According to Diageo’s January results, a rare bright spot amid sluggish sales of its main spirits brands was the surge in popularity of Guinness, the famous Irish stout that became Britain’s beer of choice last year.

CEO Debra Crew identified social media “Guinnfluencers” as key to the brand’s success and told reporters that consumption among women had grown by 24 percent, with growth driven primarily by 25-45-year-old consumers in the UK and Ireland.

Guinness, long associated with Irish pubs, rugby and older drinkers, has found new consumers thanks to shifts in its marketing strategy. The pubs of London’s Soho are now teeming with cool young stout drinkers, echoing America’s hipster appropriation of blue-collar beers like Pabst Blue Ribbon and Michelob.

Meme accounts including @real_housewives_of_clapton and @shitlondonguinness helped create Guinness’s new viral status, which peaked two weeks ago when designer JW Anderson showed a collection of Guinness-branded sweaters on the catwalk at Milan Fashion Week.

Guinness UK marketing director Anna MacDonald said she could not be sure how much of the boom was due to the viral effect and how much was the result of her own marketing strategy. “I think it’s a little bit of both. . . It’s a virtuous circle,” MacDonald said. “But you have to be the type of brand that can thrive in that space and embrace it.”

Even @shitlondonguinness recording how badly Guinness pints are going down in London pubs is a sign of how much people care about the brand, MacDonald said, pointing out that the account has spawned copycats across the country, where demand has also grown.

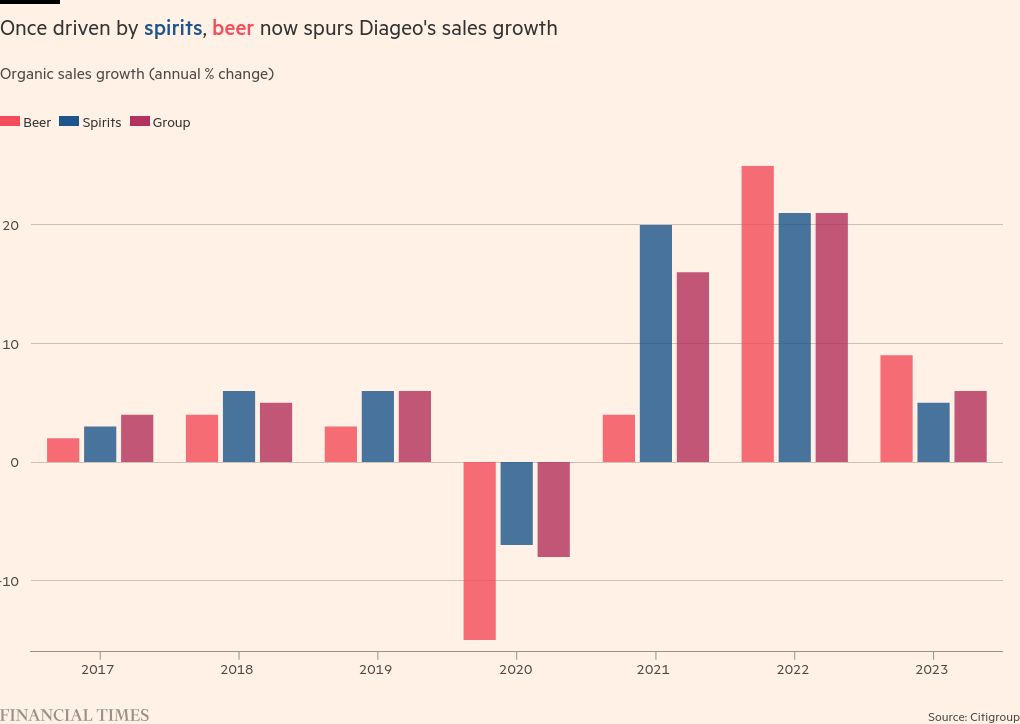

Diageo’s beer portfolio has long lagged behind its spirits, which include brands such as Casamigos tequila and Smirnoff vodka, and the company has slowly sold off its beer assets, most recently Guinness Nigeria – a super-strong strain of stout brewed in the West African nation.

However, since the post-Covid slump in spirits sales, this trend has reversed, driven almost entirely by Guinness growth.

