Wednesday 03/07/2024 12:03

A number of analysts have suggested that the economic legacy for the next government will not be as bad as many fear.

Although the UK slipped into a shallow recession at the end of last year, the economy beat expectations and grew by 0.7 percent in the first quarter. This made it the fastest growing economy in the G7.

In a note published today, Simon French, head of research at Panmure Liberum, argued that the economy is “not as bad as is often thought”, pointing in particular to strong household balance sheets and relatively low government debt.

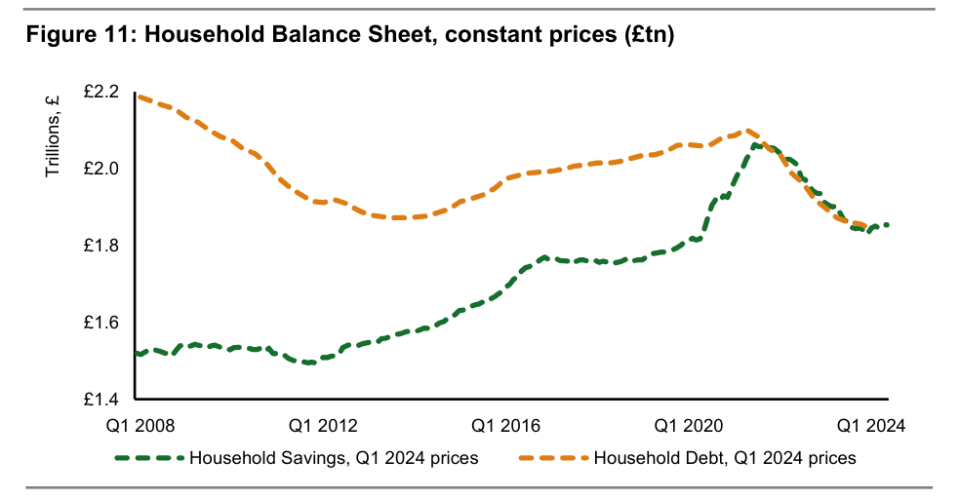

“One area that has received less comment than we believe is warranted has been the fifteen years of deleveraging undertaken by the UK household sector,” French wrote.

In 2008, UK households had a total debt of £700 billion. Since then, households have improved their financial situation to the point where debt and cash balances are now equal, at around £1.85 trillion each.

This should mean that households will be more confident to go out and spend or take on a little more debt, boosting domestic consumption.

While national debt is at its highest level since the 1960s and approaching 100 percent of GDP, it is actually the second lowest in the G7, behind Germany.

“Whatever public sector debt the UK government faces in the coming years, it will not be alone – internationally – facing these challenges,” French wrote.

Sanjay Raja, chief UK economist at Deutsche Bank, was also relatively upbeat about the state of the economy. “The next government will inherit a stronger economy than most expected in 2024,” he wrote in a recent note.

The main driver of growth over the year is likely to be household disposable income, supported by strong household balance sheets. “Household balance sheets remain healthy, with deposits exceeding loans this year for the first time in history,” argued Raja.

It also expects businesses to “catch up” with investment levels that have remained depressed since the Brexit vote.

Looking ahead, indicators of consumer and business confidence have increased ahead of the general election, which should provide further support for growth in the coming years. The bank expects growth to accelerate to around 1.5 percent in 2025 and 2026.

Capital Economics expects that the next government could also benefit from a looser monetary policy. The consultancy expects inflation to remain low for the foreseeable future, allowing the Bank of England to cut interest rates and cut yields.

“This would mean that the next government would start with the economic wind in their sails,” they argued.

The French also noted that debt servicing costs have already eased from around four percent of GDP in the last quarter of 2022 to 2.8 percent in the first quarter of this year.

Despite the improving economic outlook, economists agreed that major issues still urgently need to be addressed.

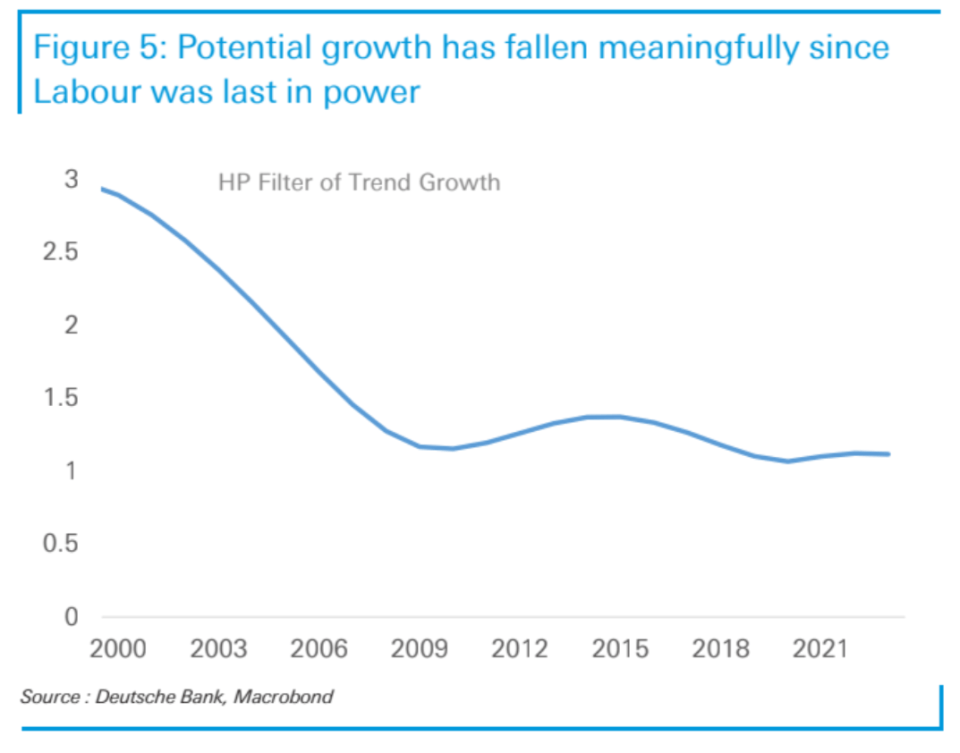

Raja pointed out that potential growth has fallen dramatically over the past 20 years, while living standards have barely risen since 2017.

Pantheon Macroeconomics analysts also pointed out that the Office for Budget Responsibility (OBR) was already among the most optimistic forecasters.

This means that stronger growth does not “magically generate” more funds for spending because strong growth already presupposes FIG.

For French, the “great misunderstanding” was whether Labor had the “required backbone” to take on its own interests and deliver meaningful supply-side reform on issues such as planning.