Many additional rate taxpayers face tax bills on savings interest without perhaps realizing it.

HMRC estimates that it will collect £10.37bn in tax on savings interest in the current tax year 2024-25.

Of that amount, he expects a whopping £6.8 billion to come from additional rate taxpayers because, unlike basic and higher rate taxpayers, they have no allowance for personal savings.

This means that 65 per cent of the total amount HMRC expects to receive in tax on savings interest in the current tax year will be paid by additional rate taxpayers.

Claw it back: Additional rate taxpayers expected to pay £6.8bn in tax on savings interest this tax year

There are currently 1.1 million additional taxpayers in the UK, HMRC’s latest figures for the current tax year show.

This has more than doubled since the 2020/21 tax year, when there were 433,000. This means they typically face a bill of £618 for savings.

Additional rate taxpayers have incomes above £125,140 and pay the top rate of tax at 45 per cent.

Unlike basic and higher rate taxpayers, additional rate taxpayers have no Personal Savings Allowance (PSA), meaning any interest their savings earn is taxed at 45 per cent.

With interest rates rising so much over the past two and a half years and personal allowances remaining frozen, there will be more taxpayers paying even more tax in the coming years.

Laith Khalaf, head of investment analysis at AJ Bell said: ‘The Office for Budget Responsibility estimates that freezing the personal allowance will create an extra 350,000 taxpayers over the next four years.’

Here are five things you can do if you have big savings as a taxpayer and want to get some of your interest back from the taxman.

1. Max out of your cash Isa

An obvious place to start is with Isas. Isas are a useful tool for savers to beat tax, as they allow you to save up to £20,000 a year completely tax-free.

Every April, savers receive a brand new annual Isa allowance of £20,000 for that financial year.

This means you can save up to £20,000 in an Isa completely tax-free – with any interest on your savings tax-free.

Isas are becoming more popular than ever due to high interest rates and the freeze on the Personal Savings Allowance.

New Bank of England data shows savers poured £4.2bn into tax-free accounts in May.

It comes just a month after savers poured a record £12.3bn into Isas in April. The May sum is a record month since Isas began in their current form 25 years ago.

Between January 2023 and May 2024, £73.5 billion poured into cash Isas to protect their hard-earned savings from the taxman.

Isas now offer attractive rates of 5 per cent or more, so there’s no reason to avoid an Isa for other types of accounts because the rates are just as good or better.

An Additional Tax payer who puts £20,000 into a top savings account and pays 5.02 per cent would earn around £1,004 in interest after a year.

An additional rate taxpayer would pay £451.80 in tax on this and so would only receive £552.50 in interest, but would pay no tax on the interest if the £20,000 was in an Isa.

> See This is Money’s round up of the five best cash Isas

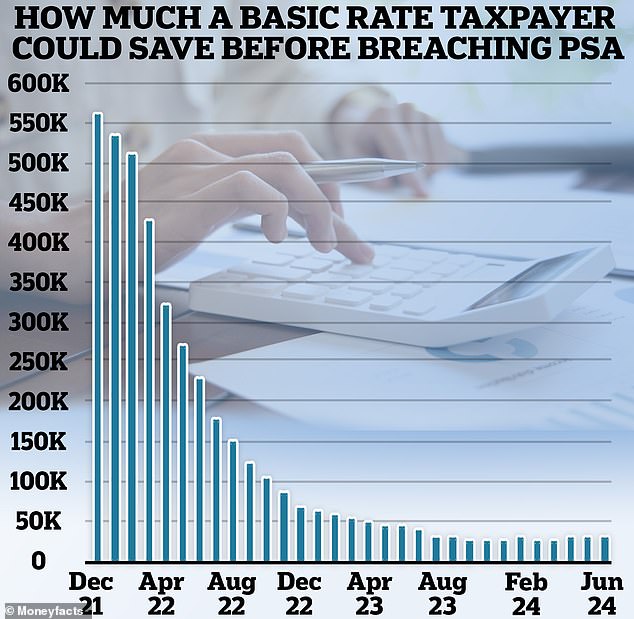

Even a basic rate taxpayer would now breach their PSA of £1,000 with savings of less than £20,000.

2. Maximize premium bonds

Next in line are premium bonds. NS&I accounts are the most popular savings product in the country, with approximately 22 million customers putting their money into Treasury-backed savings accounts.

Every month, premium bond holders are entered into a prize draw.

For every £1 you invest in premium bonds, you get a unique bond number with an equal chance of winning a monthly prize of between £25 and £1m – there are two £1m prizes per month.

There’s no guarantee you’ll win any prize that month – but anything you win is tax-free.

Premium bonds do not bear interest. Instead, there is an annual prize pool rate that funds the monthly tax-free prize draw.

The current odds of winning the prize are 21,000 to 1, with the annual interest rate on the prize pool – which is not guaranteed, unlike a savings account or Isa – currently at 4.4 per cent.

