European central bankers warned that risks were piling up for the region’s economy, including trade tensions and high government debt, as they met in Portugal this week.

Falling inflation and reviving growth in the eurozone were overshadowed by the victory of far-right Eurosceptic Marine Le Pen in the first round of French parliamentary elections at the European Central Bank’s annual conference at a luxury hotel in Sintra, near Lisbon.

Members of the ECB’s Governing Council told the Financial Times it was too early to speculate whether they might be forced to intervene if France suffered a “Liz Truss moment” – referring to the debt crisis triggered by the former UK prime minister’s unfunded tax cuts in 2022 .

But most saw the French election as a sign of a broader shift in a more populist, protectionist and turbulent direction that is likely to hit Europe harder than most parts of the world.

Pierre Wunsch, the governor of Belgium’s central bank, has warned that the US and China are stealing a march on Europe with subsidies and tariffs.

“We are moving into a world that is more disruptive and also much more transactional, which is problematic for Europe,” he warned. “We don’t have a clear story to offer people.”

The US sharply raised tariffs on a range of imports from China, including electric vehicles and semiconductors, while the EU followed to a lesser extent with higher duties on Chinese imports of electric cars, due to take effect on Thursday.

Beijing has threatened retaliation for the moves. Trade tensions could intensify if Republican nominee Donald Trump wins the November election after promising to impose additional 10 percent tariffs on all imports from Europe. More than half of the eurozone’s gross domestic product is generated by exports, making it particularly vulnerable to a trade war.

Jan Hatzius, chief economist at Goldman Sachs, said in a presentation in Sintra that Trump’s pledge to raise tariffs on EU imports by 10 percent would hit the eurozone economy disproportionately hard – he predicted it would knock 1 percent off the bloc’s GDP. while cutting only 0.1 percent of US GDP.

Such a shock would be enough to more than wipe out the 0.9 percent growth the ECB expects the euro zone to produce this year.

“Europe is a legal construct that moves slowly on a level playing field,” Wunsch said. “In a transactional world where others use tariffs or subsidies and don’t share our climate ambitions, it’s challenging for us now.”

Gabriel Makhlouf, Governor of the Central Bank of Ireland, said: “I am particularly concerned about the geopolitical scene and economic fragmentation. All indications are that it will go even further.”

“I expect some supply shock,” he added. “It will have an impact on the price and accelerate steps towards greater self-sufficiency, so we will not rely so much on other countries. Small countries will be the biggest losers.”

Bostjan Vasle, governor of Slovenia’s central bank, said the potential for governments not to reduce budget deficits as required by the EU’s overhauled debt rules was another risk policymakers had to contend with. “Fiscal policy may also increase risks if current plans for fiscal consolidation do not materialize.”

Declining to comment specifically on the French election, Vasle said: “It is very important to have stability in the eurozone, politically, socially and financially. We have tools that would allow us to intervene to defend financial stability in the event of unwarranted and disorderly market dynamics. But we’re not at that stage.”

Investors speculated that the French election could trigger a bond market sell-off that would force the ECB to intervene with its new but untested debt-buying scheme, a transmission protection tool. However, Wunsch said it was “too early to talk about TPI”.

Several central bankers have predicted that the risk of a market crash will be enough to dissuade the next French government from spending. “All governments, in my experience, recognize that there is a difference between the reality of governing and the reality of campaigning,” Makhlouf said. “You only have to look at Liz Truss to realize that.

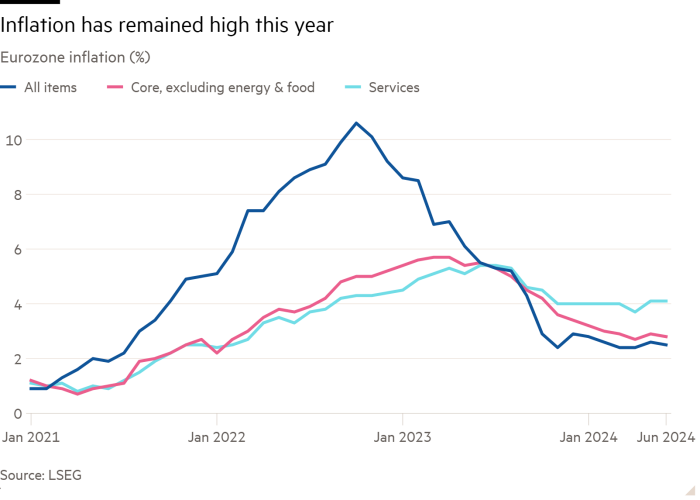

Ratemakers broadly agreed that inflation was moving in the right direction – bolstered by data released on Tuesday that showed eurozone inflation returned to 2.5 percent in the year to June, after briefly rising to 2.6 percent. cent in May.

But it is almost certain to leave interest rates unchanged at its meeting in two weeks – last month they cut them for the first time in nearly five years. ECB President Christine Lagarde said they could afford to “take time to gather new information” as unemployment remained at record lows in the eurozone.

Vasle said a “surprisingly strong” labor market is pushing up wage growth and keeping inflation above 4 percent in the labor-intensive services sector. “The anecdotal evidence is that it looks like a very good tourist season in many countries, including mine, because people are ready to spend on services and this will not contribute to disinflation.”

Portugal’s central bank governor Mário Centeno expressed his frustration with the recent surge in support for populist, Eurosceptic political parties opposed to closer European integration shortly before hosting a closing dinner on Wednesday night.

He said it was a “paradox” given how governments and the ECB had taken unprecedented measures to protect jobs, stop companies collapsing and avoid a European financial crisis after the pandemic.

“It’s so hard to give people a positive message when they’re constantly being told about the huge challenges ahead and the sacrifices they have to make – we should focus on the successes,” Centeno said. “It is not that bad.”