Unlock Editor’s Digest for free

FT editor Roula Khalaf picks her favorite stories in this week’s newsletter.

A senior European Central Bank official said the “remarkable” growth of private funds and other sources of funding outside of regulated banks is the biggest threat to the stability of the eurozone’s financial system.

“There are certainly warning lights ahead,” Elizabeth McCaul, a member of the ECB’s supervisory board, told the Financial Times.

“The most common is the area where we probably have the least visibility and where things can move faster than . . . normal credit dynamics – this is the market of non-bank financial intermediaries.”

Non-bank financial intermediaries, often called “shadow banks”, held €42.9 trillion in assets in the EU in the third quarter of last year, compared with €38 trillion held by traditional lenders, according to the European Commission.

The growth of the sector since the global financial crisis has been “remarkable” and “something we are always concerned about”, McCaul said.

“It is outside the banking supervision and regulatory perimeter,” she added, stressing that the opaque links between the sector and banks through repurchase agreements, credit lines or derivatives raise concerns, which “translates into systemic risks.”

McCaul said there were warning signs how those risks could materialize suddenly, including the collapse of family office Archegos Capital Management three years ago, which resulted in $10 billion in losses for investment banks including Credit Suisse and Nomura.

“We had our ups and downs. Maybe even more than the swings,” she said, adding that the sell-off in UK debt markets two years ago, driven by losses from complex derivatives strategies in pension funds, was “another warning light”.

McCaul is the only American citizen to sit on the ECB’s supervisory board since it was created a decade ago to oversee the eurozone’s biggest banks.

She said Europe’s banking sector had “proved to be quite resilient to some very significant challenges over the last few years” after capital levels rose by almost a quarter and non-performing loans fell by two-thirds over the past decade.

But the rise of shadow lenders reminded her of the collapse of US hedge fund Long-Term Capital Management in 1998, when she was superintendent of banks in New York.

“You learn your lessons on the job,” she said. “I suspect correlation risk is re-emerging.

“Some of these funds, particularly some hedge funds, are getting so big that they can partially move the market on their own and they’re not likely to act as shock absorbers like banks sometimes do,” she said.

US hedge funds Citadel and Millennium manage more than $60 billion in assets each.

The ECB was “particularly focused on the private equity and private credit markets,” it said, warning that their exposures could be closely correlated with those of banks.

McCaul dismissed claims by some private equity managers that they are reducing risk by moving activities off banks’ balance sheets and diversifying among investors.

McCaul said their arguments echoed those of those who packaged and sold subprime mortgages as collateralized debt obligations before that market imploded and caused the financial crash in 2008. “I’m reminded of the subprime crisis,” she said.

The world’s leading financial watchdogs are working on ways to bring greater transparency and reduce risk in lightly regulated areas outside the traditional banking sector. So far, however, they have been hesitant to bring non-banknotes under their direct supervision.

McCaul, who will leave the ECB in November, said he was checking that the 113 eurozone banks he oversees have a full view of their exposure to non-banks.

“If an institution has credit arrangements, trading arrangements or hedging strategies linked to the NBFI market, we ask what line of sight and due diligence they are doing,” she said.

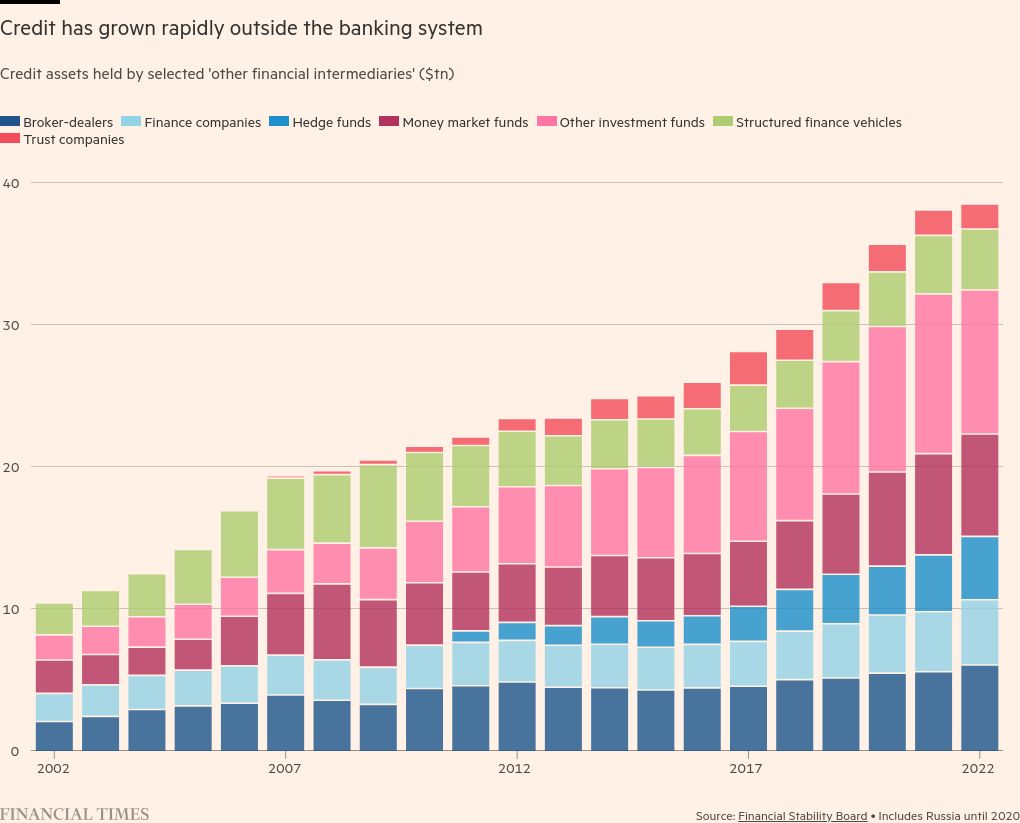

The Rise of “Shadow Banking”

Since the banking meltdown of 2008, credit creation has shifted off banks’ balance sheets and toward other firms that act like traditional lenders but are less regulated. These firms are often referred to as “shadow banks”.

The Financial Stability Board – an international watchdog group created after the 2008 crash – monitors these “non-bank financial intermediaries”, which it defines as any financial entity other than a commercial bank, central bank or public finance institution.

This vast sector includes money market funds, asset managers, pension funds, insurance companies, hedge funds, private equity funds, credit funds and real estate investment trusts. It has built up a stockpile of assets worth $218 trillion – nearly half of all global financial assets.