Above: File image by Huw Pill. Image © Global Utmaning, Lasse Skog. Adapted from the original, reproduced under a CC license, non-commercial.

Sterling gained support after a key member of the Bank of England’s rate-setting body signaled there was no immediate demand for a rate hike.

Monetary Policy Committee member and chief economist Huw Pill said it remained a question of when a rate cut “still seems appropriate”.

But in his first post-election appearance at Asia House, Pill said he saw “uncomfortable strength” in services inflation, a signal that the bank may not feel it is in the clear to cut interest rates on August 1.

Market-implied odds of an August rate cut fell to less than 50% following the comments, from above 65% earlier in the day. The pound to euro exchange rate is up a quarter of a percent on the day at 1.1852. The pound to dollar exchange rate is a third of a percent higher at 1.2828.

Pill is the first permanent member of the Bank’s Monetary Policy Committee to speak since the pre-election blackout imposed on civil servants. His words helped markets adjust to the bank’s thinking following recent data that included more inflationary pressure above consensus.

Market focus returns to domestic data and Bank of England interest rate policy after a brief period dominated by political changes in the UK and the Eurozone. Recent legislative upheavals in France have offered the pound-euro exchange rate a rise to highs near 1.19, a level that will return to contention if the chances of an August rate cut are fully erased by the release of inflation data next week.

Sterling has a tailwind: the UK election had limited impact, but some analysts say expectations of better relations with the EU under the new government are constructive for sterling’s outlook.

However, if inflation and labor market data beat expectations next week, expect the odds of an August rate cut to rise again. That can weigh a pound.

“The fairly positive reaction to the election week has played out in line with our expectations. Now that the election result is fully factored in, market attention is turning to the upcoming easing of UK inflation and the likelihood of an August rate cut. BoE election- induced communication ‘blackout’ is over , which provides a clearer path for immediate rate cuts,” says Joe Tuckey, head of FX analysis at Argentex.

“Sterling may struggle to make further short-term gains after this solid run,” he adds.

Analysts at Capital Economics say the pound-euro could soon enter a protracted period of devaluation.

“We think yield differentials will shift in favor of the euro in the coming months. This is because our forecast of where the ECB’s deposit rate will settle is not far below the rate implied by market prices, while we think the Bank of England will cut rate.” faster and further than investors seem to expect,” says Diana Iovanel, chief markets economist at Capital Economics.

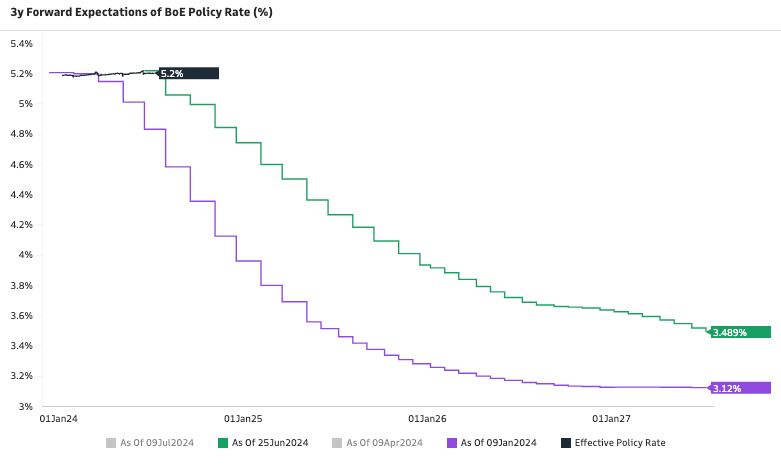

Above: Markets saw fewer rate cuts and at a slower pace than in January. This shift has supported the pound sterling this year.

Markets still see a slow pace of easing in the coming months as the bank remains cautious about the prospect of stubborn inflation. The central bank’s expectation is that inflation will move above the 2.0% target by the end of the year, which calls for caution.

But Capital Economics thinks UK CPI inflation will fall to around 1.5% by the end of this year and remain below the bank’s target for some time.

This may give the bank cover to cut interest rates by more than markets currently expect, leading to a fall in the pound.

Capital Economics predicts that the EUR/GBP exchange rate will strengthen by around 5% by the end of 2025 from recent lows of 0.84 to 0.88. This would correspond to a move in GBP/EUR to 1.1363.

To understand how this forecast contrasts with the consensus, request the Corpay H2 GBP/EUR Forecast Guide as it contains the median forecasts of over 30 investment banks.