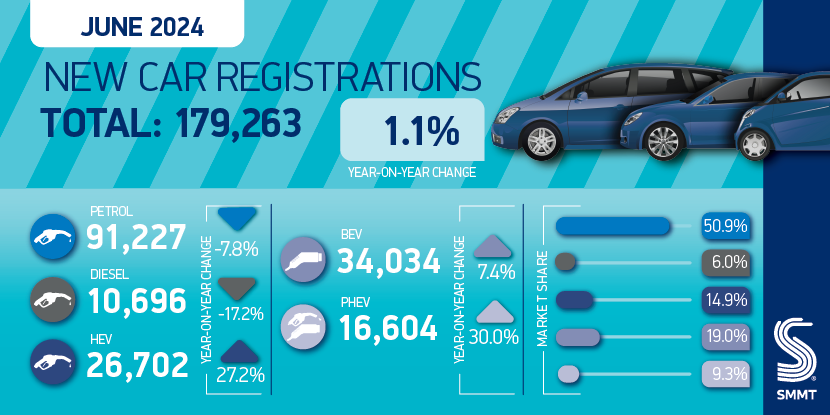

- The new car market rose 1.1% to 179,263 units in June – and for the first time since 2019, it passed the million motor mark in the first half of the year.

- Battery EVs record their highest monthly market share since December 2023, but year-on-year growth remains steady at 16.6%.

- The industry is calling on the next government to support consumers as fewer than one in five new battery electric cars go to private buyers.