The maximum amount you can save on premium bonds is £50,000.

> Read more: Premium bonds or savings account: which would a financial expert choose?

3. Max. pension contributions

Looking ahead, superannuation contributions can be a very effective way to reduce income tax in general, not just tax on savings interest.

The annual contribution is the amount you can pay into your pension each year and get tax relief.

What you can pay depends on how much you earn. Each has an annual pension of £60,000 or 100 per cent of their respective earnings, whichever is less.

You can contribute to your pension over and above your annual allowance, but any tax relief you take will need to be repaid through your annual allowance.

April Leeson, of The Private Office, said: “As an additional tax payer, you may be able to carry forward your unused annual allowance, and therefore tax relief, up to three years earlier, paying more than £60,000 a year.

“If a saver had £100,000 saved and was able to pay into their pension, that would mean they would actually receive £25,000 of basic tax relief, making a gross contribution of £125,000.”

The money is then within your pension package, so you won’t be able to access it until you are 55 or 57 from April 2028. As long as the funds are within your pension, they will grow tax-free.

For anything above your 25% tax-free lump sum, the tax payable will depend on your marginal rate of income tax at the time plus your rate of withdrawals or income.

By paying money into a pension, you can also claim back more and additional tax relief through your annual self-assessment for the amount of your contribution, although whether you have to do this depends on the type of scheme you’re in.

If you pay enough, you can start to recover your lost ‘tapered’ personal allowance of £12,570 so you can also benefit from this tax-free amount.

Depending on how much you earn, your annual allowance could be less than £60,000, with the full reduced allowance being £10,000.

4. Use as many other allowances as possible

If you’ve already used up your Isa, premium bonds and superannuation contributions, you can try to use the extra allowances to shield more of your savings from savings interest tax if you’re an additional rate taxpayer.

If you have investments, one way you could offset your tax bill from savings is by using dividends.

The dividend allowance is the total amount you can receive in dividends before you have to pay tax on them. It has been reduced to £500 from £1,000 for the current tax year.

A saver with £100,000 invested in an unwrapped investment would face tax on dividends, income or interest and capital gains on the investments.

Depending on the type of investment or strategy, there may be more capital growth than dividends or vice versa.

The first £500 of dividends paid each tax year would be exempt from dividend tax. For additional rate taxpayers, any dividends in excess of this £500 would be taxed at 39.95 per cent.

Leeson said: “If £100,000 was worth £103,000 at the end of the tax year, there would be no capital gains tax. If it is worth £110,000 after one year, then there could be a realized profit of £10,000.

“Then £3,000 of that is exempt and the remaining £7,000 is taxed at 20 per cent. That’s £8,600 net profit after tax.

“In comparison, if the saver left the funds in cash and somehow earned £10,000 in interest, then this would be taxed (without Personal Savings Allowance available) at 45 per cent (£4,500), leaving a net gain of £5,500 ( vs. 8,600 when applying capital gains).

5. Consider investment bonds

Investment bonds are another way additional rate taxpayers can offset their savings tax bill.

Their goal is to grow the investor’s money over time. An investor gives a lump sum of money to a life insurance company to invest for you, usually in a range of funds.

There are two categories of investment bonds – onshore and offshore. The main difference is their tax treatment.

Onshore bonds are subject to UK corporation tax, which is offset by your provider, while offshore bonds are issued from non-UK tax havens such as the Isle of Man, Dublin, Luxembourg or the Channel Islands, where there is little or no tax. tax charged on funds.

One of the main benefits of investment bonds is the rule that allows savers and investors to withdraw up to 5 percent of their investment in the bond, each policy year, without paying immediate tax until 100 percent of the policy is withdrawn. .

Savers do not pay tax on their bond proceeds until a taxable event occurs. A chargeable event may include death when benefits are due or the maturity of the policy.

This “deferral” of tax is one of the features that distinguishes investment bonds from other types of investments.

Leeson said: ‘Both onshore and offshore investment bonds offer different tax treatment, but they can lead to big savings in income tax, most often when additional rate taxpayers stop earning as much (and therefore become basic rate taxpayers).’

SAVE MONEY, MAKE MONEY

Savings offers

Savings offers

Best rates plus £50 bonus until 15th July

Cash Isa at 5.17%

Cash Isa at 5.17%

Includes 0.88% bonus for one year

Free sharing offer

Free sharing offer

No account fee and free stock trading

Savings of 5.78%.

Savings of 5.78%.

Account with a 365-day notice period

Fiber broadband

Fiber broadband

BT £50 Rewards Card – £30.99 for 24 months

Affiliate Links: This is Money may earn a commission if you download a product. These deals are selected by our editorial team because we think they are worth highlighting. This does not affect our editorial independence.

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. This helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any business relationship to influence our editorial independence.