Beer sales rose 7 percent in Europe and 3 percent in the US in the six months to the end of December, while spirits fell 4 percent in both regions.

Guinness sales in Europe rose 24 percent, driven mainly by drinkers in the UK and Ireland, while sales of non-alcoholic Guinness 0.0 more than doubled.

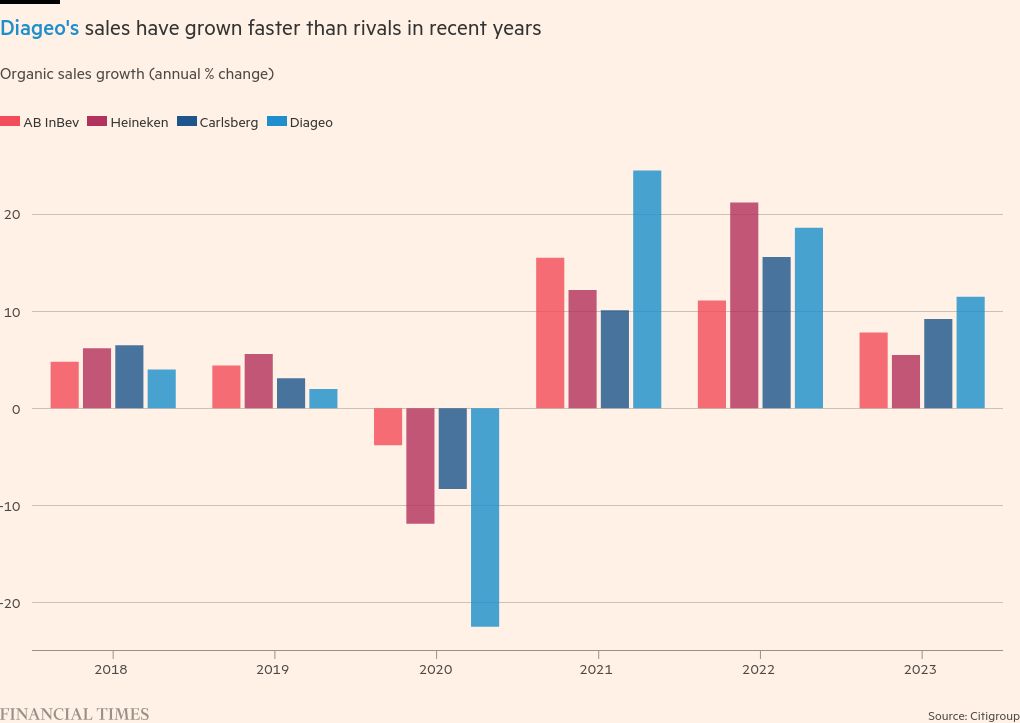

“Diageo’s beer business is becoming a bigger contributor to the group’s growth,” said Citigroup analyst Simon Hales. “After many years of underperforming their larger brewing peers, Diageo’s beer portfolio is now outgrowing them, a fact that we believe is not fairly reflected in the group’s share price.”

Ahead of this month’s full-year results, analysts will be watching for a recovery in spirits sales after a period of destocking as retailers sold through stocks built up during the Covid boom.

