This article is a local version of our Energy Sources newsletter. Premium subscribers can sign up here to receive the newsletter every Tuesday and Thursday. Standard subscribers can upgrade to Premium here or explore all FT newsletters

Good morning and welcome back to The Power Source coming to you from New York.

While the US celebrates independence from Britain, our colleagues across the pond are reporting on the general election, where Labor is expected to win a landslide. The party has put energy at the center of its campaign, pledging to reduce carbon emissions from electricity generation to net zero by 2030 and create a state-owned energy company.

In today’s Energy Source, we sit down with the CEO of FirstEnergy. The U.S. investor-owned energy company sees no path to phasing out coal because of growing demand for more continuous power driven by data centers for artificial intelligence and new manufacturing.

Our second point delves into a new report from the Clean Air Task Force that questions green hydrogen’s ability to decarbonize the energy sector. Data Drill looks at how the global LNG market is set for a glut.

Thank you for reading,

Amanda

‘We’re just being honest’: FirstEnergy CEO on coal shutdown delays

Rapidly growing artificial intelligence-driven energy demand and the deteriorating state of the US grid are narrowing the path to decarbonisation, warns FirstEnergy, one of the largest US investor-owned companies.

“When we looked at emissions reductions, it was based on the fact that our coal plants would run less at the end of the decade,” Brian Tierney, FirstEnergy’s chief executive, told Energy Source. “We don’t see a way to that now.”

The Ohio-based utility withdrew its 2030 goal to phase out coal earlier this year and kept its two West Virginia plants operating until 2035 and 2040, citing rising energy demand, reduced generation capacity and state policy.

“The things that collide are people’s increasing demand and their desire for reliability that is affordable for most customers and then what is sustainable. It is easier for two of these three things to match each other. It’s harder to solve all three at once,” Tierney said.

“That’s why we had to withdraw our interim target. Some people think we were bad people for doing that. I think . . . we’re just being honest,” he added.

The comments from FirstEnergy come amid a series of delays at coal plants as the scramble to meet growing demand for power from AI data centers puts decarbonization plans on hold. On Monday, Google announced that its emissions jumped nearly 50 percent over the past five years due to data center expansion, casting doubt on its 2030 net-zero goal.

FirstEnergy serves five Mid-Atlantic states and is part of the PJM Interconnection, an electricity market that includes Northern Virginia, the world’s largest data center hub. Demand for electricity in the PJM region is one of the fastest growing in the nation, with the operator this year more than tripling its growth forecast for the next decade.

Natural gas accounted for 43 percent of U.S. electricity generation last year, while wind and solar contributed 14 percent, according to the Energy Information Administration. Coal generation, which makes up 16 percent of the energy mix, has declined rapidly over the past decade as plants have been decommissioned and gas has become a more competitive option.

The Biden administration has set a goal of creating a carbon-free energy sector by 2035. FirstEnergy’s 2040 exit date conflicts with new U.S. Environmental Protection Agency rules that require coal-fired power plants to be phased out by 2039 or to install expensive carbon capture systems. . The rule has been challenged by several Republican attorneys general, utilities and trade groups, who say the emissions capture technology is premature and will raise prices for consumers.

The report questions the role of clean hydrogen in the energy sector

Clean hydrogen faces “limited prospects” in its ability to decarbonize the grid and could exacerbate the struggle to meet growing energy demand, the Clean Air Task Force warns in a new report shared exclusively with Energy Source.

The environmental non-profit found that burning pure hydrogen in power plants is technically feasible but highly inefficient and costs twice as much as other low-carbon alternatives for continuous energy.

The report’s authors looked at the costs of producing blue hydrogen, made using gas and capturing its emissions, and green hydrogen, which splits water using electricity. CATF estimates that green hydrogen burns three times as much energy as it returns to the grid, depleting the already limited supply of low-carbon sources needed by everyday energy consumers. At the same time, blue hydrogen has a highly variable emission profile.

“[Green hydrogen] it generally increases overall electricity demand and cannibalizes clean electricity that could be used for another application,” said Kasparas Spokas, who co-authored the report with Ghassan Wakim. “People need to be careful about this strategy to decarbonize the energy sector.”

The news comes as the hype around clean hydrogen dies down as projects struggle to secure financing amid faltering demand and uncertain regulations. BloombergNEF, for example, estimates that only 6 percent of U.S. clean hydrogen projects have binding supply contracts secured.

