist at T Rowe Price.

On June 19, the commission proposed to open an over-indebtedness procedure for France as Brussels warned of “high risks” arising from its medium-term debt sustainability analysis. The ratio of public debt to the public sector is on track to rise steadily to around 139 percent of GDP in 2034, it said.

France has so far avoided the crises experienced by Italy and the United Kingdom in recent years. In 2018, the spending plans of the Italian coalition of the Five Star Movement and the League party pushed the gap between Italian and German 10-year bond yields to more than 300 basis points. That was the highest level since Prime Minister Silvio Berlusconi, reflecting investors’ assessment of Italy’s political risk.

JPMorgan analysis suggests France could face a sudden jump in borrowing costs. A “shock” in which borrowing costs jump by 1.5 percentage points over two years would lift the debt-to-GDP ratio to just over 115 percent, marginally above its central projections, the bank said in a recent report.

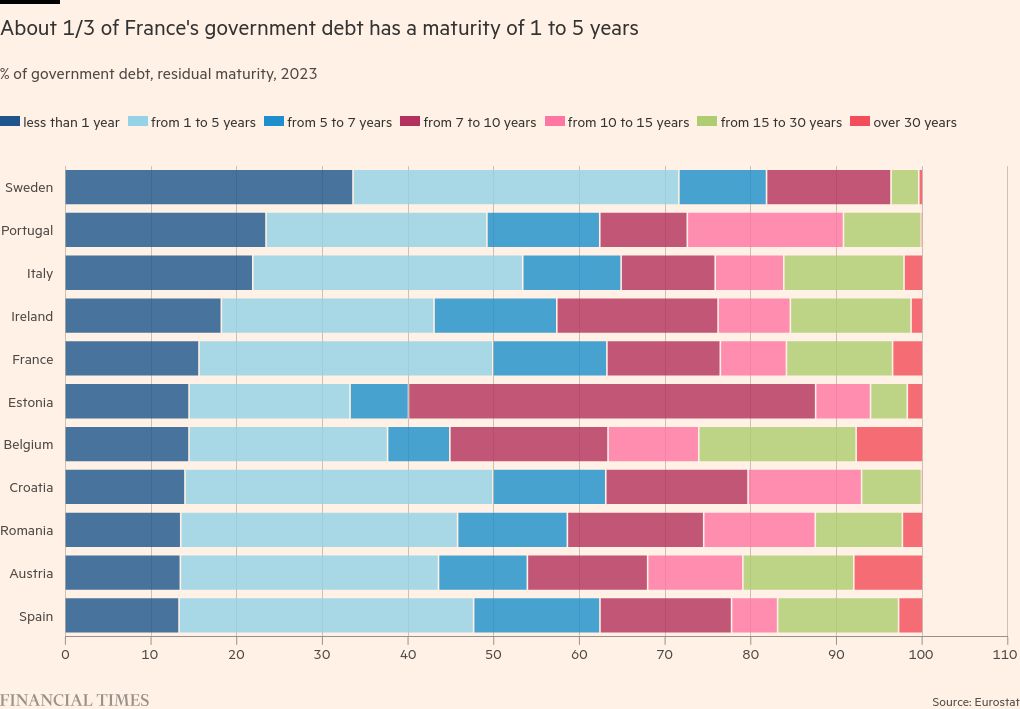

That’s partly because French debt stocks are relatively old, with an average maturity of 8.5 years, according to S&P. That means only 8-10 percent of its debt comes up for refinancing each year, according to Barclays, dampening the impact of rising borrowing costs.

“The Liz Truss scenario seems unlikely at the moment – I don’t see a sudden disruption to French bond markets,” said Holger Schmieding, chief European economist at Berenberg, who predicts Le Pen’s party will pursue a relatively dovish fiscal policy. .

However, the country’s long-term fundamentals are not good, Schmieding said, especially if France deviates from Macron’s pro-growth policies. A confrontational approach with Brussels is seen as increasing the risk of wider turbulence in the EU. Some investors also worry that a broader selloff in French debt would trigger contagion in other European countries, forcing the European Central Bank to intervene.

France’s public debt rose above 115 percent of GDP in 2020, almost double what it was in 2007. Last year, the debt-to-GDP ratio was the third highest in the EU, after Greece and Italy, at 111 percent of GDP.

In this context, Schmieding pointed to the potential for higher borrowing costs or further downgrades, especially if growth falters.

“It’s a serious fiscal problem in the long term,” Schmieding said.