SEE REGISTRATION OF CARS BY BRAND

DOWNLOAD PRESS RELEASE AND DATA SHEET

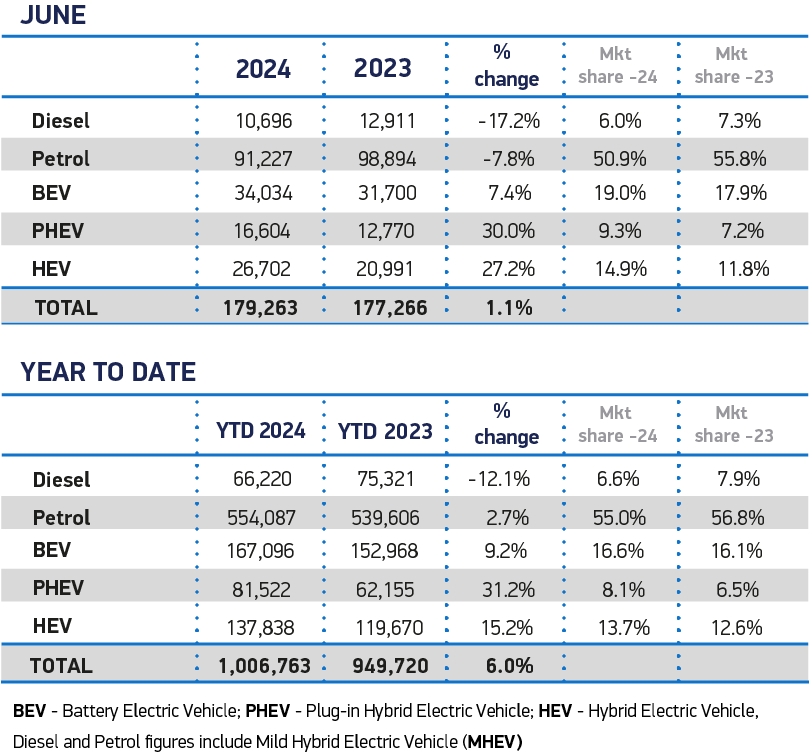

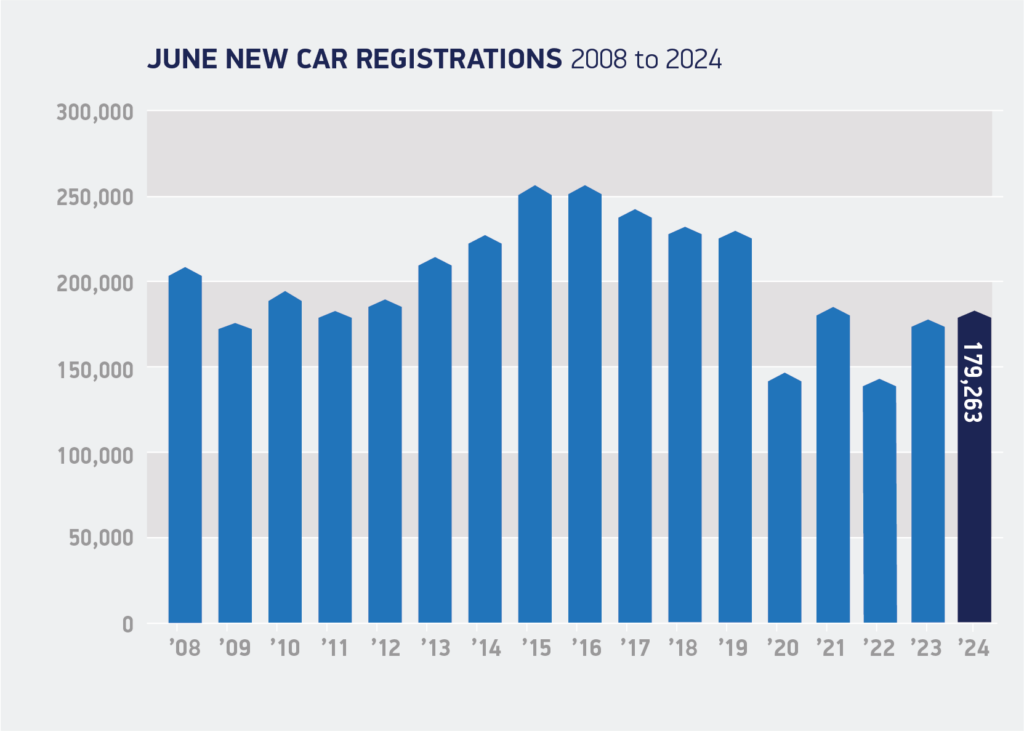

Britain’s new car market hit the half-yearly million motor mark for the first time in five years after new car registrations rose a modest 1.1% to 179,263 units in June, according to new figures released by the Society of Motor Manufacturers and Traders (SMMT). As a result, 1,006,763 new cars have been registered so far in 2024, up 6.0% from the previous year, but still down -20.7% from 2019.1

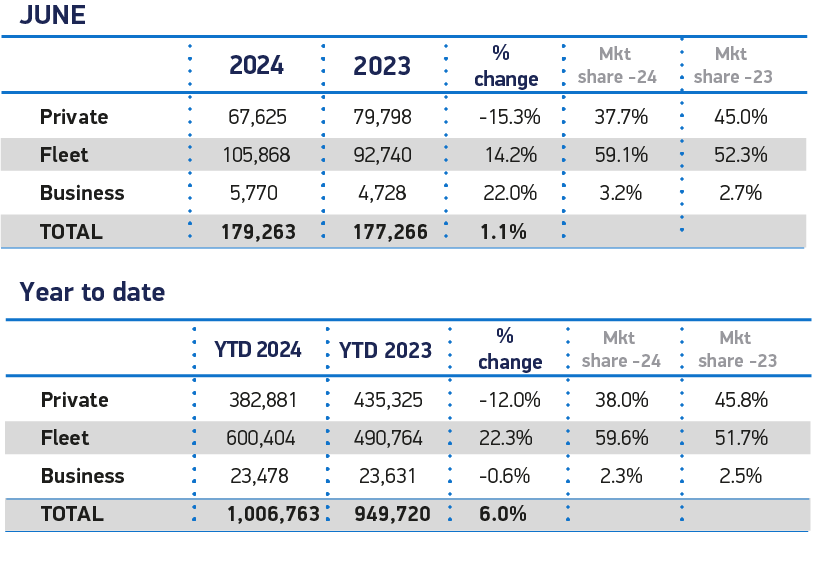

Market growth in June was mainly driven by the fleet sector, where demand increased by 14.2%, while private retail demand fell for the ninth month in a row, by -15.3%. Retailers accounted for less than four in 10 new cars registered (37.7%).

Electrified vehicle uptake continued to grow strongly in June, with plug-in hybrid (PHEV) volumes up 30.0% to reach a 9.3% market share, while hybrid electric vehicles (HEV) grew 27.2% to reach 14.9% of the market. Both powertrains also outpaced the growth of battery electric vehicles (BEVs), which grew by 7.4% but achieved the highest monthly share this year, accounting for 19.0% of all new vehicle registrations.

The UK’s transition to zero emissions – and the ability of manufacturers to meet the requirements of the Vehicle Emissions Trading Scheme – currently depends on the fleet sector as private consumer interest continues to wane. Private BEV take-up is down -10.8% year-on-year, with less than one in five new BEVs going to private buyers. Overall, BEVs now account for 16.6% of the new car market so far this year, slightly above the 16.1% achieved in the same period last year, with take-up lagging behind government-mandated levels.

As the UK heads to the polls today, the car industry is calling on the next government to provide more support for consumers on the journey to zero-emission mobility. Restoring fiscal incentives for private consumers by halving VAT on BEVs for three years would revive the market and put an additional 300,000 private BEVs on the road over the next three years – instead of petrol or diesel cars, beyond current outlooks.2 This would help ensure that half of all cars in use are zero-emission by 2035, reducing CO2 emissions from road transport by 175 million tonnes by then.

Vehicle excise duty schedules are also set to be revised to classify zero-emission vehicles (ZEVs) as essential rather than “luxury” vehicles, by changing the “expensive car” supplement due to apply from next April. In addition, the use of public charging points could be made fairer by reducing VAT from 20% to 5% in line with domestic charging – a move that would encourage ZEV take-up and send the right message to consumers.

Mike Hawes, CEO of SMMT, said:

At mid-year, the new car market is in its best shape since 2021 – but that belies the bigger challenge ahead. The private consumer market continues to shrink in a difficult economic environment, but with the right policies, the next government can restart the market and ensure a faster and fairer transition to zero emissions. All parties agree on the need to reduce carbon, and replacing older fossil fuel-based technologies with new electrified powertrains is a crucial step to achieving this goal.

Notes for editors

From January 1 to June 2019, new car registrations: 1,269,245

2 SMMT: Back Automotive and reap £50bn growth