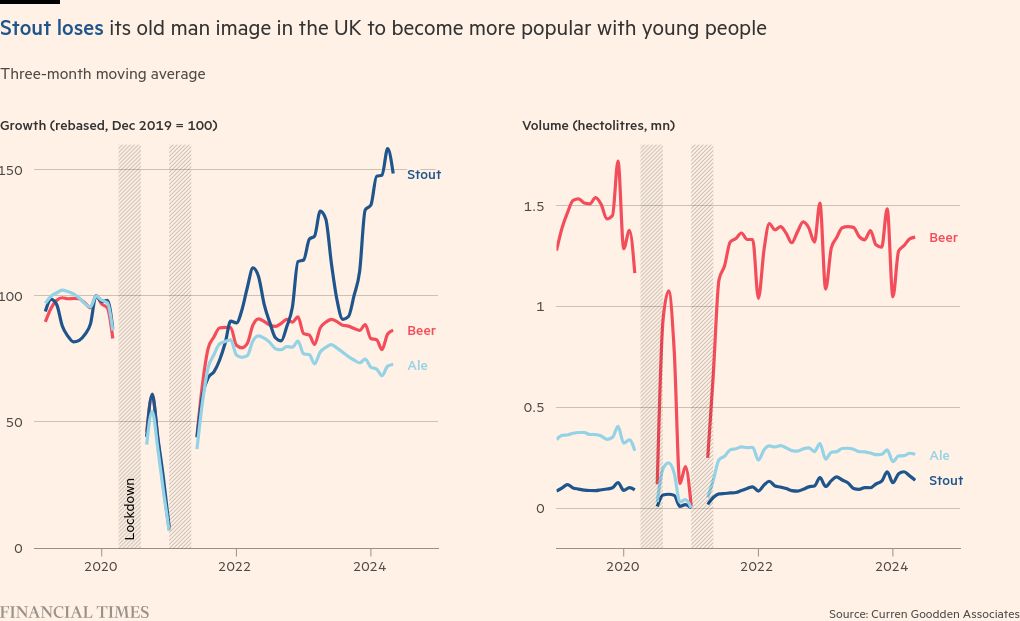

According to food and beverage consultancy Curren Goodden Associates, stout volumes in pubs rose 14 per cent year-on-year in the latest quarter, while lager and lager fell 8 and 9 per cent, while overall beer volumes fell 4 per cent.

“We’re definitely seeing a new customer,” said Mark Brooke, managing director of Admiral Taverns Proper Pubs. “Guinness was able to appeal to a more female audience” while maintaining a relationship with the traditional consumer.

Guinness was “less fizzy” than lager and had fewer calories, making it more popular with women, Brooke reasoned.

MacDonald said Diageo had done nothing specifically to target women. Instead, he credits a simple shift in how the team targeted its media spend to reach all consumers, not just the older man who was once its core.

“One thing that is true about women, which is true about all people, but especially about women, is that humanity is important,” she said. “Part of the challenge was dialing in the humanity that has always been at the heart of our best marketing at Guinness.”

“I like Guinness because lager makes you feel bulkier at the end,” said Maria Aguinaga, 35, enjoying an after-work pint with colleagues outside the Hand & Shears pub near London’s Smithfield Market.

For women, “there’s a rebelliousness to drinking pints,” said Ali Dunworth, the book’s author Overview of Irish Pintsnoting that pubs were traditionally male spaces and women were once only served pints.

Guinness remains very popular in its home market, where the stout has been brewed since the 1770s. But Dunworth said some customers had been put off by pub price hikes since the start of last year and turned to rival stouts.

Her own local pub in Maynooth taped Murphy’s, a stout rarely seen in Irish pubs outside the south of the country. “Price-sensitive customers go to Murphy’s,” she said.

Consumers squeezed by the cost of living crisis have cut spending on more expensive spirits after turning to home-brewed cocktails during the Covid-19 lockdown. However, beer sales have not fallen as drastically and volumes are starting to return to normal, helped by warmer weather and sporting events such as the Euro 2024 football championship.

MacDonald said tastes have shifted in favor of classic and established brands after a period of “anti-brand” consumer sentiment, exemplified by the rise of craft beers. “They were looking for independent, anti-establishment brands,” she said. “But now it’s a closed circle with Gen Z.

Despite the new consumers, the company continues to benefit from Guinness’ association with rugby, with Debra Crew assuring the media during a business update in January that “rugby boys still love it”.

In the UK, 38 percent of rugby fans say Guinness is their drink of choice, a double since 2014, according to Fanzo, a pub discovery app for sports fans. The brand is the main sponsor of the Six Nations rugby tournament.

“As the Six Nations and rugby audiences have gotten younger, Guinness has been able to ride the wave of penetration among younger audiences,” said Dominic Collingwood, co-founder of Fanzo.

Diageo hopes to repeat this success with football. Guinness last month signed a four-year sponsorship deal with the Premier League, starting in the 2024-25 season.

“A regular Guinness drinker won’t drink anything else,” said James Baer, managing director of Amber Taverns, which operates nearly 170 pubs across the UK, where he said there had been a double-digit percentage increase in Guinness sales in the past. year.

“If you’re a regular Guinness drinker and the pub doesn’t have Guinness and you’re with a group of friends, you’re probably going to say, ‘Can we find somewhere with Guinness?'” But with other brands, “you wouldn’t go to that pub.”