Data drill

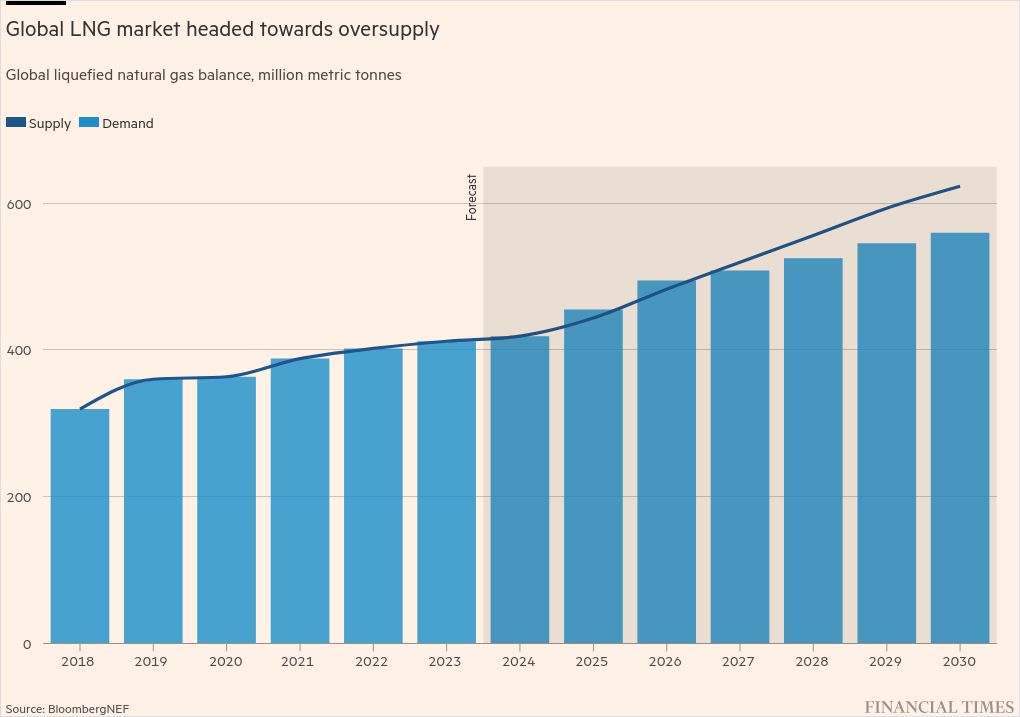

The global market for liquefied natural gas is headed for oversupply, BloombergNEF said in a new outlook published on Tuesday.

The research firm expects global demand for refrigerated fuel to reach 560 million tons by 2030. That is about 11 percent lower than expected supply, according to BNEF, which warned that project delays and further Russian sanctions could tighten the market.

The outlook comes as a wave of new LNG terminals is expected to come online by the end of the decade, with the US and Qatar the main capacity additions. On Monday, a Louisiana district court judge appointed by Donald Trump lifted President Joe Biden’s moratorium on LNG project approvals, putting a permit freeze up in the air.

Job Moves

-

Iberdrola subsidiary ScottishPower appointed Charles Langan as financial director and Nicola Connelly as CEO of its SP Energy Networks division.

-

Curtis Phillippon was appointed CEO of a Canadian medium-sized company Gibson Energy. Philippon joins from Certarus.

-

Pharos energy named Katherine Roe as CEO and Mohamed Sayed as chief operating officer. Roe joins from Wentworth Resources, where she served as CEO and previously as CFO. Sayed previously served as Middle East Group Technical and General Manager at Pharos Energy.

-

Jennifer Knealethe company’s financial director Targa resourceswas named president of finance and administration for the Texas Central Company. William Byers replaces Kneale as CFO and joins from Manchester Energy.

Power Points

The Power Source was written and edited by Jamie Smyth, Myles McCormick, Amanda Chu, Tom Wilson and Malcolm Moore, with support from the FT’s global team of reporters. Contact us at energy.source@ft.com and follow us on X at @FTEenergy. Follow past issues of the newsletter here.

Recommended newsletters for you

Moral money — Our must-see newsletter on socially responsible business, sustainable finance and more. Register here

Climate Graphics: Explained — Understanding the most important climate data of the week. Register here