Evenlode is an employee-owned investment company that makes money for clients in its own quiet way.

Based in Chipping Norton, Oxfordshire, its 18-strong investment team manages £5.6bn of assets with the overriding aim of generating “smooth” returns for investors.

Although its £3.3bn income fund has been so popular that it currently discourages new investors from coming on board with a 5% entry fee, Global Equity Income and Global Equity remain open for business.

Global Equity is the youngest of the three funds and has the best investment track record in absolute terms. With £433m under its belt, it is on the cusp of its fourth birthday and has generated a total return of 54 per cent so far.

This compares with the 43 percent return achieved by the average global mutual fund.

“Global Equity has performed well in a variety of market and economic conditions,” says Chris Elliott, co-manager alongside James Knoedler. “We are particularly pleased with how the portfolio has fared from inflationary shocks in 2021 and beyond. It is performing well, which confirms the quality of our stock selection.”

Managers are not interested in making big sector bets or favoring specific stock markets. Their mission is to find profitable, cash-generating companies that have a competitive advantage—and an advantage that will last into the future.

“We’re looking for three key ingredients,” says Elliott. “We want to buy companies that have a strong market position, a sustainable competitive advantage over competitors and are willing to sacrifice some profits to continue investing in their businesses.”

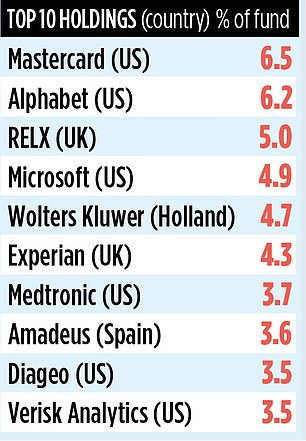

There are just under 80 companies on their radar, but the fund is currently invested in only 33. Of these, 20 have been held by the fund since its inception in July 2020 – such as Mastercard and Alphabet (its two largest positions ), Swiss food giant Nestlé and a Spanish software company Amadeus.

“For stocks we like, we set a price we’re comfortable buying at — and a price we’d like to get out at,” adds Knoedler.

“In this way, we regularly shuffle money around our opportunities to generate the best returns for investors without taking too much risk.”

Recent additions to the portfolio include UK exhibition group Informa, shipbroker Clarksons (also listed in the UK) and US online accommodation booking service Airbnb.

Liquidations include US cosmetics giant Estee Lauder and management consultancy Aon – companies whose shares were thought to be no longer cheap and face a clouded outlook.

Although the fund has exposure to some giant US tech companies, artificial intelligence (AI) specialist Nvidia is absent. “For the right price, we would buy it,” says Knoedler.

“But ideally we would like to have a longer financial history of the company before we buy its shares. Artificial intelligence has happened quite quickly for the enterprise.”

Unlike most other global equity funds, Evenlode Global Equity has a significant portion of its portfolio in UK companies, including RELX, the London Stock Exchange and drinks company Diageo.

“The key for us,” says Elliott, “is where our holdings generate their income. While UK companies make up 18 per cent of the fund’s assets, only five per cent of the portfolio’s returns come from the UK.

In contrast, although Asia-Pacific stocks make up less than two percent of the portfolio, the region accounts for around 17 percent of returns.”

The fund’s total fees are reasonable at 0.85 percent.

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-made portfolios

Hargreaves Lansdowne

Hargreaves Lansdowne

Free fund trading and investment ideas

interactive investor

interactive investor

Investing for a flat fee from £4.99 per month

eToro

eToro

Equity investing: 30+ million community

Trading 212

Trading 212

Free stock trading and no account fee

Affiliate Links: This is Money may earn a commission if you download a product. These deals are selected by our editorial team because we think they are worth highlighting. This does not affect our editorial independence.

Compare the best investment account for you